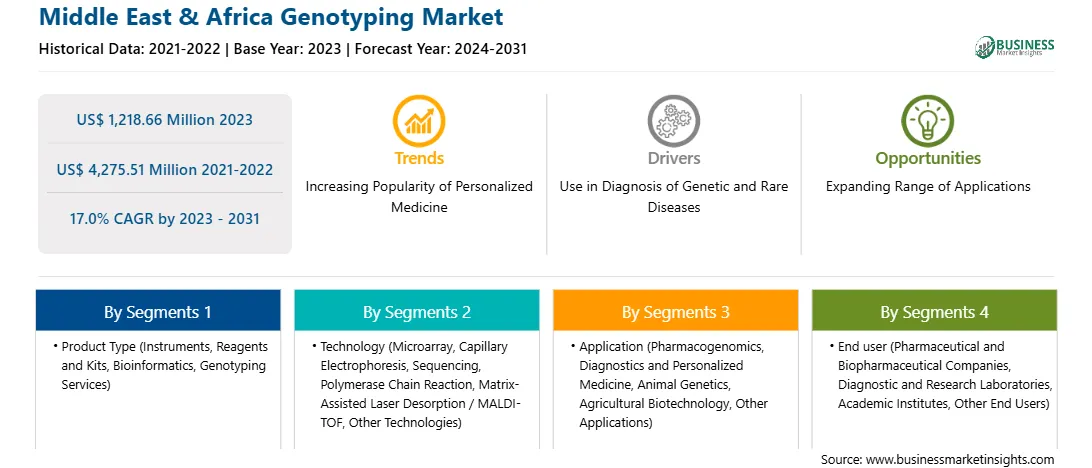

The Middle East & Africa genotyping market was valued at US$ 1,218.66 million in 2023 and is expected to reach US$ 4,275.51 million by 2031; it is estimated to record a CAGR of 17.0% from 2023 to 2031.

Increasing Popularity of Personalized Medicine Bolsters Middle East & Africa Genotyping Market

According to the National Health Service of England, personalized medicine is the medical treatment tailored to the unique traits of each patient. The method is based on scientific advancements that provide an understanding of a person's unique genetic and molecular profile that contributes to their susceptibility to diseases as well as helps determine the safest and most effective medical treatments. Genomic medicine, guided by each person's unique genetic, clinical, and environmental information, is a fundamental component of personalized medicine. The fundamentals of personalized medicine involve the standardization, development, and integration of various essential tools into health systems and clinical workflows for the whole-genome studies of transcription, sequence variation, proteins, and metabolites. Health risk assessment, family health history, and clinical decision assistance for complex risk and predictive information are combined with genomic data to detect individual risks and guide clinical treatment, laying the groundwork for a more informed and effective patient care approach.

DNA-based risk assessment for common complex diseases, genome-guided therapy, dose selection, and molecular signatures for cancer diagnosis and prognosis are examples of genome information has already enabled personalized health care. The integration of personalized medicine with healthcare can aid in more precise diagnoses, enable the prediction of disease risk before the occurrence of symptoms and provide individualized treatment plans with maximum safety and efficiency. Genotype data can be utilized as a guideline to determine the correct warfarin dose. The Clinical Pharmacogenetics Implementation Consortium has developed genotype-based drug guidelines to assist physicians in optimizing pharmacological therapies based on genetic test results. Genomic analysis of tumors can help tailor therapeutic approaches for treating individuals with hereditary cancer.

Although scientific discoveries related to personalized medicine are making their way from labs to clinics, the widespread acceptance of personalized medicine necessitates significant changes in regulatory, reimbursement procedures, and legislative privacy laws for rapid adoption of these medicines. Thus, increasing awareness and popularity of personalized medicine due to ongoing research and use of genome editing techniques is expected to act as a trend for growth of the genotyping market.

Middle East & Africa Genotyping Market Overview

The genotyping market growth in the Middle East & Africa is attributed to factors such as significant advancements in healthcare facilities, the high adoption rate of robotics in therapy, and geographic expansion efforts by market players. Moreover, the rising incidence of cancer, growing investments in the healthcare sector from several private and government institutions and increasing collaborations with hospitals from developed regions are expected to boost the genotyping market growth in the Middle East & Africa during the forecast period.

Middle East & Africa Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Middle East & Africa Genotyping provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,218.66 Million |

| Market Size by 2031 | US$ 4,275.51 Million |

| Global CAGR (2023 - 2031) | 17.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Genotyping refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Genotyping Market Segmentation

The Middle East & Africa genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the Middle East & Africa genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Middle East & Africa genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Middle East & Africa genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Middle East & Africa genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Middle East & Africa genotyping market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are among the leading companies operating in the Middle East & Africa genotyping market.

The Middle East & Africa Genotyping Market is valued at US$ 1,218.66 Million in 2023, it is projected to reach US$ 4,275.51 Million by 2031.

As per our report Middle East & Africa Genotyping Market, the market size is valued at US$ 1,218.66 Million in 2023, projecting it to reach US$ 4,275.51 Million by 2031. This translates to a CAGR of approximately 17.0% during the forecast period.

The Middle East & Africa Genotyping Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Genotyping Market report:

The Middle East & Africa Genotyping Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Genotyping Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Genotyping Market value chain can benefit from the information contained in a comprehensive market report.