The MEA region includes South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The region is projected to witness a rapid rise in urbanization and industrialization in the coming years. Gulf countries are economically advanced, while the African countries are yet to match their economic conditions. Manufacturers in the Middle East countries focus on leveraging the latest technological developments—especially those in logistics tracking and advance delivery services—and expanding retail & e-commerce, automotive, and transportation & logistics industries. In addition to increasing disposable incomes and surging populations, the rapid adoption of express delivery services in the developing countries in Africa as well as growing infrastructural developments in the MEA countries, is anticipated to contribute toward the express delivery market growth in the region. Moreover, the active involvement of the MEA countries in various global events is leading to the infrastructural development and strengthening of the economy, which, in turn, is expected to fuel the demand for express delivery in the coming years.

South Africa, Morocco, Egypt, the UAE, Saudi Arabia and Kuwait are the main countries facing the economic effects of COVID-19 in the Middle East and African region. It is becoming clear with the COVID-19 pandemic spreading through the above-mentioned countries that few can avoid its effects, posing major challenges for all sectors. The outbreak has led to more people staying indoors across the region, thereby, negatively impacting the express delivery market both locally and internationally. However, the express delivery services across the region were available for necessary products such as medicines and food and beverages. The express delivery market across the region was also impacted due to the shortage of labor across the region. The availability of rails, trucks and cargo were all impacted firstly due to the restrictions imposed by the local federal government to combat the spread of the virus and secondly due to the shortage of labor. Thus, the above mentioned factors are negatively impacting the express delivery market across the region owing to the outbreak of the corona virus pandemic.

Strategic insights for the Middle East & Africa Express Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$US$ 6,626.23 Million |

| Market Size by 2027 | US$ 7507.94 Million |

| Global CAGR (2020 - 2027) | 1.8% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Destination

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Express Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

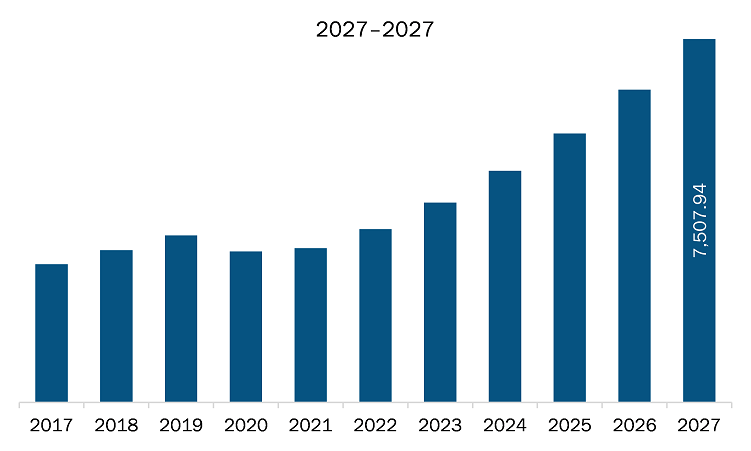

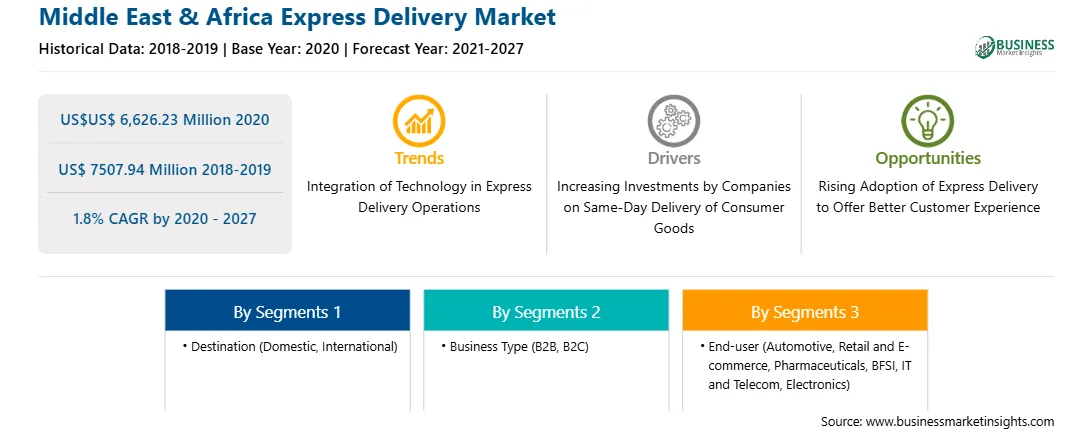

The express delivery market in MEA is expected to grow from US$ 7507.94 million by 2027 from US$ 6,626.23 million in 2020. The market is estimated to grow at a CAGR of 1.8% from 2020 to 2027. High adoption of express delivery has been observed across major essential sectors—such as food & beverages and healthcare—in all major economies worldwide. The demand from global population to receive the items to be delivered in the same day or to be delivered maximum in a day’s time has increased over the years. For instance, the demand for same day deliveries from the population for groceries is about 64%, healthcare products are 46%, specialty snacks are 42%, alcohol is 41%, and other household products is 28%. The highest adoption is noticed across the healthcare sector. In healthcare, proper prioritization reduces misery and saves lives. There must be access to high-tech medical devices and work around the clock, all year round. It is essential to deliver critical samples and medicines on time, without being tempered in the process of transportation. In the healthcare sector, high demands for quality, availability, accuracy, and cost control place similarly high expectations on logistic solutions. Thus, the above-mentioned factors are likely to influence the growth of the MEA express delivery market during the forecast period

MEA express deliver market is segmented based on destination, business type, and end user Based on destination, the MEA express delivery market based on destination is segmented into domestic and international. The domestic sector accounted for the highest share in the market in 2019 and International sector is expected to be fastest growing during forecast period. Based on business type is segmented into B2B and B2C. The B2B segment accounted for the highest share in 2019 and B2C sector is expected to be the fastest growing during forecast period. Based on end-user the market is segmented into Automotive, Retail and E-commerce, Pharmaceuticals, BFSI, IT and Telecom, Electronics, and Others. The automotive segment accounted for the highest share in 2019 and retail and automotive sector is expected to be the fastest growing during forecast period

A few major primary and secondary sources referred to for preparing this report on express delivery market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amazon.com, Inc.; Aramex; DHL International GmbH; FedEx Corporation; TNT Holdings B.V.; and United Parcel Service of America, Inc. among others.

The Middle East & Africa Express Delivery Market is valued at US$US$ 6,626.23 Million in 2020, it is projected to reach US$ 7507.94 Million by 2027.

As per our report Middle East & Africa Express Delivery Market, the market size is valued at US$US$ 6,626.23 Million in 2020, projecting it to reach US$ 7507.94 Million by 2027. This translates to a CAGR of approximately 1.8% during the forecast period.

The Middle East & Africa Express Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Express Delivery Market report:

The Middle East & Africa Express Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Express Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Express Delivery Market value chain can benefit from the information contained in a comprehensive market report.