The increasing preference of enterprises toward AI and machine learning facilitated workloads

The scope of artificial intelligence has dramatically influenced the enterprises in recent years as significant advancements in the field have expanded across various sectors, from healthcare and energy to construction and aerospace. The adoption of AI can help achieve better results for the enterprise, such as improving a variety of business and efficiency metrics, serving customers better, scaling without adding headcount, and providing the deepest insights into the organization’s data. The increasing preference of AI and ML in enterprises is augmenting the need for GPU database, posing a potential opportunity for market growth. Investors are looking for multiple start-ups to provide machine learning funding and investment for lucrative ML models for the betterment of society. It has been witnessed that ML investments and funding have started transforming the tech-driven market, which is further leveraging the demand for GPU database, helping the market to grow. For instance, in November 2021, H2O.ai, one of the leading providers of a cloud platform for AI system development, announced that it raised US$100 million in a series E round led by Commonwealth Bank of Australia (CBA) with participation from Pivot Investment Partners, Goldman Sachs, Celesta Capital, Crane Venture Partners, and others. Also, in October 2021, DataRobot raised US$300 million from Series G as one of the top machine learning funding to provide predictive insights and business value to the consumer-centric market. Thus, such increasing investment in AI and ML platform is creating potential opportunity for accelerating the demand for GPU to transfer more data at faster speed, further fueling the market growth.

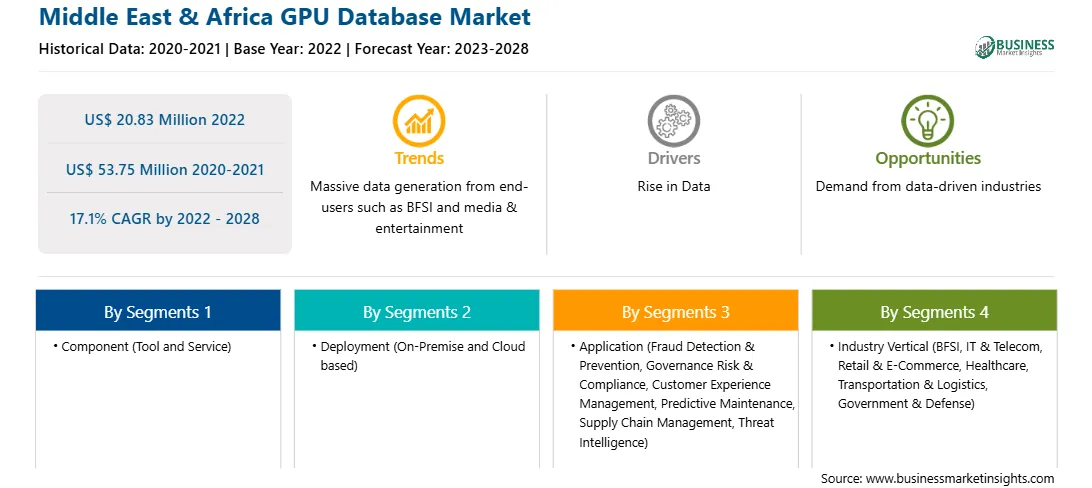

Market Overview

A new generation of connected intelligent services is redefining the way Middle Eastern enterprises work to manage customers' experience and their security. According to a recent Avaya survey, 40% of executives in GCC admit that their organization's customer experience is poor or average, and they are progressively aiming to adopt new technologies to improve it. The leaders of the public & private sectors recognize that they can differentiate themselves from their competitors by using technology to provide their customers with a better experience. At GCC, organizations are also working to integrate their products with smart city initiatives and initiatives for enhancing public well-being. The growing awareness regarding the benefits of automated GPU tools is anticipated to boost the GPU database market growth in the region over the forecast period. Furthermore, BFSI, energy, healthcare, government, and various verticals are adopting GPU databases as they possess an enormous amount of sensitive and secret data. Additionally, the network security industry in the Middle East & Africa is expanding because the Bring Your Own Device (BYOD) and Work from Home (WFH) scenarios are becoming prevalent due to the COVID-19 pandemic. Based on the Aruba Networks report, in 2021, 69% of the organizations in the Middle East adopted some form of BYOD. Similarly, the network security business in the region witnesses implementation difficulties because of the increasing complexity of establishing IT security infrastructure on operational technology (OT) and supervisory control and data acquisition (SCADA). The network of businesses in the region is threatened by the expansion of remote working practices due to the effects of the pandemic. Organizations are implementing countermeasures and working with security suppliers to handle the situation successfully. Hence, the expanding security practice across the region is anticipated to create lucrative opportunities for the Middle East & Africa GPU database market during the forecast period.

Strategic insights for the Middle East & Africa GPU Database provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa GPU Database refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa GPU Database Strategic Insights

Middle East & Africa GPU Database Report Scope

Report Attribute

Details

Market size in 2022

US$ 20.83 Million

Market Size by 2028

US$ 53.75 Million

Global CAGR (2022 - 2028)

17.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Deployment

By Application

By Industry Vertical

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa GPU Database Regional Insights

MEA GPU Database Market Segmentation

The MEA GPU database market is segmented into component, deployment, application, industry vertical, and country. Based on component, the market is segmented into tool and services segment. The tool segment registered a larger market share in 2022.

Based on deployment, the MEA GPU database market is segmented into cloud based and on-premise. The on premise segment registered a larger market share in 2022.

Based on application, the MEA GPU database market is segmented into fraud detection and prevention, governance risk & compliance (GRC), customer experience management, predictive maintenance, supply chain management, threat intelligence, and others. The customer experience management segment registered the largest market share in 2022.

Based on industry vertical, the MEA industry vertical market is segmented into BFSI, IT & telecom, retail & e-commerce, healthcare, transportation & logistics, government & defense, and others. The IT & telecom segment registered the largest market share in 2022.

Based on country, the market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The UAE dominated the market share in 2022.

Brytlyt; H2O.ai; Jedox; Nvidia Corporation; SQream Technologies; and Zilliz are the leading companies operating in the GPU database market in the region.

The Middle East & Africa GPU Database Market is valued at US$ 20.83 Million in 2022, it is projected to reach US$ 53.75 Million by 2028.

As per our report Middle East & Africa GPU Database Market, the market size is valued at US$ 20.83 Million in 2022, projecting it to reach US$ 53.75 Million by 2028. This translates to a CAGR of approximately 17.1% during the forecast period.

The Middle East & Africa GPU Database Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa GPU Database Market report:

The Middle East & Africa GPU Database Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa GPU Database Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa GPU Database Market value chain can benefit from the information contained in a comprehensive market report.