APAC consists of many developing countries witnessing high growth in their respective manufacturing sector. The region has become a global manufacturing hub as developing countries in the region such as China, India, South Korea, Taiwan, and Vietnam, are attracting several businesses of other regions or country to relocate their low- to medium-skilled manufacturing facilities to these developing countries, which have labors at lower cost. Further, governments of these countries are making developments to improve foreign investments in the region. For instance, the government of India has introduced “Make in India” initiatives to encourage companies to manufacture in India and incentivize dedicated investments into manufacturing. Similarly, the Chinese government has launched “Made in China 2025,” a national strategic plan to further develop the manufacturing industry of the People's Republic of China. In addition to this, over the years, the manufacturing spending of the region has grown significantly and is further anticipated to grow at a decent growth rate. This dramatic growth in the manufacturing spends and adoption of novel technologies are the key factors fueling the demand for fiber laser solutions in the region. Also, the region is characterized by the presence of several developed nations whose manufacturing industries are providing a significant growth prospect to the fiber laser market.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 outbreak has resulted in a massive financial loss in APAC region. The governments in APAC countries are taking several possible steps to reduce its effects. Imposing lockdowns has been one of the common measures in many countries worldwide, as well as in APAC, which led to some serious disruptions in the manufacturing sector. China dominates the global manufacturing sector with significantly unparalleled, large numbers of manufacturing units, and it is considered to have the largest production sector globally. Moreover, Wuhan, one of the country's largest industrial provinces, accounts for more than 200 Fortune 500 companies. The COVID-19 emergence and imposition of lockdown across the country substantially disrupted its manufacturing sector in 2020, thereby affecting the performance of logistics and supply chain sector. After China, India, Taiwan, and South Korea are also considered to have a substantial number of manufacturing facilities, and a large and noteworthy logistics sector. Since the emergence of the COVID-19 virus, these countries have undergone several lockdown phases, which has adversely affected the manufacturing and logistics sectors. With the declining business of automotive, electronics & semiconductor components, and other consumer electronic manufacturing, the trade in Asian economy declined noticeably. Even after the gradual resumption of businesses from the last quarter of 2020, the second wave of COVID-19 pandemic in India has again slowed down the growth of manufacturing industries in the region. This, in turn, has negatively impacted the fiber laser market.

Strategic insights for the Middle East and Africa Fiber Laser provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 92.58 Million |

