The region has adopted numerous regulations that drive the EV test equipment market in the region. These regulations include CO2 emissions performance standards for cars and vans, alternative fuels infrastructure directive, and the energy performance of buildings directive, creating huge investment grounds for major EV test equipment players in the market. The government and private players are contributing heavily to the infrastructure building activities for the smooth functioning of electronic vehicles across the region. Such factors are likely to contribute to the growth of the EV testing equipment market. Furthermore, according to the International Energy Association (IEA), governments worldwide spent US$ 14,000 million on direct purchase incentives and tax exemptions for electric vehicles in 2020. Furthermore, several governments responded to the economic slowdown brought by the COVID-19 epidemic with incentive programs and tax concessions that helped boost electric vehicle sales. For example, in India, GST and chargers on these vehicles decreased to 5% from 12% and 18%. The electric vehicle test equipment market is growing due to the aforementioned factors.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Middle East & Africa EV testing equipment market at a substantial CAGR during the forecast period.

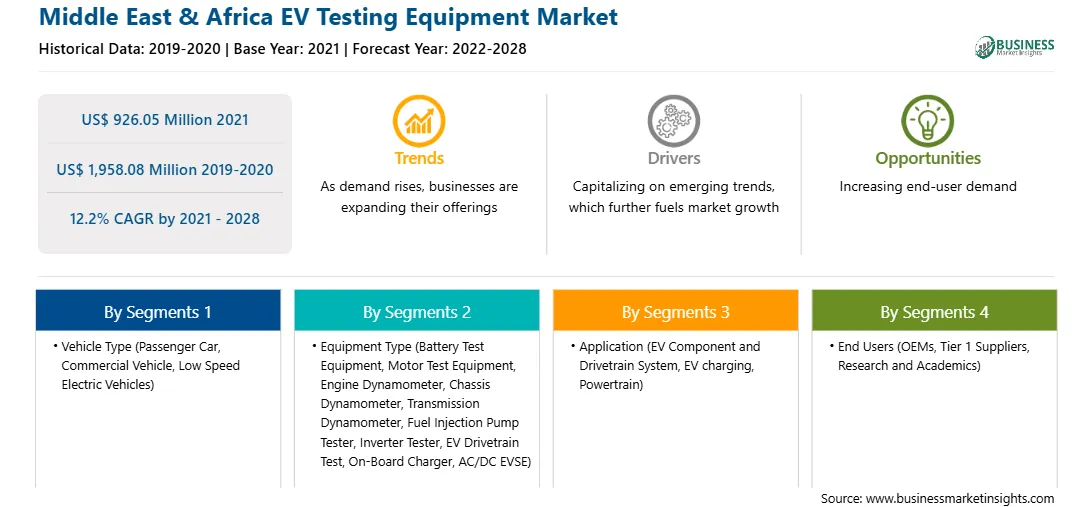

The Middle East & Africa EV testing equipment Based on vehicle type, the market is segmented into passenger car, commercial vehicle, and low speed electric vehicles. In 2021, the passenger car segment held the largest market; and it is expected to register the highest CAGR during the forecast period. Based on equipmenmt type, the Middle East & Africa EV testing equipment market is segmented into battery test equipment, motor test equipment, engine dynamometer, chassis dynamometer, transmission dynamometer, fuel injection pump tester, inverter tester, EV drivetrain test, on-board charger, and AC/DC EVSE. In 2021, the battery test equipment segment held the largest market share; and it is also expected to register the highest CAGR in the market during the forecast period. Based on application, the market is segmented into EV component and drivetrain system, EV charging, and powertrain. In 2021, the powertrain segment held the largest market share;. Based on end-users, the market is segmented into OEMs, tier 1 suppliers, research and academics, and others. In 2021, the tier 1 suppliers segment held a larger share of the market; and it is also expected to register a higher CAGR during the forecast period. Based on country, the Middle East & Africa EV testing equipment market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. In 2021, South Africa held the largest market share.

National Instruments Corporation; Horiba Ltd.; Arbin Instruments; Maccor Inc.; Keysight Technologies, Inc.; Froude, Inc.; Durr Group; Tüv Rheinland; Intertek Group Plc.; and Wonik Pne Co., Ltd. are among some of the leading companies in the Middle East & Africa EV testing equipment market.

Strategic insights for the Middle East & Africa EV Testing Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 926.05 Million |

| Market Size by 2028 | US$ 1,958.08 Million |

| Global CAGR (2021 - 2028) | 12.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa EV Testing Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa EV Testing Equipment Market is valued at US$ 926.05 Million in 2021, it is projected to reach US$ 1,958.08 Million by 2028.

As per our report Middle East & Africa EV Testing Equipment Market, the market size is valued at US$ 926.05 Million in 2021, projecting it to reach US$ 1,958.08 Million by 2028. This translates to a CAGR of approximately 12.2% during the forecast period.

The Middle East & Africa EV Testing Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa EV Testing Equipment Market report:

The Middle East & Africa EV Testing Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa EV Testing Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa EV Testing Equipment Market value chain can benefit from the information contained in a comprehensive market report.