With increased deployments of helicopters by the aerospace sector, the market for helicopter landing gear in the Middle East is slowly developing. Terrorism, humanitarian crises, and political unrest in the MEA have prompted regional economic giants such as Saudi Arabia, Israel, and Turkey to increase their military expenditure. Countries in the area are substantially investing in military helicopter acquisitions and upgrades, which is fueling the region's landing gear market expansion. Furthermore, the growth of the business ecosystem in nations such as the UAE, Saudi Arabia, and Israel, has boosted the region's general aviation industry. Oil-exporting countries in the Middle East are increasingly investing in tourism infrastructure to diversify their economies away from oil and gas. This aspect is driving the demand for helicopters in the region for VVIP transportation and commercial purposes, providing attractive opportunities for landing gear manufacturers in the region. Also, advanced robotic landing gear getting created is among the other factors expected to fuel the demand for helicopter landing gear in MEA.

The COVID-19 outbreak has affected the overall growth rate of MEA helicopter landing gear market in the year 2020 in a negative manner to some extent, due to decline in revenue and growth of companies operating in the market owing to supply and demand disruptions across the value chain. Thus, there was a decline in y-o-y growth rate during the year 2020. However, the sudden growth in vaccinations, COIVD-19 safety protocols, the restrictions are getting lifted which would positively impact the production capabilities of both civil and military helicopters, and thereby landing gears also. Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are the main MEA countries that are facing the effects of COVID-19 pandemic. Most operations in the region have been suspended due to an increase in the number of cases in the region. To deal with the pandemic, countries have been compelled to redirect funds to improve their healthcare infrastructure. As a result, the demand of landing gears for civil and military helicopters is dwindling. As a result, the COVID-19 pandemic is limiting the demand development of helicopter landing gear in the MEA. This upward growth is expected to normalize the MEA helicopter landing gear market growth over the forecast period of 2021 to 2028.

Strategic insights for the Middle East and Africa Helicopter Landing Gear provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