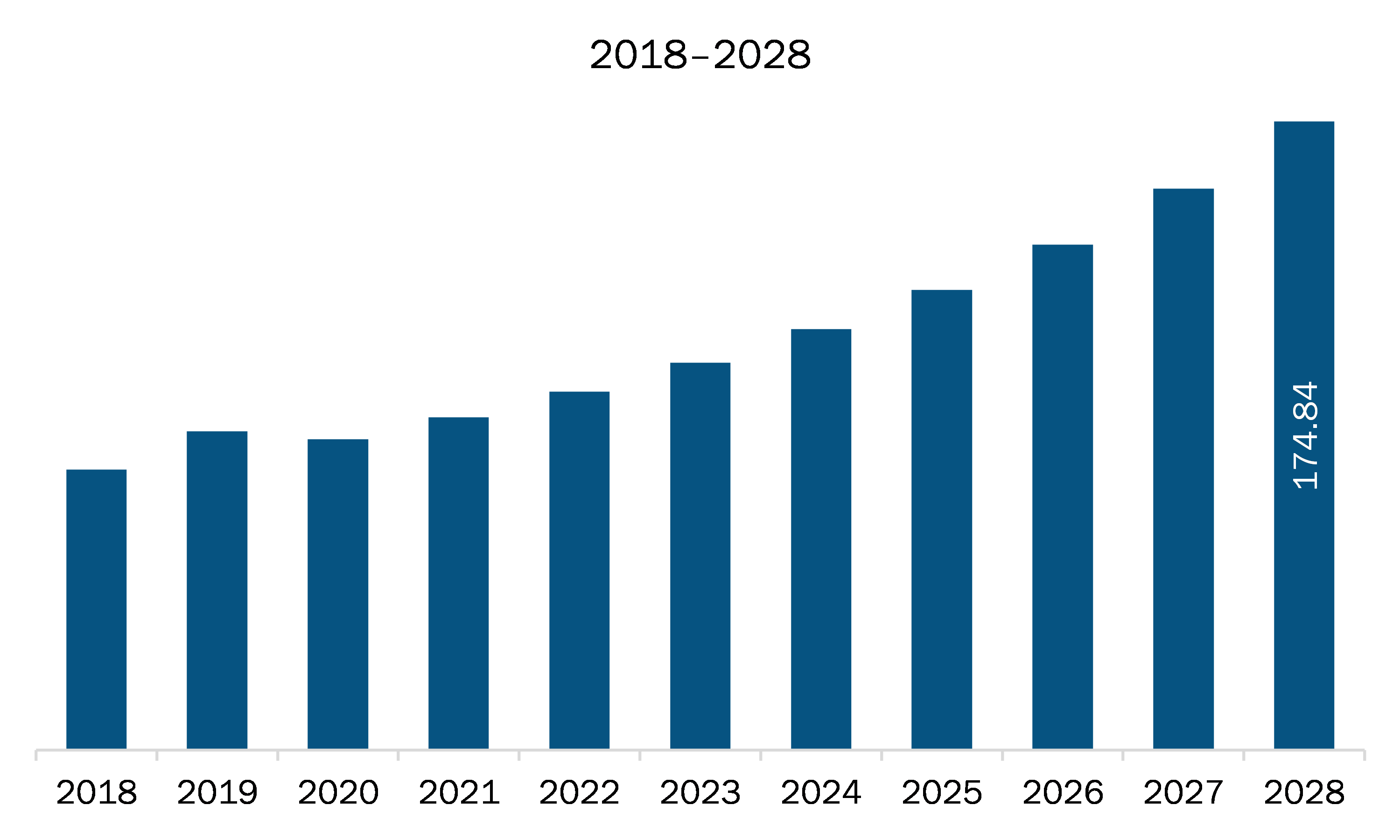

| Market Size by 2028 | US$ 174.84 Million |

| Global CAGR (2021 - 2028) | 9.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Fiber Laser refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA fiber laser market is expected to grow from US$ 92.58 million in 2021 to US$ 174.84 million by 2028; it is estimated to grow at a CAGR of 9.5% from 2021 to 2028. The fiber laser technology is now being widely used in 3D printing because of multiple qualities including feasibility of the process and capability of making stronger & denser materials by pressing the plate hard against the hanging part during the process of sintering by the help of fiber laser. The fiber laser technology has potential applications in printing embedded circuits, robotic components, and electromechanical components. Thus, the use of sintering in 3D printing is likely to have its application in a wide variety of industries. Additionally, the fiber laser technology can change the additive manufacturing industry from printing passive uniform parts to printing active integrated systems. Technological advancements and price reduction in fiber laser systems have led to their utilization in 3D printers for metal deposition primarily used for the aerospace industry. Thus, the growth of 3D printing technology is propelling the growth of the MEA fiber laser market.

In terms of type, the infrared fiber laser segment accounted for the largest share of MEA fiber laser market in 2020. In terms of application, the high power cutting and welding segment held a larger market share of the MEA fiber laser market in 2020.

A few major primary and secondary sources referred to for preparing this report on MEA fiber laser market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Coherent, Inc.; Fujikura Ltd.; IPG Photonics Corporation; Jenoptik AG; Maxphotonics Co,.Ltd; nLIGHT, Inc.; TRUMPF GmbH + Co. KG; and Wuhan Raycus Fiber Laser Technologies Co., Ltd.

The Middle East and Africa Fiber Laser Market is valued at US$ 92.58 Million in 2021, it is projected to reach US$ 174.84 Million by 2028.

As per our report Middle East and Africa Fiber Laser Market, the market size is valued at US$ 92.58 Million in 2021, projecting it to reach US$ 174.84 Million by 2028. This translates to a CAGR of approximately 9.5% during the forecast period.

The Middle East and Africa Fiber Laser Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Fiber Laser Market report:

The Middle East and Africa Fiber Laser Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Fiber Laser Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Fiber Laser Market value chain can benefit from the information contained in a comprehensive market report.