Market Introduction

The Middle East and Africa region include economies such as South Africa, Saudi Arabia, the UAE and other countries. There is an increasing use of encapsulation to control the release of food ingredients and protect them during the processing environment. The demand for dietary supplements is growing steadily in the region. There are changing consumer attitudes towards health and wellness. Increasing health consciousness amongst consumers is creating demand for dietary supplements. The demand for fortified and functional food products is also increasing in the region. Additionally, growing demand for encapsulated ingredients in personal care products will drive the growth of the market in the region.

The COVID-19 pandemic has significantly disrupted the manufacturing sector in terms of operational efficiency, owing to extended lockdowns across the region, restrictions imposed on international trades, the shutdown of manufacturing units, travel bans, supply chain disintegration, shortage in the supply of raw materials, and many other factors. In the Middle East & Africa, South Africa had the most COVID-19 cases, followed by Saudi Arabia and the UAE. Various chemicals and materials companies remained closed due to lockdowns, resulting in a decrease in the sale of various products, thereby affecting the encapsulation market. However, the implementation of effective government policies in countries like the UAE has significantly revived the industrial activities across the region, which is projected to favor the growth of the encapsulation market in the Middle East & Africa.

Strategic insights for the Middle East and Africa Encapsulation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East and Africa Encapsulation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East and Africa Encapsulation Strategic Insights

Middle East and Africa Encapsulation Report Scope

Report Attribute

Details

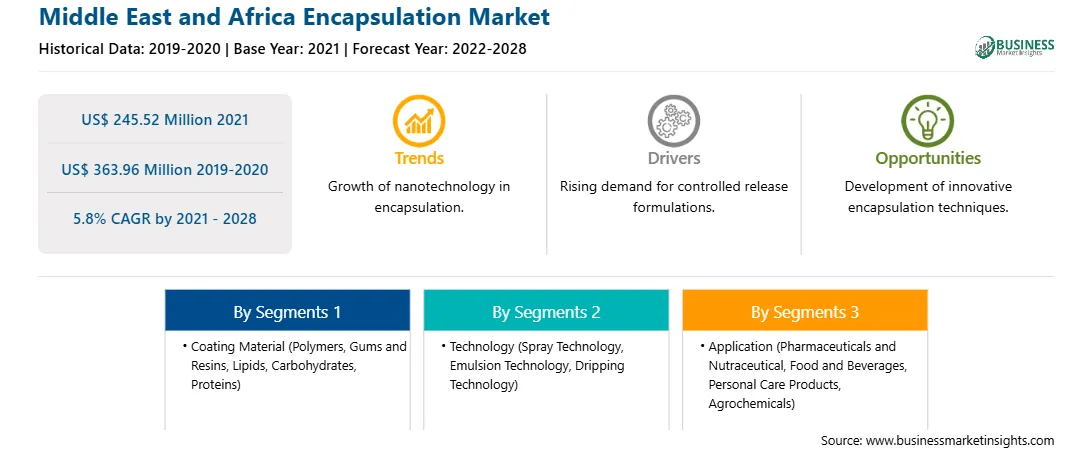

Market size in 2021

US$ 245.52 Million

Market Size by 2028

US$ 363.96 Million

Global CAGR (2021 - 2028)

5.8%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Coating Material

By Technology

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East and Africa Encapsulation Regional Insights

Market Overview and Dynamics

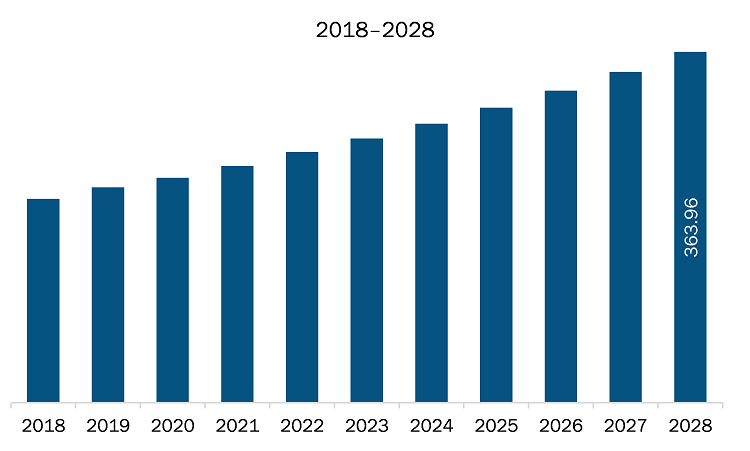

The encapsulation market in Middle East & Africa is expected to grow from US$ 245.52 million in 2021 to US$ 363.96 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028. Development of advanced technologies; numerous companies operating in the encapsulation market have made substantial investments in advanced technologies to promote the development of microencapsulation and nanoencapsulation. Modern technologies are being developed to tap niche markets. For instance, pharmaceutical companies are developing medicines for brain tumors that work through specifically operated drug delivery systems. Further, companies operating in the encapsulation market are focused on the development of new products which can display product properties, including different phase temperature change options and improvement in latent heat storage capacity. In addition, there is a growing demand for encapsulated products from the energy sector, primarily for products that can endure high-temperature ranges. Such factors are expected to provide significant growth opportunities for the market players in Middle East & Africa encapsulation market during the forecast period.

Key Market Segments

Based on coating material, the Middle East & Africa encapsulation market is segmented into polymers, gums and resins, lipids, carbohydrates, and lipids. In 2020, the carbohydrates segment held the largest share Middle East & Africa encapsulation market. Based on technology, the Middle East & Africa encapsulation market is segmented into spray technology, emulsion technology, dripping technology and others. In 2020, the spray technology segment held the largest share Middle East & Africa encapsulation market. Based on by application, the Middle East & Africa encapsulation market is segmented into pharmaceuticals and nutraceutical, food and beverages, personal care products, agrochemicals, and other. In 2020, the food and beverages segment held the largest share Middle East & Africa encapsulation market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the encapsulation market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Balchem Inc.; BASF SE; DSM; FrieslandCampina; Givaudan; and TasteTech among others.

Reasons to buy report

MIDDLE EAST & AFRICA ENCAPSULATION MARKET SEGMENTATION

By Country

Company Profiles

The Middle East and Africa Encapsulation Market is valued at US$ 245.52 Million in 2021, it is projected to reach US$ 363.96 Million by 2028.

As per our report Middle East and Africa Encapsulation Market, the market size is valued at US$ 245.52 Million in 2021, projecting it to reach US$ 363.96 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The Middle East and Africa Encapsulation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Encapsulation Market report:

The Middle East and Africa Encapsulation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Encapsulation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Encapsulation Market value chain can benefit from the information contained in a comprehensive market report.