There is a surge in the demand for products that help consumers proactively manage their health, especially those focused on specific needs in terms of energy levels, immunity, and disease treatment. Nutritional requirements differ based on the type of illness. Functionality and specific formulations of the enteral and parenteral products do not interfere with the existing treatment provided to patients and help deliver a more precise and enhanced treatment as per the requirement. The macro and micronutrient formulations of enteral and parenteral nutrition and its applications vary based on various diseases, such as cancer and gastrointestinal diseases. Isocaloric enteral nutrition formulation (1 kcal/ml) is generally prescribed to achieve estimated or measured caloric goals, while energy-dense formulae (>1 kcal/ml) are prescribed to increase calorie delivery in patients with gastrointestinal dysfunction.

Moreover, pharmaceutical companies provide enteral and parenteral nutrition with individualized (patient-specific) constituents. Standardized parenteral nutrition products contain fixed constituents and are designed to meet the average patient’s nutritional requirements considering different requirements in different age groups. These nutrition products can be sourced as institution-specific standardized formulations or patient-specific formulations. For example, Impact (offered by Nestle) is a clinically proven nutritional solution for managing patients undergoing major elective surgeries to reduce postoperative complications and hospital stay duration and improve clinical outcomes. Peptamen Formula (Nestle) is the only peptide-based formula with enzymatically hydrolyzed 100% whey protein that helps overcome tube-feeding intolerance. Such tube-feeding formulas are specialized enteral nutrition products designed to support absorption and overcome tolerance mechanisms in individuals with gastrointestinal disorders.

Further, a surge in the number of people turning to plant-based food triggers the demand for plant-based nutrition products worldwide. People are more likely to show intolerance to artificial/synthetically sourced ingredients used in higher numbers, which may lead to adverse reactions. Thus, the fewer ingredients, the better the final product. The Innova Consumer Survey 2020 showed that health, diet variety, sustainability, and taste are among the top reasons why people consider plant-based alternatives. According to Abbott, consumers and patients relying on tube feeding are no exception to this trend. Companies in the enteral and parenteral medical nutrition market anticipate that a growing focus on healthy foods would translate into a preference for healthier nutrition products. In September 2021, Abbott introduced a portfolio of plant-based proteins and organic food ingredients for children and adults. Similarly, olive oil-based parenteral nutrition products are also gaining popularity.

Therefore, functional, and patient-centric formulations and plant-based nutrition products are the prime emerging trends in the enteral and parenteral medical nutrition market.

The Middle East & Africa enteral and parenteral medical nutrition market is categorized into the UAE, Saudi Arabia, South Africa, Iran, Israel, Egypt, and the Rest of Middle East & Africa. In 2021, Saudi Arabia held a significant share of the enteral and parenteral medical nutrition market in the region. The enteral and parenteral medical nutrition market is expected to grow due to the increasing cases of cancer and stroke, as well as growing malnutrition among adults and premature babies across the region. Moreover, the growing government initiatives in the region propels the market growth.

Strategic insights for the Middle East & Africa Enteral and Parenteral Medical Nutrition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Enteral and Parenteral Medical Nutrition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Enteral and Parenteral Medical Nutrition Strategic Insights

