A gas turbine refers to a combustion engine that is eco-friendly as it not only runs on natural gas and it produces less exhaust gas pollution as compared to the internal combustion engines. The gas-fired turbines are faster, more efficient, and less polluting than coal-fired and nuclear power plants. Gas turbines make use of natural gas, light gas, and bioethanol for its working. An increase demand for natural gas fired power plants, rising concerns regarding emissions released by greenhouse gas and stringent government norms for the adoption of gas-fired turbines have stimulated the demand for gas turbines. Thus, to reduce carbon emission is expected to create a significant demand for gas turbines in the coming years, which is further anticipated to drive the Middle East and Africa gas turbine market.

Strategic insights for the Middle East and Africa Gas Turbine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

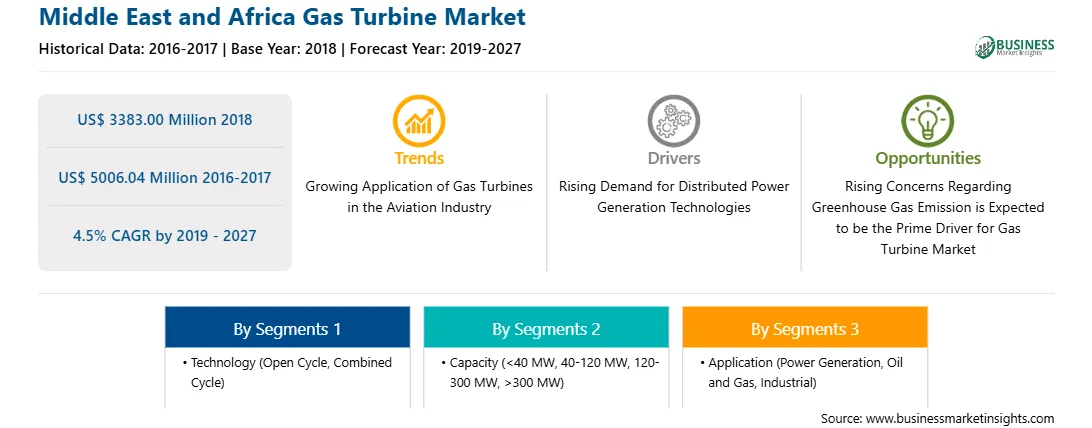

| Market size in 2018 | US$ 3383.00 Million |

| Market Size by 2027 | US$ 5006.04 Million |

| Global CAGR (2019 - 2027) | 4.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Gas Turbine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The gas turbine market in Middle East and Africa is expected to grow from US$ 3383.00 million in 2018 to US$ 5006.04 million by 2027; it is estimated to grow at a CAGR of 4.5% from 2019 to 2027. The organizations of people and resources are drifting away from the centralized system towards integrated networks that include both distributed and centralized elements. Electric power systems are riding the wave of decentralization through the deployment and use of distributed power technologies. Distributed power systems are being used and will continue to be used in the future to provide electrical and mechanical power to the nearest point of use. In the year 2012, $150 billion was distributed in distributed power technologies. As per GE estimates, the annual distributed power capacity addition will reach 200 GW in 2020, from 142 GW in 2012. This is bolstering the growth of the Middle East and Africa gas turbine market.

The COVID-19 outbreak has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global energy and power industry is one of the major industries that is suffering serious disruptions such as supply chain breaks, technology events cancellations, office shutdowns etc. as a result of this outbreak. For instance, China is the global hub of manufacturing and largest raw material supplier for various industries and it is also one of the worst affected countries. All these factors are anticipated to affect the energy and power industry in a negative manner and thus act as restraining factor for the growth of various markets related to this industry in the coming months

In terms of technology, the combined cycle segment accounted for the largest share of the Middle East and Africa gas turbine market in 2018. In terms of capacity, the 120-300 MW segment held a larger market share of the Middle East and Africa gas turbine market in 2019. Further, the power generation segment held a larger share of the market based on application in 2018.

A few major primary and secondary sources referred to for preparing this report on the gas turbine market in Middle East and Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Ansaldo Energia S.p.A., General Electric (GE), Harbin Electric Company Limited, BHEL, Kawasaki Heavy Industries Ltd., and Wärtsilä Corporation among others.

The List of Companies - Middle East and Africa Mobile Access Control Platform Market

The Middle East and Africa Gas Turbine Market is valued at US$ 3383.00 Million in 2018, it is projected to reach US$ 5006.04 Million by 2027.

As per our report Middle East and Africa Gas Turbine Market, the market size is valued at US$ 3383.00 Million in 2018, projecting it to reach US$ 5006.04 Million by 2027. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East and Africa Gas Turbine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Gas Turbine Market report:

The Middle East and Africa Gas Turbine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Gas Turbine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Gas Turbine Market value chain can benefit from the information contained in a comprehensive market report.