The food inclusions market in the Middle East & Africa is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. This region is witnessing a shift in socioeconomic condition owing to rapid economic development and rising disposable incomes. The large-scale influence of western food habits, especially on young population, and hectic work schedules are the factors bolstering the demand for convenience food in the region. There is a huge demand for food inclusions in dairy and frozen desserts, bakery products, breakfast cereals, chocolate confectionery products, and others due to rise in urban population and growing preference for quick as well as healthy meal or snacking options. Moreover, a large consumer preference for confectioneries and baked food items, including packaged products, has led to the rise in demand for food inclusions in the Middle East & Africa. The modern lifestyle has led to changes in the buying behavior and shopping style of consumers. The consumers in this region agree to pay higher amounts on nutritional and premium products, such as biscuits, pastry, and cookies, containing food inclusions, especially fruits, nuts, and chocolates.

Turkey, Iran, Iraq, and Saudi Arabia have the highest COVID-19 cases in the Middle East and Africa, and is followed by Israel and the UAE, among others. The UAE was the first country in the Middle East and Africa to report a confirmed case of coronavirus. The food inclusions market has had a major impact on its product trends. The pandemic has propelled consumers to opt for healthy food products with various functional properties. Additionally, to break through the regular routine imposed due to the lockdown, the consumer’s desire for new and innovative products to experience different culinary adventure is also influencing the market trends for food inclusions.

Strategic insights for the Middle East and Africa Food Inclusions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

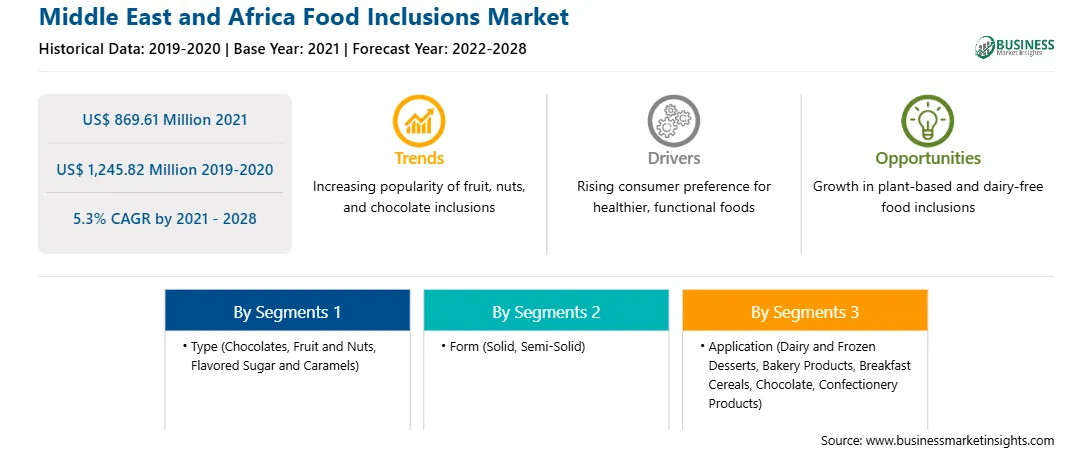

| Market size in 2021 | US$ 869.61 Million |

| Market Size by 2028 | US$ 1,245.82 Million |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Food Inclusions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The food inclusions market in Middle East & Africa is expected to grow from US$ 869.61 million in 2021 to US$ 1,245.82 million by 2028; it is estimated to grow at a CAGR of 5.3% from 2021 to 2028. It is crucial for the food & beverages industry players to differentiate their products from products offered by other players, along with adding value to their existing product line, to sustain market competition. Food & beverage manufacturers identify food inclusions as timesaving and economical way of bringing innovations in their existing products, as while using these ingredients they can skip the step of formulating an entirely new product recipe. Food inclusions are used as mix-ins in the existing product recipe to achieve an altered texture, color, aroma, or flavor. Food inclusions are widely being used in baked food, ice cream, yogurts, and others for attaining product differentiation. Further, various dried fruits, nuts, exotic fruits, and chocolate chips are added in the ice cream products to enhance their value and differentiate the products from their counterparts. Consumers, nowadays, prefer opting for unique, differentiating, and enhanced food products. Seasonal variants or limited-edition food products are being launched to attract a wider customer base. Food manufacturers use stand out colors, shaped inclusions, and indulgent inclusions in their products during Halloween and Easter to achieve product differentiation and stand out differently in the market. In April 2021, Marks and Spencer plc. issued a legal complaint against its supermarket rival, Aldi Stores Limited, on the grounds of copyright infringement. Marks and Spencer plc. sued Aldi Stores Limited on the claim that the latter’s Cuthbert the Caterpillar cake was similar to the former’s Colin the Caterpillar cake. Additionally, other supermarket chains such as Tesco, Sainsbury’s, ASDA, Morrison’s. Waitrose and Co-op also offer similar caterpillar cakes in terms of shape, base color, and size. However, the only factor differentiating their cakes are the food inclusionss used in them. Thus, food inclusions are widely being used to add value and differentiate products from competitors, which is catalyzing the market growth.

In terms of type, the chocolate segment accounted for the largest share of the Middle East & Africa food inclusions market in 2020. In term of form, the solid segment held a larger market share of the food inclusions market in 2020. Further, the bakery products segment held a larger share of the market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the food inclusions market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; AGRANA Beteiligungs-AG; Puratos; Barry Callebaut; Cargill, Incorporated; Kerry Group; Georgia Nut Company; Taura Natural Ingredients Ltd.; and Sensient Technologies among others.

The Middle East and Africa Food Inclusions Market is valued at US$ 869.61 Million in 2021, it is projected to reach US$ 1,245.82 Million by 2028.

As per our report Middle East and Africa Food Inclusions Market, the market size is valued at US$ 869.61 Million in 2021, projecting it to reach US$ 1,245.82 Million by 2028. This translates to a CAGR of approximately 5.3% during the forecast period.

The Middle East and Africa Food Inclusions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Food Inclusions Market report:

The Middle East and Africa Food Inclusions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Food Inclusions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Food Inclusions Market value chain can benefit from the information contained in a comprehensive market report.