The MEA filament LED bulb market is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. The UAE is the most advanced country in this region. From incandescent to light emitting diodes (LEDs), the lighting business in the Middle East & Africa has evolved dramatically. Previously, end users had few options to pick from, and the only differentiators were the fixtures. With the evolution came a plethora of technologies from which people may choose. High-intensity discharge lamps (HIDs) were the first to be introduced to the market, eventually giving way to other technologies such as FTLs (Fluorescent Tubular Lamps), CFLs (Compact fluorescent lamps), and now LEDs. To save energy and resources, LEDs are becoming the preferred choice across the region. Due to expanding population and approaching mega events such as 2022 FIFA World Cup, Qatar; 2023 World Aquatics Championships, Qatar; enormous infrastructure investments have been made in the Middle East in recent years, resulting in a persistent and continual need for lighting systems. Strong demand from commercial and residential lights is driving much of the expansion. The Middle East has experienced tremendous expansion, with the growing acceptance of cutting-edge technology, which is transforming the energy-saving quotient. The Middle East's ambition to reduce carbon footprints and electricity demand will propel it to become one of the world's fastest adopters of LED bulbs.

Among the MEA countries, Turkey, Iran, and South Africa have faced the highest number of COVID-19 cases. Other major countries facing the economic impact of COVID-19 include Iraq, Israel, Morocco, Saudi Arabia, and UAE. The region comprises many growing economies such as UAE and Saudi Arabia, which are prospective markets for Indoor Flooring providers due to the huge presence of a residential, and commercial, sector (including malls, café, restaurants, etc.). The region is projected to register a slight decline in raw material supply and products from various manufacturers across North America, Europe, and Asia-Pacific region, as these regions have halted their production activities and subsequently disrupting the exporting of components and products to other regions. This has impacted the production capabilities of the filament LED bulbs across the region. Additionally, the construction industry was also impacted across the region thereby, creating less or no demand for filament LED bulbs from the newly constructed residential and commercial project. Thus, based on the above-mentioned factors we can conclude that the outbreak of the pandemic across the region had a negative impact on the market growth

Strategic insights for the Middle East & Africa Filament LED Bulb provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 103.91 Million |

| Market Size by 2028 | US$ 490.64 Million |

| Global CAGR (2021 - 2028) | 24.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Filament LED Bulb refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

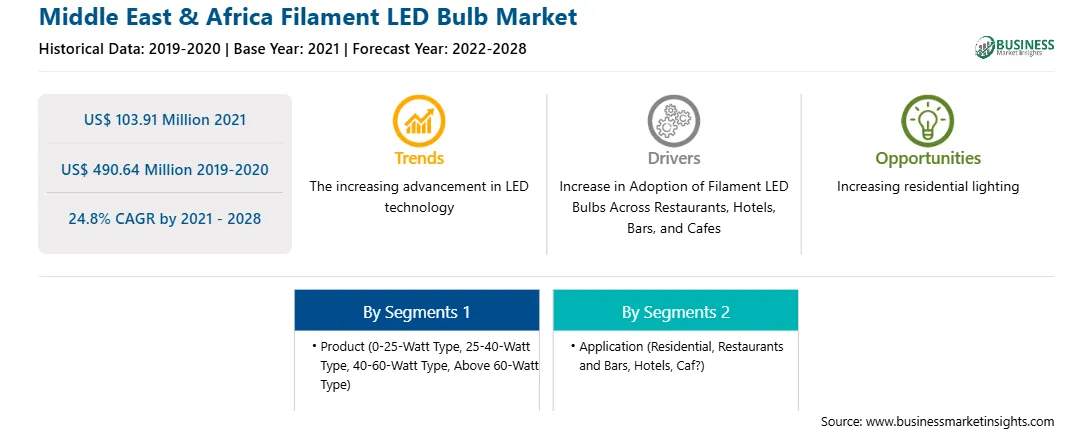

The filament LED bulb market in MEA is expected to grow from US$ 103.91 million in 2021 to US$ 490.64 million by 2028; it is estimated to grow at a CAGR of 24.8% from 2021-2028. The lighting at a restaurant is an important aspect of the overall design. Cafes and restaurants should incorporate lighting into their architectural plans as well. Lighting solutions are as important as the food and service is the environment of the café and restaurant. In cafes, bars, and restaurants, light intensity of 150 lux is generally recommended. Among other areas, entrances require 100 lux, food storage section requires 150 lux, washing section needs 300 lux, and cooking section requires 500 lux. Restaurants use four types of lighting: general lighting, accent lighting, decorative lighting, and natural lighting. In a cafe or restaurant, general lighting is the most significant feature. Homogeneous lighting is achieved by placing lighting equipment in a certain order at equal intervals. Customers will perceive the restaurant as more welcoming if it has decent overall illumination. Accent lighting can be utilized to draw focus to the areas of the restaurant that one wishes to draw attention to. This type of lighting can draw attention to the restaurant's decor, plants, tables, or merchandise. Decorative lighting refers to the lighting accessories that are employed to complete the design. Both traditional and modern lighting can be used to create decorative lighting. It can also be achieved by using specific lighting techniques. Thus, the various lighting techniques used in restaurants, hotels, bars, and cafes are influencing the adoption of filament LED bulbs, thereby contributing to the growth of the market.

In terms of product, 0-25-Watt type segment held the largest share MEA filament LED bulb market in 2020. In terms of application, the

A few major primary and secondary sources referred to for preparing this report on the filament LED bulb market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Havells India Ltd

The Middle East & Africa Filament LED Bulb Market is valued at US$ 103.91 Million in 2021, it is projected to reach US$ 490.64 Million by 2028.

As per our report Middle East & Africa Filament LED Bulb Market, the market size is valued at US$ 103.91 Million in 2021, projecting it to reach US$ 490.64 Million by 2028. This translates to a CAGR of approximately 24.8% during the forecast period.

The Middle East & Africa Filament LED Bulb Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Filament LED Bulb Market report:

The Middle East & Africa Filament LED Bulb Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Filament LED Bulb Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Filament LED Bulb Market value chain can benefit from the information contained in a comprehensive market report.