Geographically, the helicopter market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. The governments of Middle East & African countries such as Saudi Arabia, South Africa, the UAE, Qatar, Kuwait, and Iran have been investing in technologically advanced equipment, which has propelled the adoption of helicopters. This factor has resulted in the entry of OEMs in the region, thereby creating competition in the Middle East market. Established OEMs such as Airbus S.A.S and Leonardo S.p.A have strengthened their local network in the region. These players have been investing in R&D to fill the gap of supply and demand and cater the pre-requisite needs of military forces and commercial application. In the MEA, a large number of helicopters planned to be procured are for light twin engine model. Further, medium twin-engine model is the next most preferred helicopter model in the region. Airbus S.A.S has a significant presence throughout the region, employing more than 3,100 people across Morocco, Tunisia, South Africa, Nigeria, Saudi Arabia, the UAE, Qatar, and Oman. Regional headquarter of Airbus is in Dubai.

In case of COVID-19, MEA is highly affected especially South Africa. The MEA helicopter market is majorly affected by the disruption in the supply chain. Owing to the closure of countries' borders, the supply chain of several components and parts has been disturbed. South Africa has a few helicopter manufacturers, which produce general aviation helicopters. The widespread COVID-19 virus has led the manufacturers to suspend their operations or operate with a minimal workforce temporarily. Additionally, the disruption in the supply chain business due to the trade ban has also adversely affected the country’s helicopter manufacturing process. On the other hand, Saudi Arabian government spends substantial amounts toward its military force, law enforcement teams, and firefighting teams, thereby continuously supporting the teams with upgraded technologies in order to remain mission ready. However, the COVID-19 outbreak in the country has impacted and postponed a number of helicopter procurement deals.

Strategic insights for the Middle East and Africa Helicopters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

