The GPS (Global Positioning System) is a monitoring station and satellite network that distributes a signal used for positioning, timing, and navigation operations. The signal is free, reliable, and extremely accurate. By the time the GPS signal reaches the surface of the Earth, it is weak and likely to be overcome by higher power radio frequency (RF) energy. An unprotected C/A Code receiver can be interrupted by even a small jammer of ~10 watts of power for ~30 km. GPS anti-jamming protects GPS receivers from malicious intentional jamming and interference activities. The GPS anti-jamming process uses power minimization to reduce the interference and jamming effect to allow proper functioning of the GPS receiver. The growth of the GPS anti-jamming market in MEA is majorly driven by factors such as the growing implementation of advanced GPS infrastructure and extensive investment in the defense sector by the governments across MEA. Increasing demand for unnamed airborne vehicles (UAVs) is another factor supporting the MEA GPS anti-jamming market growth. Also, factor such as low-cost GPS anti-jamming solutions generation is also driving the MEA GPS anti-jamming market growth.

Furthermore, in case of COVID-19, MEA is highly affected especially Saudi Arabia. The outbreak is impacting the economic and industrial growth of the region in a substantial manner. The region comprises of many growing economies which are prospective markets for the demand of GPS anti-jamming market players, owing to the huge investments in infrastructure development, transportation sector, military expenditure, and growing manufacturing & construction industries. Due to these factors, the demand for GPS anti-jamming solutions in anticipated to be high in the region but the ongoing COVID-19 outbreak may hinder the GPS anti-jamming market growth in coming quarters due to decline in industrial activities and investments. The MEA region is also anticipated to be especially impacted as there is already pressure on oil-based economies in this region due to falling and uncertain oil prices. In addition to this, the factory lockdowns, business shutdowns and travel bans are further aggravating the economic problems of the countries present in the MEA region. Hence, the estimated decline in MEA’s economic growth and impact of COVID-19 on growth on various industries in the region is expected to negatively impact the GPS anti-jamming market in 2020 and 2021.

Strategic insights for the Middle East & Africa GPS Anti-Jamming provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

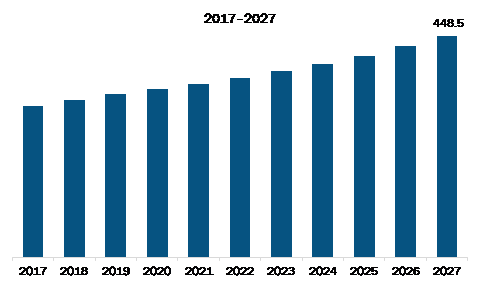

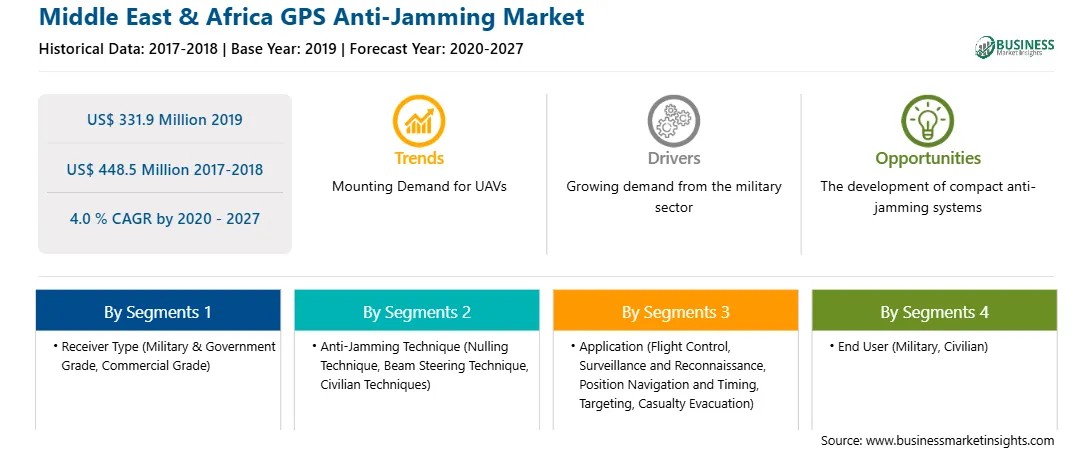

| Market size in 2019 | US$ 331.9 Million |

| Market Size by 2027 | US$ 448.5 Million |

| Global CAGR (2020 - 2027) | 4.0 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Receiver Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa GPS Anti-Jamming refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA GPS anti-jamming market is expected to grow from US$ 331.9 million in 2019 to US$ 448.5 million by 2027; it is estimated to grow at a CAGR of 4.0 % from 2020 to 2027. Upsurge in developments to improve the overall GPS infrastructure is expected to escalate the MEA GPS anti-jamming market. The GPS technology is used in aviation, surveying and mapping, trucking and shipping, search and rescue, tracking, space exploration, and offshore drilling, among many other scientific uses. The technology improves the efficiency of these applications. The GPS solutions are embedded in trains, boats, aircraft, automobiles, watches, cell phones, etc., for improving performance and efficiency of the processes involving these entities. GPS also fosters scientific goals, such as earthquake prediction, weather forecasting, and environmental protection. Precise GPS time signals also assist in critical economic activities such as communications network synchronization, power grid management, and electronic transaction authentication. The deployment of new satellites is expected to enhance the GPS accuracy, uptime, and accessibility across MEA. For personal tracking and business usage, the future of GPS tracking will be more precise and useful. Thus, the rise in developments to improve the overall GPS infrastructure will increase the use of GPS, which will accelerate the demand of GPS anti-jamming system to avoid signal jamming, which further will drive the MEA GPS anti-jamming market.

In terms of receiver type, the military & government grade segment accounted for the largest share of the MEA GPS anti-jamming market in 2019. In terms of anti-jamming technique, the nulling technique segment held a larger market share of the MEA GPS anti-jamming market in 2019. Similarly, in terms of application, the surveillance and reconnaissance segment held a larger market share of the MEA GPS anti-jamming market in 2019. Further, the military segment held a larger share of the MEA GPS anti-jamming market based on end user in 2019.

A few major primary and secondary sources referred to for preparing this report on the MEA GPS anti-jamming market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE SYSTEMS PLC; FURUNO ELECTRIC CO., LTD.; infiniDome Ltd.; L3HARRIS Technologies, Inc.; Lockheed Martin Corporation; NovAtel Inc.; Raytheon Technologies; Thales Group.

The Middle East & Africa GPS Anti-Jamming Market is valued at US$ 331.9 Million in 2019, it is projected to reach US$ 448.5 Million by 2027.

As per our report Middle East & Africa GPS Anti-Jamming Market, the market size is valued at US$ 331.9 Million in 2019, projecting it to reach US$ 448.5 Million by 2027. This translates to a CAGR of approximately 4.0 % during the forecast period.

The Middle East & Africa GPS Anti-Jamming Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa GPS Anti-Jamming Market report:

The Middle East & Africa GPS Anti-Jamming Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa GPS Anti-Jamming Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa GPS Anti-Jamming Market value chain can benefit from the information contained in a comprehensive market report.