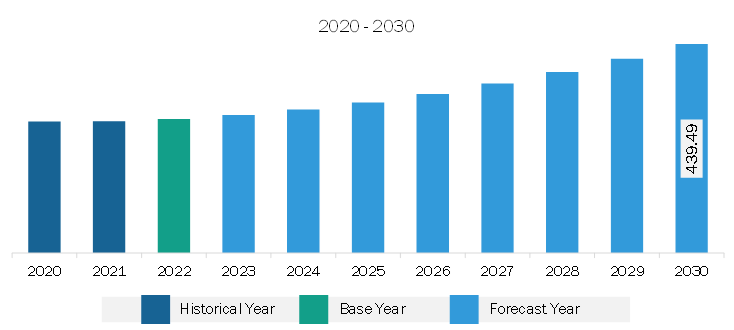

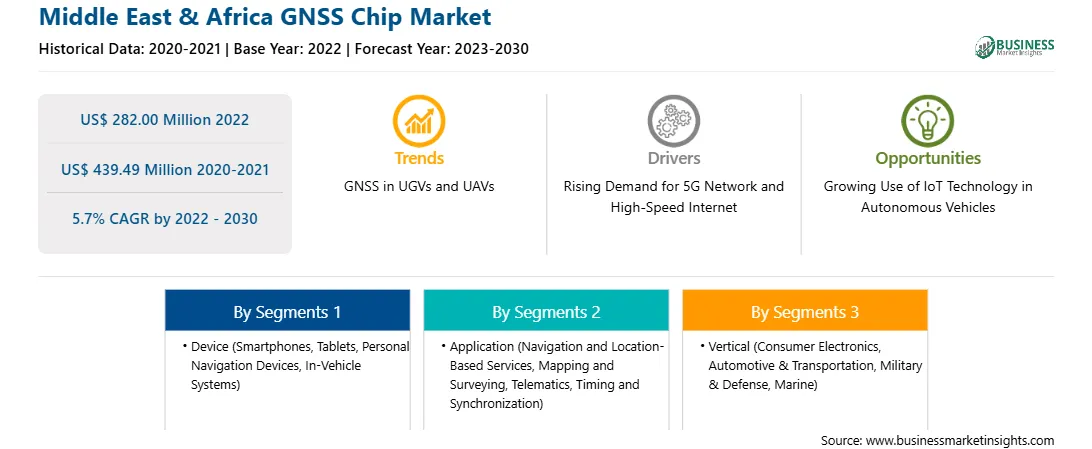

The Middle East & Africa GNSS chip market was valued at US$ 282.00 million in 2022 and is expected to reach US$ 439.49 million by 2030; it is estimated to register at a CAGR of 5.7% from 2022 to 2030.

Growing Use of GNSS Chip in Consumer Electronic Devices Bolsters Middle East & Africa GNSS Chip Market

Smartphones, smart wearables, digital cameras, tablets, and other consumer electronic devices use GNSS technology for mapping, geo-marketing, and navigation applications. GNSS chips are majorly being integrated into these devices to offer precise locations to users while running, walking, or driving. This feature has led to increasing adoption of various location-based services (LBS) and applications depending on the 4G network solution.

Market players develop GNSS-based wearable devices. In June 2022, Quectel Wireless Solutions, a global IoT solutions provider, announced the release of its LC76G module, a compact single-band ultra-low power GNSS module featuring fast and accurate location performance. In addition, in July 2022, Qualcomm released two new system-on-chip (SoC) platforms—the Snapdragon W5+ and W5—for wearable devices such as smartwatches. It uses the GNSS for GPS connectivity. In August 2020, Sony Corporation announced the release of high-precision GNSS receiver LSIs for IoT and wearable devices. Moreover, a rise in the use of location-based services such as online food delivery, online cab services, and others propels the demand for GNSS. Furthermore, government support for the implementation of GNSS technology contributes to the Middle East & Africa GNSS chip market growth. With leading GNSS chipset providers developing Galileo-ready chipsets and global smartphone brands integrating these chipsets in their latest smartphone models, the Middle East & Africa GNSS chip market reports growth.

Middle East & Africa GNSS Chip Market Overview

The MEA consists of countries, including South Africa, the UAE, Saudi Arabia, and the Rest of MEA. In MEA, the use of smartphones is expected to dominate the consumer electronics sector due to the increasing young population. Smartphones are rising in demand across all countries in the MEA and are the main driver of growth for GNSS chips. For instance, according to Flurry, in March 2021, Turkey was the top country in terms of smartphone users in the Middle East. Turkey accounts for 28% of smartphone users, followed by Egypt (23% of smartphone users), Saudi Arabia (14% of smartphone users), and Iraq (12% of smartphone users).

According to the International Data Corporation (IDC), overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will top US$ 238 billion in 2024, an increase of 4.5% over 2023. Technological advancements in unmanned UAVs are expected to increase due to cloud computing takeoff, navigation, data capture, and data aerial vehicles (UAVs) are taking place at a high pace. Integration of Al in UAVs has enhanced their capabilities, such as transmission and data analysis, without human intervention. Implementing a GNSS chip can allow an unmanned vehicle to measure precise real-time positioning information. Therefore, the growth in the consumer electronics sector and UAV in the MEA is influencing the demand for the GNSS chip market.

The presence of several GNSS chip manufacturers, including Intel Corporation, MediaTek Inc., FURUNO ELECTRIC CO., Broadcom, STMicroelectronics, Septentrio N.V., and u-blox Holding AG in the region is expected to benefit the growth of the market.

Middle East & Africa GNSS Chip Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa GNSS Chip provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa GNSS Chip refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa GNSS Chip Strategic Insights

Middle East & Africa GNSS Chip Report Scope

Report Attribute

Details

Market size in 2022

US$ 282.00 Million

Market Size by 2030

US$ 439.49 Million

Global CAGR (2022 - 2030)

5.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Device

By Application

By Vertical

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa GNSS Chip Regional Insights

Middle East & Africa GNSS Chip Market Segmentation

The Middle East & Africa GNSS chip market is segmented based on device, application, vertical, and country.

Based on device, the Middle East & Africa GNSS chip market is segmented into smartphones, tablets, personal navigation devices, in-vehicle systems, and others. The smartphones segment held the largest share in 2022.

In terms of application, the Middle East & Africa GNSS chip market is segmented into navigation and location-based services, mapping and surveying, telematics, timing and synchronization, and others. The navigation and location-based services segment held the largest share in 2022.

By vertical, the Middle East & Africa GNSS chip market is segmented into consumer electronics, automotive & transportation, military & defense, marine, and others. The consumer electronics segment held the largest share in 2022.

Based on country, the Middle East & Africa GNSS chip market is categorized into South Africa, Saudi Arabia, UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa GNSS chip market in 2022.

Qualcomm Inc, Broadcom Inc, Trimble Inc, Furuno Electric Co Ltd, MediaTek Inc, STMicroelectronics NV, and u-blox Holding AG are some of the leading companies operating in the Middle East & Africa GNSS chip market.

The Middle East & Africa GNSS Chip Market is valued at US$ 282.00 Million in 2022, it is projected to reach US$ 439.49 Million by 2030.

As per our report Middle East & Africa GNSS Chip Market, the market size is valued at US$ 282.00 Million in 2022, projecting it to reach US$ 439.49 Million by 2030. This translates to a CAGR of approximately 5.7% during the forecast period.

The Middle East & Africa GNSS Chip Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa GNSS Chip Market report:

The Middle East & Africa GNSS Chip Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa GNSS Chip Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa GNSS Chip Market value chain can benefit from the information contained in a comprehensive market report.