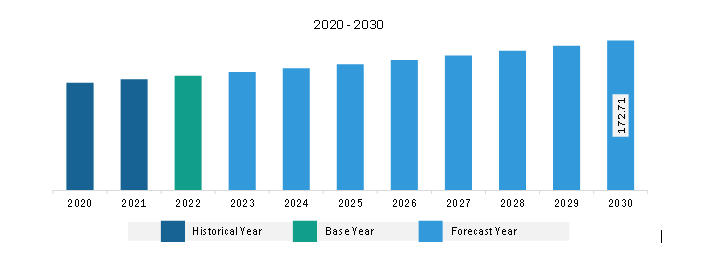

The Middle East & Africa high-end rum market was valued at US$ 132.08 million in 2022 and is expected to reach US$ 172.71 million by 2030; it is estimated to record a CAGR of 3.4% from 2022 to 2030.

Post COVID-19 pandemic, consumer’s preference for at-home alcohol consumption has increased. The trend of at-home drinking is strongest in Western regions owing to the number of factors including the macroeconomic climate and cultural attitudes towards drinking. According to consumer research conducted by the IWSR in April 2023, approximately 60% of consumers across North America, Middle East & Africa, Australia, and South Africa all report to be going out less. Thus, the preference for cocktail making at home is also increasing among consumers.

To maintain the status and prestige, consumers stock high-end rums in their homes and offers high-end rum cocktails in celebrations and house parties. Thus, high-end rums act as a major ingredient in many popular cocktails such as Daiquiris, Mojitos, and Piña Coladas. These cocktails are enjoyed by consumers across the globe, and their popularity is driving the demand for high-end rum. The availability of a wide variety of flavors in rum gives a distinct aroma and flavor to the cocktail, contributing to its growing popularity. The rise of cocktail culture, driven by consumer interest in mixology and craft cocktails, has significantly boosted the demand for high-end rum.

Moreover, young consumers are more likely to explore and seek out distinctive and trendy alcoholic beverages, including rum-based cocktails. The growing influence of this demographic within these establishments further contributes to the growth of the high-end rum industry. Thus, the rising trend of homemade cocktail across the globe is expected to create new trends in the high-end rum market.

The Middle East & Africa is experiencing significant growth in the high-end rum market owing to the growing young population and increasing social media influence. Social media and global trends increasingly influence the young population in the region. According to the Organization for Economic Co-operation and Development (OECD), in 2021, young people under the age of 30 contributed to more than 55% of the population across the Middle East & Africa. The high-end rum brands effectively used social media platforms to showcase the luxury associated with high-end rums. Thus, social media's influence on the young generation fuels the high-end rum market in the region. Alcohol consumption has been among the most important leisure activities in many African societies. As per the World Population Review Report in 2022, South African alcohol consumers are among the heaviest drinkers globally and consume 9.45 liters of alcohol per person in a year. Thus, such a high rate of alcohol consumption and adoption of luxurious spirits in the region boosts the demand for high-end rum.

However, drink brands often overlook the Middle East & Africa due to its religious, social, and political outlook. Alcohol is completely prohibited in several parts of the region, such as Saudi Arabia, Kuwait, Yemen, Iran, and the Emirate of Sharjah. In addition, consumption remains low in countries where consumption of alcohol is allowed. Thus, all these factors will most likely limit the high-end rum market growth in the region.

Strategic insights for the Middle East & Africa High-End Rum provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa High-End Rum refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa High-End Rum Strategic Insights

Middle East & Africa High-End Rum Report Scope

Report Attribute

Details

Market size in 2022

US$ 132.08 Million

Market Size by 2030

US$ 172.71 Million

Global CAGR (2022 - 2030)

3.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Category

By Distribution Channel

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa High-End Rum Regional Insights

The Middle East & Africa high-end rum market is categorized into product type, category, nature, distribution channel, and country.

Based on product type, the Middle East & Africa high-end rum market is categorized into white, dark, and gold. The gold segment held the largest market share in 2022.

In terms of category, the Middle East & Africa high-end rum market is segmented into super premium, ultra-premium, and prestige & prestige plus. The super premium segment held the largest market share in 2022.

By nature, the Middle East & Africa high-end rum market is bifurcated into plain and flavored. The plain segment held a larger market share in 2022.

In terms of distribution channel, the Middle East & Africa high-end rum market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment held the largest market share in 2022.

By country, the Middle East & Africa high-end rum market is segmented into South Africa, the UAE, Nigeria, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa high-end rum market share in 2022.

Pernod Ricard SA, Davide Campari Milano NV, Brown Forman Corp, and Diageo Plc are some of the leading companies operating in the Middle East & Africa high-end rum market.

1. Pernod Ricard SA

2. Davide Campari Milano NV

3. Brown Forman Corp

4. Diageo Plc

The Middle East & Africa High-End Rum Market is valued at US$ 132.08 Million in 2022, it is projected to reach US$ 172.71 Million by 2030.

As per our report Middle East & Africa High-End Rum Market, the market size is valued at US$ 132.08 Million in 2022, projecting it to reach US$ 172.71 Million by 2030. This translates to a CAGR of approximately 3.4% during the forecast period.

The Middle East & Africa High-End Rum Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa High-End Rum Market report:

The Middle East & Africa High-End Rum Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa High-End Rum Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa High-End Rum Market value chain can benefit from the information contained in a comprehensive market report.