Heat shrink tubing has multiple uses and is widely utilized within telecommunications networking cables. Heat shrink tubes are used to safeguard these cables, connections, conductors, terminals, and joints against environmental damage. Further, the oil & gas industry faces the most challenging environmental conditions and effects. Extreme heat, pressure, corrosion, and other factors impact the equipment used in the oil & gas industry. Heat shrink tubing ensures the equipment delivers reliable and consistent performance. Likewise in a phone or laptop, charging cords have a point of vulnerability at the end of the cord where it attaches the connector; heat shrink tubing is used to seal/protect that point of vulnerability between the cord and the connection. Thus, the demand for heat shrink tubing across telecommunications, oil & gas, electrical and electronics industries provides ample opportunities for the market growth.

The rise in the sale of vehicles is aiding the demand for heat shrink tubing owing to the increasing integration of electronic components for various advanced features. As per the International Organization of Motor Vehicle Manufacturers, the sale of new vehicles surged from 1,069,175 units in 2020 to 1,310,053 units in 2021 in the Middle East & Africa. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) 2021 report, South Africa produced 246,541 and 304,340 vehicle units in 2020 and 2021, respectively. Moreover, the Turkish Automotive Manufacturers Association (OSD) stated that the total vehicle sales in Turkey increased from 38,131 units in January 2022 to 49,652 units in February 2022. Such prospects are expected to support the growth of the automobile industry in the Middle East & Africa, which is likely to continue to trigger the demand for heat shrink tubing in the coming years.

Further, the power industry sector is a major source of investment opportunities in the Middle East & Africa. The Middle East & Africa is experiencing growth in renewable energy owing to factors such as improved technology, falling costs, and public preference for greener electricity. The region is also experiencing a renewed interest in privately developed utility projects. For instance, Dubai has set a 75% clean energy target by 2050. Several countries in the region have set renewables targets from ~13% to 52% of installed capacity by 2030. Further, the UAE started the first nuclear plant in the Arab in 2020. Egypt has also started to work in its first nuclear power project at El-Dabaa, and Saudi Arabia is expected to tender a 2.8 GW nuclear power project to international vendors in the near future. Thus, such growth prospects in the automotive and energy industries are likely to propel the Middle East & Africa heat shrink tubing market growth.

Strategic insights for the Middle East & Africa Heat Shrink Tubing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Heat Shrink Tubing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Heat Shrink Tubing Strategic Insights

Middle East & Africa Heat Shrink Tubing Report Scope

Report Attribute

Details

Market size in 2022

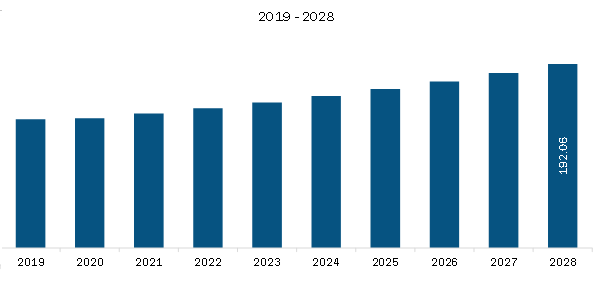

US$ 145.90 Million

Market Size by 2030

US$ 192.06 Million

Global CAGR (2022 - 2030)

4.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Voltage

By Material

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Heat Shrink Tubing Regional Insights

Middle East & Africa Heat Shrink Tubing Market Segmentation

The Middle East & Africa heat shrink tubing market is segmented into voltage, material, end user, and country.

Based on voltage, the Middle East & Africa heat shrink tubing market is segmented into low voltage (less than 5kV), medium voltage (5-35 kV), and high voltage (above 35kV). In 2022, the low voltage (less than 5kV) segment registered the largest share in the Middle East & Africa heat shrink tubing market.

Based on material, the Middle East & Africa heat shrink tubing market is segmented into polyolefin, polytetrafluoroethylene, fluorinated ethylene propylene, perfluoro alkoxy alkane, polyvinylidene fluoride, and others. In 2022, the polyolefin segment registered the largest share in the Middle East & Africa heat shrink tubing market.

Based on end user, the Middle East & Africa heat shrink tubing market is segmented into energy, utilities, electrical power, infrastructure/building construction, industrial, telecommunication, automotive, aerospace, defense, mass transit and mobility, medical, petrochemical, and mining. In 2022, the utilities segment registered the largest share in the Middle East & Africa heat shrink tubing market.

The energy segment is further segmented into renewable and non-renewable. The utilities segment is further segmented into electricity, natural gas, steam supply, water supply, and sewage removal. The electrical power segment is further segmented into power generation, power transmission, and power distribution. The infrastructure/building construction segment is further segmented into residential & commercial, data centers, distribution, HVAC, and infrastructure. The industrial segment is further segmented into residential & commercial, data centers, distribution, HVAC, and infrastructure. The industrial segment is further segmented into industrial equipment and industrial electrical. The telecommunication segment is further segmented into wireless, broadband, CATV, and others. The automotive segment is further segmented into heavy duty machinery and agriculture, EV vehicles, hybrid vehicles, diesel vehicles, gasoline vehicles, and autonomous vehicles. The aerospace segment is further segmented into commercial aircraft, space exploration, and others. The defense segment is further segmented into military aircraft, military equipment & machinery, and others. The mass transit and mobility segment is further segmented into mass transit and mobility. The medical segment is further segmented into high temperature (150 C>) and low temperature (<150 C).

Based on country, the Middle East & Africa heat shrink tubing market is segmented into the South Africa, Sudia Arabia, the UAE, and the Rest of Middle East & Africa. In 2022, South Africa segment registered the largest share in the Middle East & Africa heat shrink tubing market.

3M Co, HellermannTyton Ltd, Molex LLC, Sumitomo Electric Industries Ltd, and TE Connectivity Ltd are some of the leading companies operating in the Middle East & Africa heat shrink tubing market.

The Middle East & Africa Heat Shrink Tubing Market is valued at US$ 145.90 Million in 2022, it is projected to reach US$ 192.06 Million by 2030.

As per our report Middle East & Africa Heat Shrink Tubing Market, the market size is valued at US$ 145.90 Million in 2022, projecting it to reach US$ 192.06 Million by 2030. This translates to a CAGR of approximately 4.7% during the forecast period.

The Middle East & Africa Heat Shrink Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Heat Shrink Tubing Market report:

The Middle East & Africa Heat Shrink Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Heat Shrink Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Heat Shrink Tubing Market value chain can benefit from the information contained in a comprehensive market report.