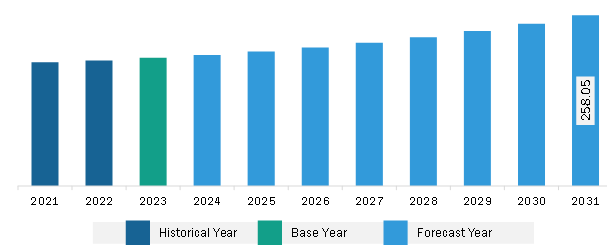

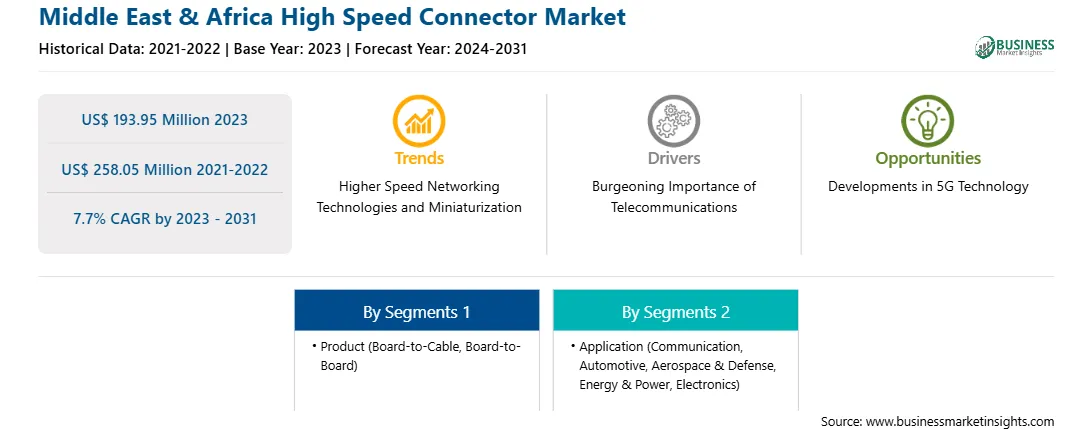

The Middle East & Africa high speed connector market was valued at US$ 193.95 million in 2023 and is expected to reach US$ 258.05 million by 2031; it is estimated to register at a CAGR of 7.7% from 2023 to 2031.

In response to the surging demand for high-speed connectors, companies are increasingly investing in the development of new and innovative product offerings. A few of the major product developments in the high-speed connector market are mentioned below.

• In May 2023, Carlisle Interconnect Technologies (CarlisleIT), a division of Carlisle Companies (CSL) announced the newest product of its Octax Hybrid line of high-speed data connectors. These connectors are ideal for defense, commercial aviation, and industrial applications. This new series of high-performance, multi-port connectors combines 10 GB of data with additional discretes in a single 38999 shell.

• In September 2021, Amphenol ICC (one of the global leaders in connector technology design and manufacturing) and eTopus Technology announced the deployment of a platform with 112 Gbps interconnect technology in their products. This solution is suited for high-speed communications, artificial intelligence (AI), machine learning (ML), and industrial and instrumentation applications. This interconnect uses the four-level pulse amplitude modulation (PAM4) technology that allows the packing of the maximum possible bandwidth into each communication channel.

• In November 2023, Fischer Connectors released new high-speed connectors and cable assemblies for ultrahigh-definition (UHD) audio/video data transfer at a rate of 18 Gbit/s in demanding environments, matching the performance speed of HDMI 2.0.

Innovations in high-speed connectors, following high investments from manufacturers to strengthen their product portfolios with the addition of innovative products based on changing consumer requirements, boost the high-speed connector market growth.

Middle East & Africa High Speed Connector Market Overview

The high-speed connector market in the Middle East & Africa is analyzed on the basis of trends across industries in countries such as South Africa, Saudi Arabia, UAE, and the Rest of the Middle East & Africa. The automotive, telecommunications, and consumer electronics sectors, etc., in the abovementioned countries generate a huge demand for advanced connectivity components. Moreover, connected cars and advanced infotainment systems are among the modern trends in the automotive sector in the Middle East. In September 2023, Saudi Arabia announced plans to launch the 5.9 gigahertz bandwidth for vehicle-to-everything (V2X) technology. This technology uses sensors, cameras, and wireless connectivity, allowing car drivers to communicate with co-drivers, pedestrians, and even traffic lights. Electric systems and infotainment systems require advanced high-speed connectors to execute data transfer at a faster rate. Thus, electrification of vehicles and the incorporation of telematics resulted in a high demand for high-speed connectors across the Middle East. Market players across the Middle East & Africa region are also introducing new products supporting the demand generated by the flourishing automotive sector. For instance, in October 2023, Amphenol Communications Solutions announced the release of more options in its FLH series of mini-sealed 2.50mm pitch IP67 and IP20 connectors, including new versions with poke-in wire terminal and panel mount receptacles with PCB tails, extending the connectivity options from wire-to-wire to wire-to-board and wire-to-panel. The company also offers pre-made FLH cable assemblies in standard as well as custom lengths.

Strategic insights for the Middle East & Africa High Speed Connector provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa High Speed Connector refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa High Speed Connector Strategic Insights

Middle East & Africa High Speed Connector Report Scope

Report Attribute

Details

Market size in 2023

US$ 193.95 Million

Market Size by 2031

US$ 258.05 Million

Global CAGR (2023 - 2031)

7.7%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa High Speed Connector Regional Insights

The Middle East & Africa high speed connector market is segmented based on product, application, and country.

Based on product, the Middle East & Africa high speed connector market is segmented into board-to-cable, board-to-board, and others. The board-to-board segment held the largest share in 2023.

In terms of application, the Middle East & Africa high speed connector market is segmented into communication, automotive, aerospace & defense, energy & power, electronics, and others. The aerospace & defense segment held the largest share in 2023.

Based on country, the Middle East & Africa high speed connector market is categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa high speed connector market in 2023.

Samtech lnc, Molex LLC, TE Connectivity Ltd, Fujitsu Ltd, OMRON Corp, and Amphenol Corp are some of the leading companies operating in the Middle East & Africa high speed connector market.

The Middle East & Africa High Speed Connector Market is valued at US$ 193.95 Million in 2023, it is projected to reach US$ 258.05 Million by 2031.

As per our report Middle East & Africa High Speed Connector Market, the market size is valued at US$ 193.95 Million in 2023, projecting it to reach US$ 258.05 Million by 2031. This translates to a CAGR of approximately 7.7% during the forecast period.

The Middle East & Africa High Speed Connector Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa High Speed Connector Market report:

The Middle East & Africa High Speed Connector Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa High Speed Connector Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa High Speed Connector Market value chain can benefit from the information contained in a comprehensive market report.