Middle East & Africa Enteral and Parenteral Medical Nutrition Report Scope

Report Attribute

Details

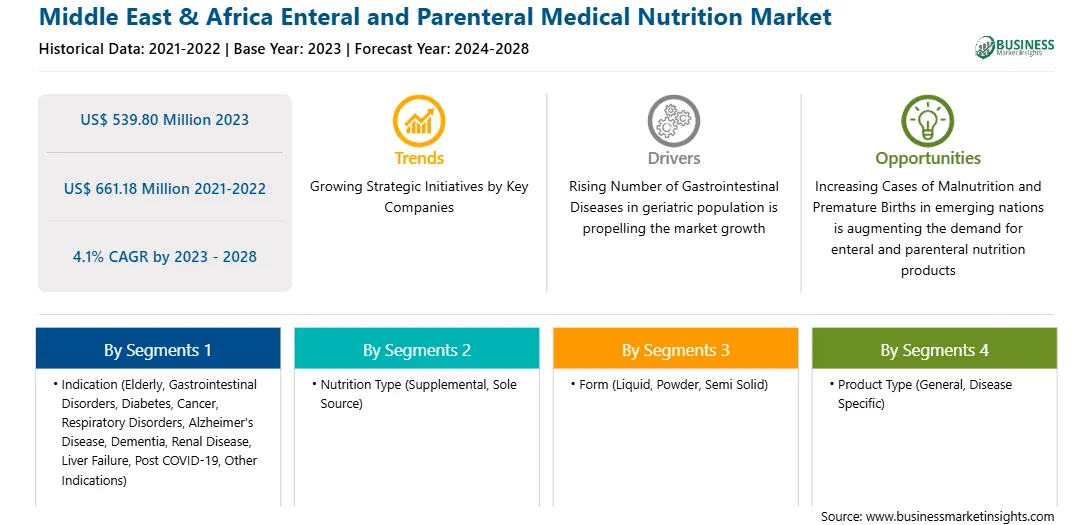

Market size in 2023

US$ 539.80 Million

Market Size by 2028

US$ 661.18 Million

Global CAGR (2023 - 2028)

4.1%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Indication

By Nutrition Type

By Form

By Product Type

By Route of Administration

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Enteral and Parenteral Medical Nutrition Regional Insights

The Middle East & Africa enteral and parenteral medical nutrition market is segmented into indication, nutrition type, form, product type, route of administration, age group, and distribution channel, and country.

Based on indication, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into elderly, gastrointestinal disorders, diabetes, cancer, respiratory disorders, alzheimer’s disease, dementia, renal disease, liver failure, post covid-19, and other indications. The elderly segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023. Gastrointestinal disorders are segmented into IBD, IBS, and others.

Based on nutrition type, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into supplemental and sole source. The supplemental segment held a larger share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Based on form, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into liquid, powder, and semi solid. The liquid segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Based on product type, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into general and disease specific. The general segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Based on route of administration, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into oral, tube feed, and parenteral. The parenteral segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Based on age group, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into above 60 years, 18-60 years, 3-18 years, and below 3 years. The above 60 years segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Based on distribution channel, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into a hospital pharmacies, retail stores, e-commerce, and others. The hospital pharmacies segment held the largest share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023

Based on country, the Middle East & Africa enteral and parenteral medical nutrition market is segmented into Saudi Arabia, South Africa, the UAE, Iran, Israel, Egypt, and the Rest of Middle East & Africa. Saudi Arabia dominated the share of the Middle East & Africa enteral and parenteral medical nutrition market in 2023.

Abbott Laboratories; B. Braun SE; Baxter International Inc; Easy Line Ltd; Fresenius Kabi AG; Nestle SA; and Nutricia International BV are the leading companies operating in the Middle East & Africa enteral and parenteral medical nutrition market.

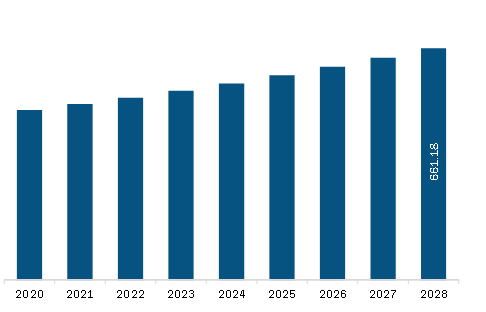

The Middle East & Africa Enteral and Parenteral Medical Nutrition Market is valued at US$ 539.80 Million in 2023, it is projected to reach US$ 661.18 Million by 2028.

As per our report Middle East & Africa Enteral and Parenteral Medical Nutrition Market, the market size is valued at US$ 539.80 Million in 2023, projecting it to reach US$ 661.18 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The Middle East & Africa Enteral and Parenteral Medical Nutrition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Enteral and Parenteral Medical Nutrition Market report:

The Middle East & Africa Enteral and Parenteral Medical Nutrition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Enteral and Parenteral Medical Nutrition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Enteral and Parenteral Medical Nutrition Market value chain can benefit from the information contained in a comprehensive market report.