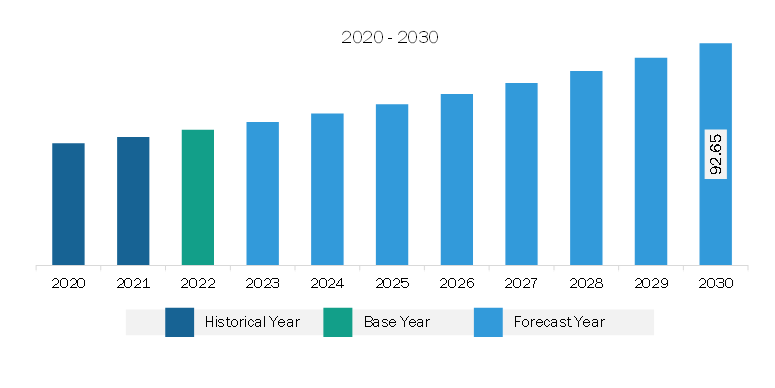

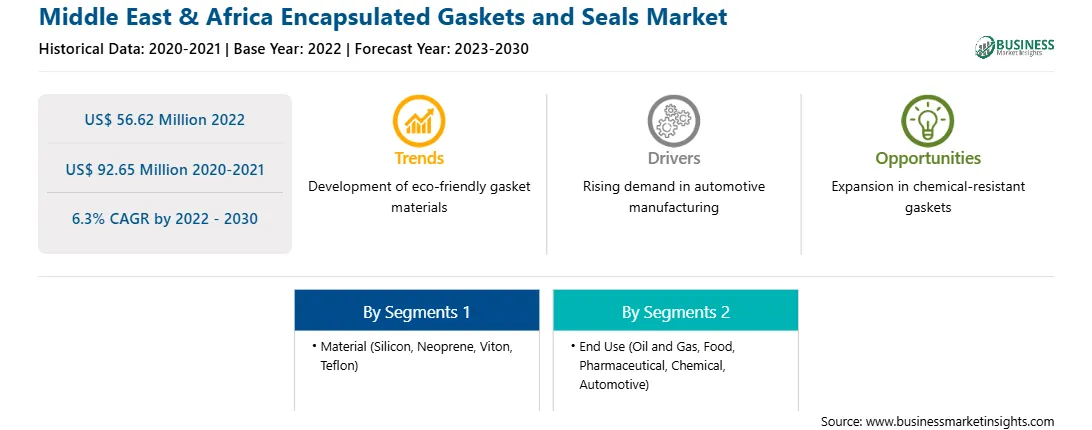

The Middle East & Africa encapsulated gaskets and seals market was valued at US$ 56.62 million in 2022 and is expected to reach US$ 92.65 million by 2030; it is estimated to register a CAGR of 6.3% from 2022 to 2030.

Automated systems enhance efficiency, reduce production time, and minimize errors in application processes. The integration of smart sensors allows real-time monitoring of various parameters during the gasket application process. This includes monitoring material dispensing, production, and quality control, leading to improved product consistency and reliability. Precision manufacturing, machining, and molding technologies for the production of encapsulated gaskets and seals offer tight tolerances and improved dimensional accuracy. Advanced machining, such as Computer Numerical Control (CNC), enables the creation of intricate and complex designs. This precision in manufacturing is essential for producing gaskets with specific shapes and profiles tailored to the requirements of diverse industrial applications.

Nano materials, robotics & automation, and advanced forming are some of the novel manufacturing technologies with a promising scope in the development of encapsulated gaskets and seals market. Precision manufacturing facilities are designed to have quick changeover capabilities, allowing for the rapid transition between gasket specifications. Integrating technologies such as CNC systems, sensors, and high-precision actuators offers exceptional accuracy and precision. Thus, advancements in manufacturing technologies are expected to expand the potential of the encapsulated gaskets and seals market.

