Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market

No. of Pages: 119 | Report Code: TIPRE00026213 | Category: Life Sciences

No. of Pages: 119 | Report Code: TIPRE00026213 | Category: Life Sciences

Middle East & Africa consists of three major countries namely United Arab Emirates (UAE), Saudi Arabia and South Africa. Market growth is expected due to increasing R&D expenditure. Thus, depreciation pressures are fueling the regulatory outsourcing trend. In addition, contract analysis organizations provide price-efficient solutions and compliance with health authority requirements, reimbursement scenario changes, and pricing pressures and developments from market participants in medical outsourcing technology in countries like Saudi Arabia, the United Arab Emirates, and South Africa. Countries are developing their health facilities, investing heavily in novel drug therapy research, and increasing partnerships with foreign companies are likely to fuel market growth over the forecast period. Soaring market consolidation activities is the major factor driving the growth of the MEA healthcare regulatory affairs outsourcing market.

COVID-19 has had severe effect on South Africa, Israel, the UAE, and Saudi Arabia, among other countries in the Middle East and Africa. The pandemic has increased demand for home-care medical devices. The region is witnessing an increase in the number of patients being admitted to intensive care units (ICU), an increasing number of drugs that pose multiple diagnostic and therapeutic challenges to strained health systems, leading to an increase in medical devices. The Middle East and Africa, like the other regions, also experienced three waves of the pandemic. With the pandemic not over yet, governments must take steps to prevent it from spreading, protect hospitals from traffic jams, and ensure uncompromising care for all patients. The countries in the MEA region have taken strict precautionary measures to control the spread of COVID-19. Countries such as the UAE, Saudi Arabia, Jordan, Iraq, and Iran have strictly imposed lockdowns. The pharmaceutical market experiences different dynamics in different MENA countries. For example, high purchasing power and a cultural predilection for expensive foreign brands in Saudi Arabia compel them to import a large percentages (85%) of pharmaceutical products. The inclination of South Africa toward generics has increased in the recent years. Additionally, various healthcare companies are likely to refer to more regulatory advice during the recovery phase, post-pandemic, especially focusing on remote monitoring, telemedicine, data protection, etc. Also, with the growing emphasis on accelerating product development and obtaining quick approvals for therapies, vaccines, and devices effective against COVID-19, companies are likely to work even more closely with regulators. Medical matters play a central role in overcoming barriers to accessing health care professionals (HCPs). In addition, due to the compliance requirements, Medical Affairs is responsible for providing the HCPs in the MEA with unbiased and transparent medical information in real-time.

Strategic insights for the Middle East and Africa Healthcare Regulatory Affairs Outsourcing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