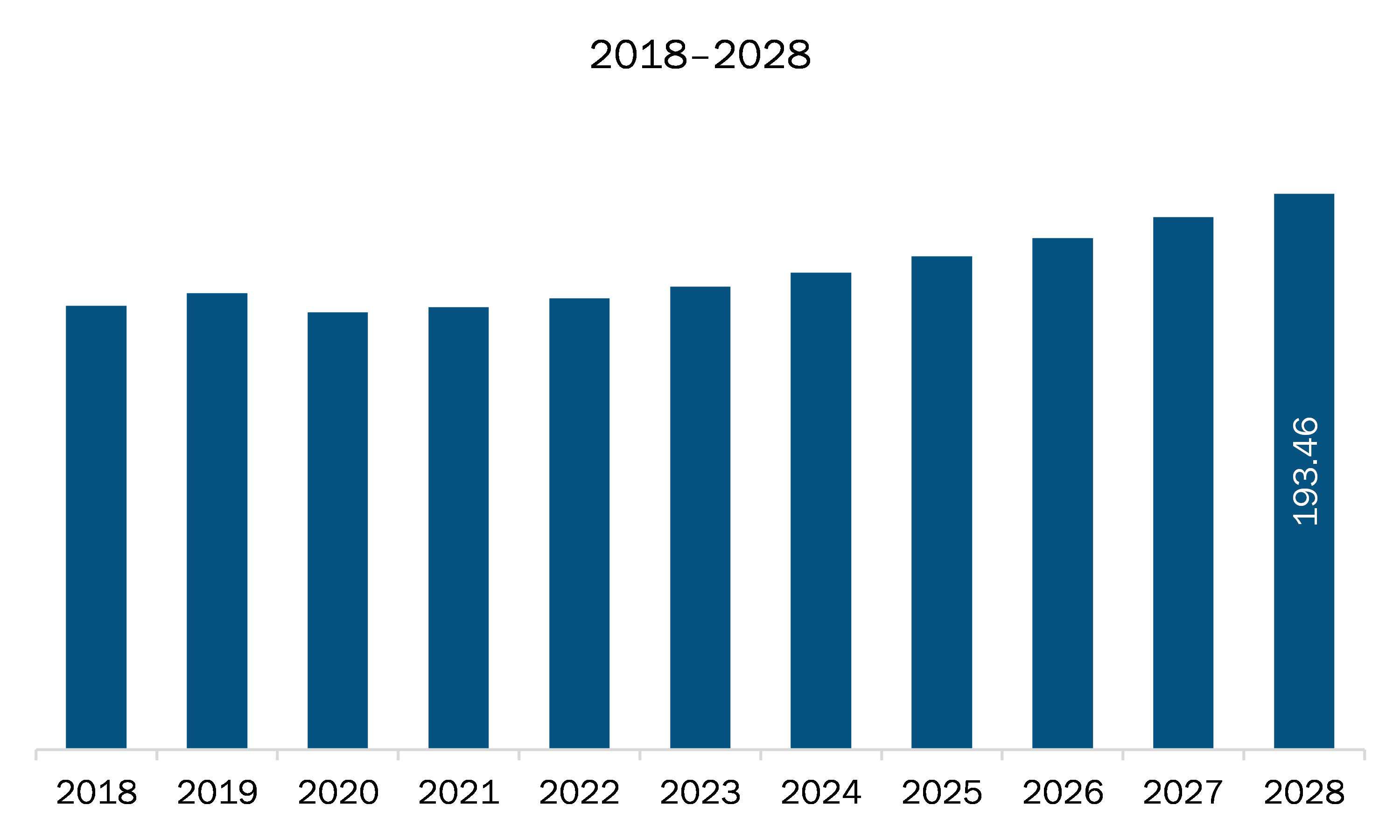

| Market size in 2021 | US$ 154.01 Million |

| Market Size by 2028 | US$ 193.46 Million |

| Global CAGR (2021 - 2028) | 3.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Helicopter Landing Gear refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The helicopter landing gear market in MEA is expected to grow from US$ 154.01 million in 2021 to US$ 193.46 million by 2028; it is estimated to grow at a CAGR of 3.3% from 2021 to 2028. Composites are heavily utilized for structural components for helicopters due to their stiffness and superior specific strength properties compared to steel and aluminum. Also, the weight savings which are realized by putting composites is one of the drivers influencing c=use of composites. The first ever composite landing gear component was designed at NLR was a torque link for NH-90 helicopter’s main landing gear. In the landing gear applications, torque link is utilized to prevent landing gear from wobbling at the course of landing operations. In a framework of different technology programs, the Structures Technology Department as a part of the Aerospace Vehicles division of NLR has designed numerous composite landing gear components for fighter aircraft and large military helicopters. The landing gear programs are carried out with SP aerospace- landing gear manufacturer. Moreover, companies’ presence in the helicopter landing gear is another factor creating substantial growth opportunities for composites. For instance, GYRO-TECH provides 2 types of composite main landing gear to cater helicopter platform, especially the light helicopters.

The MEA helicopter landing gear market is segmented into Type, material, and application. Based on type, the helicopter landing gear are segmented into skids and wheeled. The skids segment held the largest market share in 2020. Based on material, the helicopter landing gear market is segmented into aluminum landing gear set, steel landing gear set, composite landing gear set, and titanium landing gear set. The composite landing gear set segment dominated the market in 2020. Based on application, the helicopter landing gear market is segmented into civil helicopter and military helicopter. Military helicopter segment held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the helicopter landing gear market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CIRCOR AEROSPACE, INC.; Dart Aerospace; LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH; Safran;

The Middle East and Africa Helicopter Landing Gear Market is valued at US$ 154.01 Million in 2021, it is projected to reach US$ 193.46 Million by 2028.

As per our report Middle East and Africa Helicopter Landing Gear Market, the market size is valued at US$ 154.01 Million in 2021, projecting it to reach US$ 193.46 Million by 2028. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East and Africa Helicopter Landing Gear Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Helicopter Landing Gear Market report:

The Middle East and Africa Helicopter Landing Gear Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Helicopter Landing Gear Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Helicopter Landing Gear Market value chain can benefit from the information contained in a comprehensive market report.