The Middle East, known for its thriving oil & gas sector, has been a pivotal force behind the increased demand for encapsulated gaskets and seals. These specialized seals, featuring an additional protective layer, offer durability and resistance to extreme temperatures, chemicals, and pressure-critical attributes in the challenging environments prevalent in the region's energy industry. According to the National Iranian Oil Company, the country has ~158 billion barrels of crude oil reserves. According to data from Gachsaran Oil & Gas Production Company, the field, which has been in operation since 1930, currently produces 650,000 bpd of oil. Moreover, as industrial activities in the Middle East have expanded, the need for reliable sealing solutions in applications such as pipelines, valves, and drilling equipment has intensified, further propelling the market for encapsulated gaskets and seals.

In Africa, the burgeoning manufacturing sector has played an important role in driving the demand for advanced sealing technologies. Encapsulated gaskets and seals find extensive use in machinery, automotive, and processing equipment, where their enhanced resistance and durability to wear and tear make them indispensable. This demand is further fueled by the region's growing infrastructure projects, emphasizing the importance of robust sealing solutions in construction and heavy machinery applications. In addition, the mining industry in Africa is booming. For instance, the report published by the Minerals Council of South Africa in 2022 revealed that the mining production in South Africa was valued at US$ 57 billion in 2021 and reached US$ 61 billion in 2022.

In South Africa, mining exports accounted for US$ 46.3 billion, or 24% of the country's international trade, in 2022. The total sales of iron ore in South Africa accounted for US$ 5.4 billion in 2022, representing a rise of 47.3% compared to 2019. In addition, according to the International Trade Administration, Saudi Arabia's untapped mineral reserves accounted for US$ 1.3 trillion in 2021. Further, the World Mining Data 2022 report by the Federal Ministry of the Republic of Austria revealed that Africa accounted for 889.6 million metric tons of mineral production (excluding bauxite). The mining production rate of minerals in Africa increased by 16.2% from 2000 to 2020.

Key players in the encapsulated gaskets and seals market have strategically positioned themselves to cater to the unique needs of the Middle East & Africa, offering tailored solutions for diverse industries. Technological advancements and innovations in material science have also contributed to the market growth. Companies operating in the market are continuously developing new formulations to enhance the performance of encapsulated gaskets and seals in challenging operational conditions. As these regions continue to witness industrial expansion, the encapsulated gaskets and seals market is poised for sustained growth, driven by the imperative for reliable and durable sealing solutions across diverse applications.

Strategic insights for the Middle East & Africa Encapsulated Gaskets and Seals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 56.62 Million |

| Market Size by 2030 | US$ 92.65 Million |

| Global CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Encapsulated Gaskets and Seals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa encapsulated gaskets and seals market is categorized into material, end use, and country.

Based on material, the Middle East & Africa encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest market share in 2022.

Based on end use, the Middle East & Africa encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022.

By country, the Middle East & Africa encapsulated gaskets and seals market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa encapsulated gaskets and seals market share in 2022.

AS Aston Seals SPA, Gasco Inc, Trelleborg AB, and VH Polymers are some of the leading companies operating in the Middle East & Africa encapsulated gaskets and seals market.

The Middle East & Africa Encapsulated Gaskets and Seals Market is valued at US$ 56.62 Million in 2022, it is projected to reach US$ 92.65 Million by 2030.

As per our report Middle East & Africa Encapsulated Gaskets and Seals Market, the market size is valued at US$ 56.62 Million in 2022, projecting it to reach US$ 92.65 Million by 2030. This translates to a CAGR of approximately 6.3% during the forecast period.

The Middle East & Africa Encapsulated Gaskets and Seals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Encapsulated Gaskets and Seals Market report:

The Middle East & Africa Encapsulated Gaskets and Seals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Encapsulated Gaskets and Seals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Encapsulated Gaskets and Seals Market value chain can benefit from the information contained in a comprehensive market report.