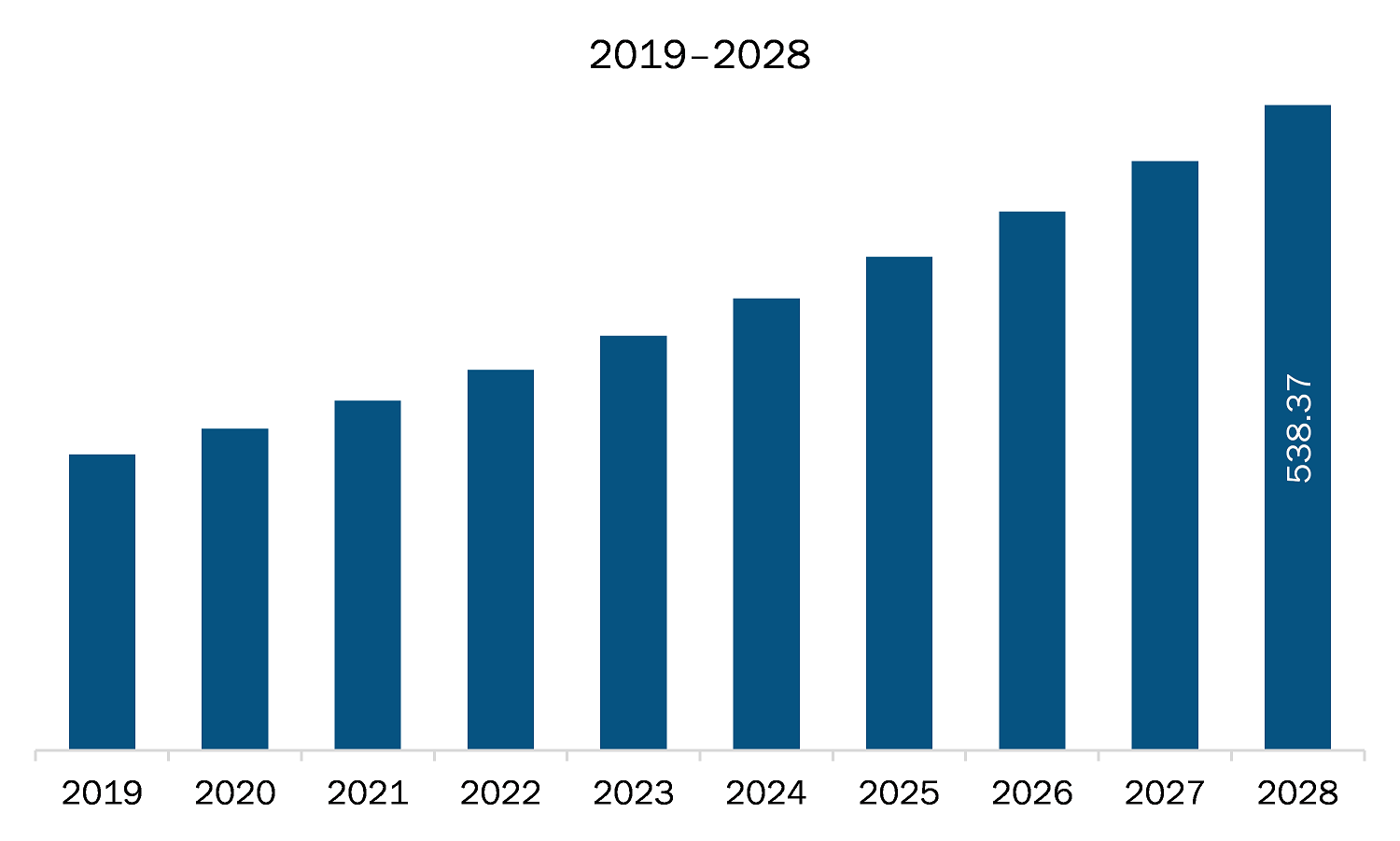

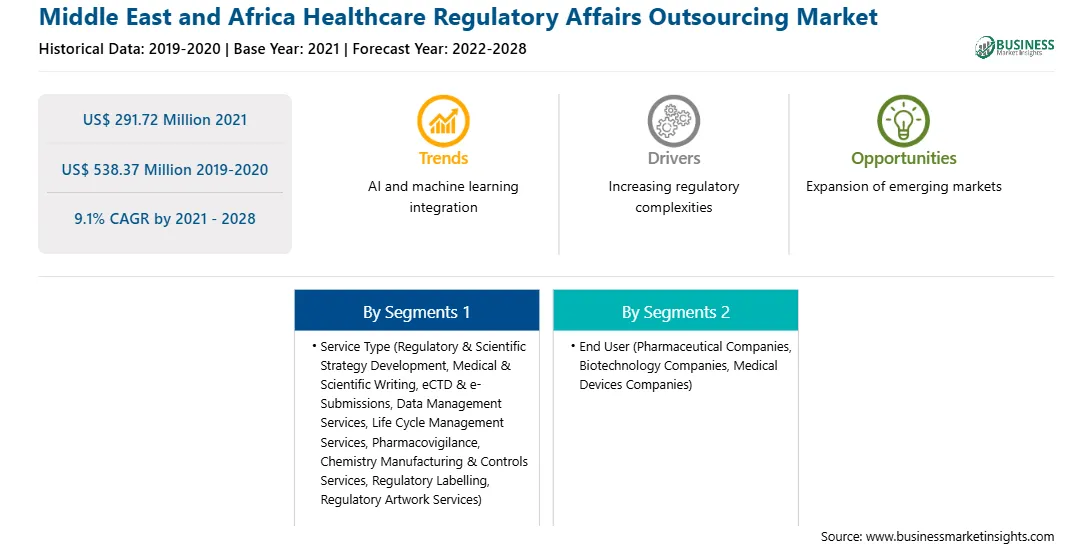

| Market size in 2021 | US$ 291.72 Million |

| Market Size by 2028 | US$ 538.37 Million |

| Global CAGR (2021 - 2028) | 9.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Healthcare Regulatory Affairs Outsourcing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The healthcare regulatory affairs outsourcing market in MEA is expected to grow from US$ 291.72 million in 2021 to US$ 538.37 million by 2028; it is estimated to grow at a CAGR of 9.1% from 2021 to 2028. Healthcare regulatory affairs outsourcing functions have become challenging across the world. The increasing demand to obtain approval for new products, focusing more on core strengths with minimum operational cost and maintain compliance have increased during the last decade. Healthcare regulatory approval processes have become more stringent, and time consuming and market players are striving to obtain approval for their product in the first attempt to acquire greater market shares. Due to strictness by regulatory agencies in developed countries and constantly changing regulatory landscape in developing countries, companies are compelled to start in house regulatory department, or they opt to outsource the regulatory activities. It is not feasible option to establish in house regulatory affairs department to most of the healthcare companies as it would increase the operational costs and decrease the revenue, therefore companies are increasingly adopting outsourcing model based on the size and priority of the projects. Subsequently, the investments in the regulatory information systems have increased significantly to keep pace with the need to automate activities like regulatory publishing and operations. In such scenario, outsourcing has steadily become an important part of the healthcare regulatory affairs, which is expected to raise demand for healthcare regulatory affairs outsourcing, thereby driving the market growth.

The MEA healthcare regulatory affairs outsourcing market has been segmented based on service type, end user, and country. On the basis of service type, the MEA healthcare regulatory affairs outsourcing market is segmented into medical & scientific writing, pharmacovigilance, data management services, life cycle management services, eCTD and e-Submissions, regulatory and scientific strategy development, chemistry manufacturing and controls (CMC) services, regulatory labelling, and regulatory artwork services. The medical & scientific writing segment dominated the market in 2020 and pharmacovigilance segment is expected to be the fastest growing during the forecast period. Based on end user, the market is segmented into pharmaceutical companies, biotechnology companies, and medical devices companies. The pharmaceutical companies segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Likewise, the medical devices companies segmented is categorized into medical device materials & biomaterials, medical device, biomarkers and in vitro diagnostics (IVD), medical device software (SaMD), medical device electromechanics, medical device substance-based, and medical device of combination product.

A few major primary and secondary sources referred to for preparing this report on healthcare regulatory affairs outsourcing market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Arriello Ireland Ltd., IQVIA Inc., PAREXEL INTERNATIONAL CORPORATION, PHARMALEX GMBH, and ProductLife Group are among others.

The Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market is valued at US$ 291.72 Million in 2021, it is projected to reach US$ 538.37 Million by 2028.

As per our report Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market, the market size is valued at US$ 291.72 Million in 2021, projecting it to reach US$ 538.37 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market report:

The Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Healthcare Regulatory Affairs Outsourcing Market value chain can benefit from the information contained in a comprehensive market report.