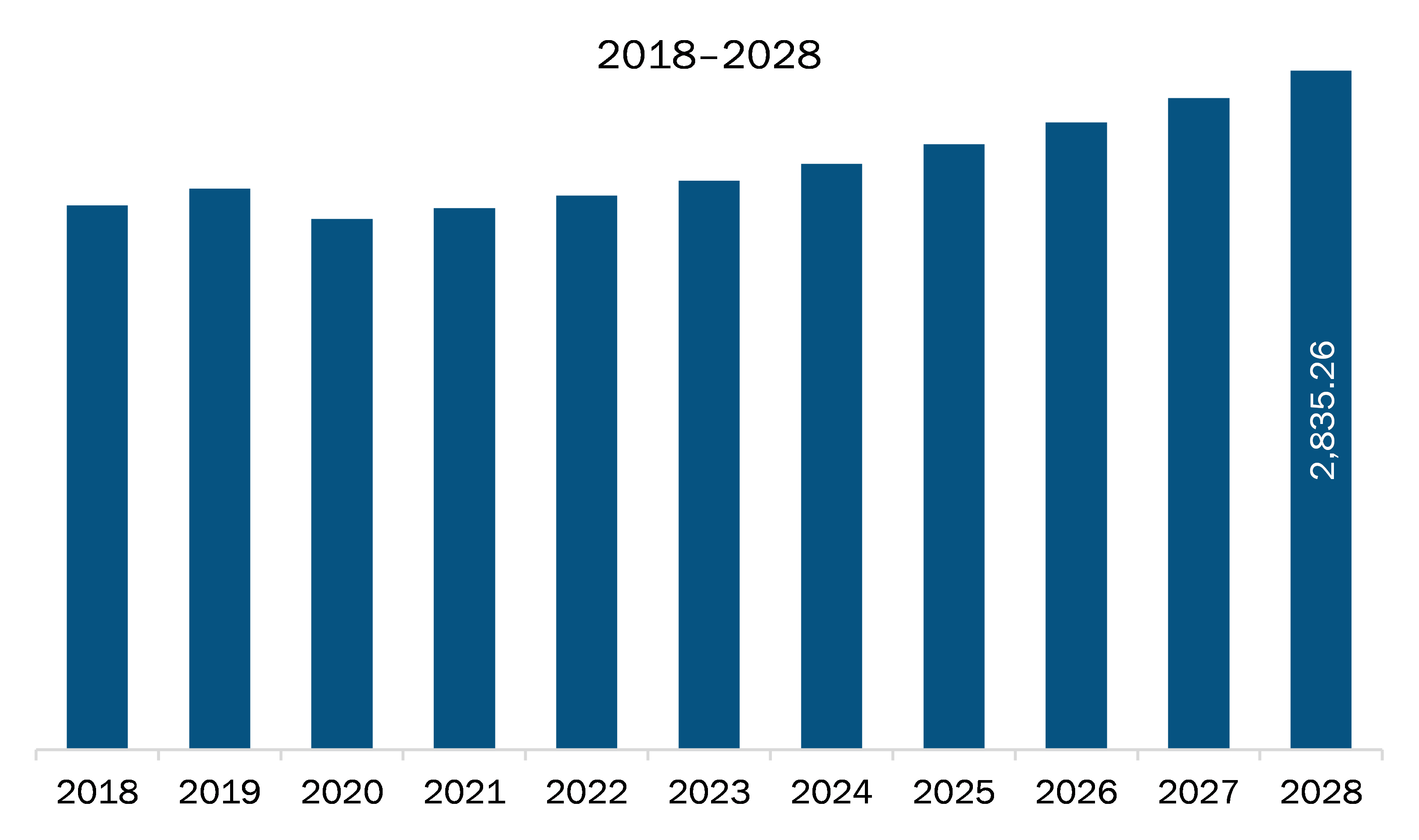

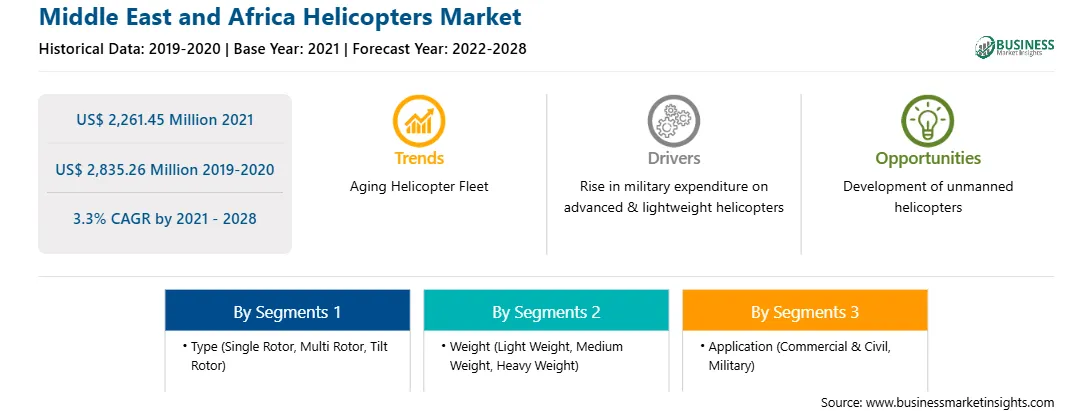

| Market size in 2021 | US$ 2,261.45 Million |

| Market Size by 2028 | US$ 2,835.26 Million |

| Global CAGR (2021 - 2028) | 3.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Helicopters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA helicopters market is expected to grow from US$ 2,261.45 million in 2021 to US$ 2,835.26 million by 2028; it is estimated to grow at a CAGR of 3.3% from 2021 to 2028. The increasing need for helicopters for various search and rescue operations is driving the MEA helicopter market. Countries located in MEA region are heavily investing in procuring the most advanced and highly capable helicopters. Due to the growing demand for new and advanced SAR helicopters, the overall market is growing. These helicopters were heavily equipped with advanced solutions including reliable and powerful rescue hoists and winches. The SAR helicopters are used for medical emergency/evacuation, firefighting and law enforcement, utility, and search and rescue operation. Helicopters are being significantly used for medical emergency or medical evacuation as well. Medical evacuation is the process of safely evacuating wounded people by medical personnel with assistance from military forces. During any kind of natural calamities or man-made calamities, there is heavy requirement for medical evacuation team. The team consists of medical professionals and military personnel who provide the needed medical care to the victims of any disaster. The team uses aircraft/helicopter fleet to evacuate the disaster-prone area. For law enforcement and firefighting, the helicopter is used for fire or other emergencies, patrol duties, and back up to ground unit. For utility application, helicopters are used for lifting operation that happens during oil and gas offshore processing. For search and rescue operation, the helicopters are deployed by military personnel to rescue and search operations. As a part of rescue and search operation, helicopters are used for all types of search and rescue processes (mountain rescue, disaster rescue, and natural calamity rescue among others).

In terms of type, the single rotor segment accounted for the largest share of the MEA helicopters market in 2020. In terms of weight, the medium weight segment held a larger market share of the MEA helicopters market in 2020. Further, the military segment held a larger share of the MEA helicopters market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA helicopters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Airbus S.A.S.; Bell Textron Inc.; Boeing; Kaman Corporation; Leonardo S.p.A.; Lockheed Martin Corporation; and MD Helicopters, Inc.

The Middle East and Africa Helicopters Market is valued at US$ 2,261.45 Million in 2021, it is projected to reach US$ 2,835.26 Million by 2028.

As per our report Middle East and Africa Helicopters Market, the market size is valued at US$ 2,261.45 Million in 2021, projecting it to reach US$ 2,835.26 Million by 2028. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East and Africa Helicopters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Helicopters Market report:

The Middle East and Africa Helicopters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Helicopters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Helicopters Market value chain can benefit from the information contained in a comprehensive market report.