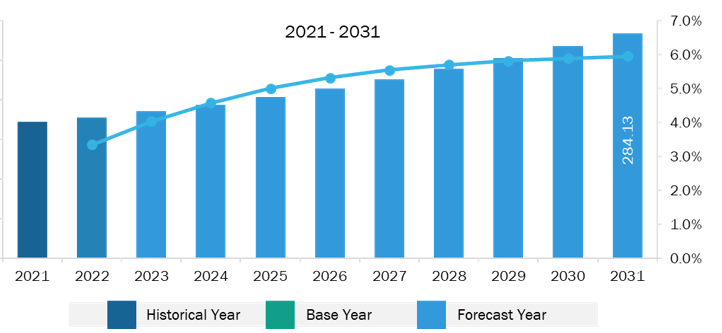

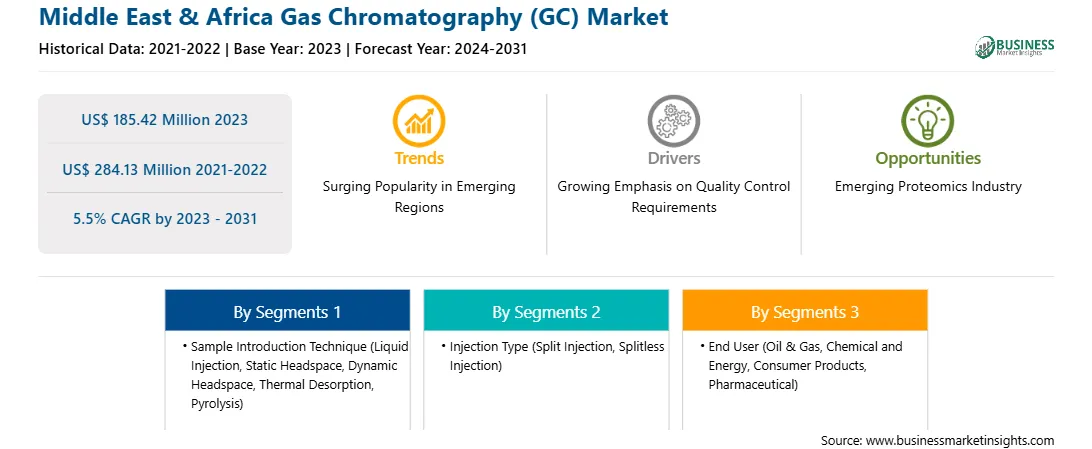

The Middle East & Africa gas chromatography (GC) market was valued at US$ 185.42 million in 2023 and is expected to reach US$ 284.13 million by 2031; it is estimated to register a CAGR of 5.5% from 2023 to 2031.

Industries such as automotive, culinary arts, petrochemicals, and environmental stewardship prioritize thorough examination of their products and processes. Regulatory bodies governing these industries impose stringent standards to ensure public well-being and environmentally friendly operations. To meet these standards, organizations invest in advanced gas chromatography instrumentation to ensure compliance and detect even the smallest impurities and contaminants that could compromise product quality. Gas chromatography facilitates the effective separation, identification, and quantification of complex compound mixtures. As a result, the technique plays a crucial role in certifying the integrity of raw materials, intermediates, and final outputs. The ability of gas chromatography to identify trace-level anomalies is essential in preventing quality discrepancies. Gas chromatography plays a vital role in quality control within the food processing industry. Grocery stores often sell mass-produced food from a limited number of stores. Contaminated batches or improper storage practices could impact a vast number of individuals and lead to serious widespread consequences, thereby hampering the brand image of food production companies. Food processing businesses rely on gas chromatography to detect and eliminate contaminants such as pesticides, pollutants, and naturally occurring toxins, thereby ensuring the safety and quality of the food they produce. Gas chromatography is also used as a quality control method to assess the freshness and sensory attributes, including taste, smell, and texture, which consumers expect from their food.

The Middle East & Africa (MEA) gas chromatography market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The region is considered oil-rich because of its large reserves of oil and natural gas. Major oil-producing countries in the region include Saudi Arabia, Iraq, Iran, Kuwait, and the UAE. The global gas chromatography market players are focused on expanding their business in the region. For example, on March 5, 2024, Shimadzu Middle East & Africa inaugurated its new state-of-the-art facility in Jebel Ali Free Zone, Dubai. The facility aims to be a center of excellence focused on innovation that will facilitate greater collaborations with researchers and advance scientific discoveries and will position the company to provide better sales, service, and application support to customers. Spread over 64,000 sq. ft, the new regional hub boasts state-of-the-art laboratories for analytical instruments and testing machines, a medical training center, advanced R&D and integration areas for GC analyzers, training rooms, and order fulfillment and warehousing space. According to Bio Energy Consult, with urbanization and population growth in the Middle East, there is a rise in the generation of all types of waste. In Middle Eastern countries, approximately 150 Mt of waste is generated annually. Governments in the region are focused on implementing policies to encourage the reuse of treated wastewater. For example, the UAE has set ambitious targets for wastewater reuse to reach zero discharge into the environment by the end of 2024. The increase in wastewater treatment generates the demand for the gas chromatography-mass spectrometry (GC/MS) method for analyzing wastewater.

Strategic insights for the Middle East & Africa Gas Chromatography (GC) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 185.42 Million |

| Market Size by 2031 | US$ 284.13 Million |

| Global CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Sample Introduction Technique

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Gas Chromatography (GC) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the Middle East & Africa gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of Middle East & Africa gas chromatography (GC) market share in 2023.

In terms of injection type, the Middle East & Africa gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of Middle East & Africa gas chromatography (GC) market in 2023.

By detector type, the Middle East & Africa gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of Middle East & Africa gas chromatography (GC) market in 2023.

Based on end user, the Middle East & Africa gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas chemical and energy segment held the largest share of Middle East & Africa gas chromatography (GC) market in 2023.

By country, the Middle East & Africa gas chromatography (GC) market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa gas chromatography (GC) market share in 2023.

Thermo Fisher Scientific Inc; Shimadzu Corp; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); and VUV Analytics are some of the leading companies operating in the Middle East & Africa gas chromatography (GC) market.

The Middle East & Africa Gas Chromatography (GC) Market is valued at US$ 185.42 Million in 2023, it is projected to reach US$ 284.13 Million by 2031.

As per our report Middle East & Africa Gas Chromatography (GC) Market, the market size is valued at US$ 185.42 Million in 2023, projecting it to reach US$ 284.13 Million by 2031. This translates to a CAGR of approximately 5.5% during the forecast period.

The Middle East & Africa Gas Chromatography (GC) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Gas Chromatography (GC) Market report:

The Middle East & Africa Gas Chromatography (GC) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Gas Chromatography (GC) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Gas Chromatography (GC) Market value chain can benefit from the information contained in a comprehensive market report.