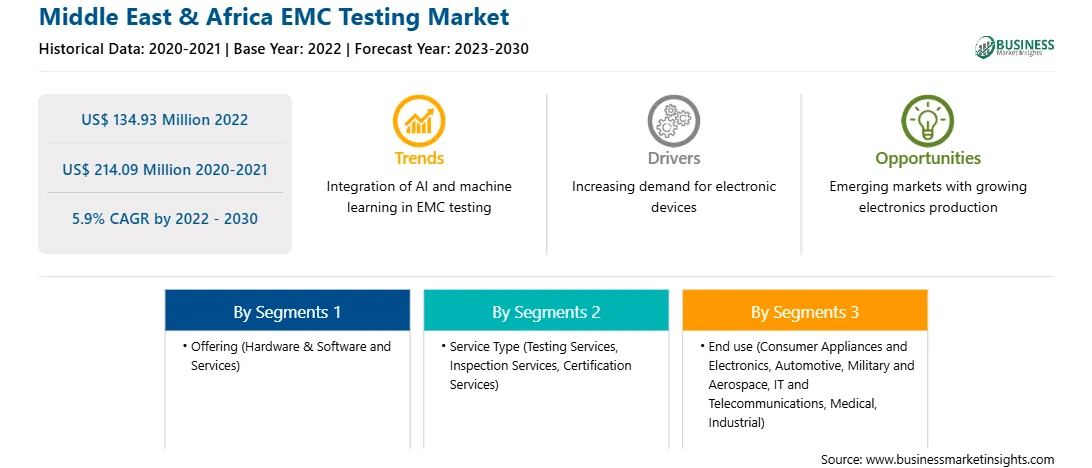

The Middle East & Africa EMC testing market was valued at US$ 134.93 million in 2022 and is expected to reach US$ 214.09 million by 2030; it is estimated to grow at a CAGR of 5.9% from 2022 to 2030.

Irrespective of the uncertainties that originated from the onset of COVID-19, service providers continue to work for fast adoption of 5G, with more than 160 commercial 5G services already available. 5G subscriptions sometimes include larger buckets or even limitless data, in addition to much faster speeds. Significant engineering efforts are required on test specifications, instruments, and firmware before 5G user devices can deliver on the efficiency of the new technology. One of the areas that need to be addressed for 5G adoption is electromagnetic compatibility (EMC) testing. The need for gadgets supporting 5G is rapidly increasing, and there is a large market for testing for 5G gadgets. The evolution of industry standards for testing equipment is a time-consuming process, and test procedures can be applied to any device with little modifications. Two new technologies in the future wave of 5G gadgets will pose a challenge to current methods of testing 5G gadgets. The first challenge is that 5G equipment can use two widely separated frequency ranges, which will necessitate far more adaption than an emissions limit line extension. Second, 5G devices will use improved antenna systems to use both transmission bands, which will necessitate significant changes to current test procedures. Thus, the new standards required for 5G testing will encourage the growth of the Middle East & Africa electromagnetic compatibility (EMC) testing market in the coming years.

Geographically, the EMC testing market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East has a booming manufacturing sector, which is mainly attributed to governments' efforts to encourage the expansion of this sector. According to the UAE's Department of Economic Development, in August 2023, non-oil foreign trade reached US$ 340 billion, becoming the second-largest contributor to the UAE's economy. Several countries in Africa are attracting large FDIs in their manufacturing sector. The growth of this sector would propel the demand for EMC testing across the region during the forecast period. For instance, according to the United Nations Conference on Trade and Development, Africa received an investment of US$ 10 billion for the top 15 greenfield mega projects, including heavy manufacturing plants, automotive, and electronics. This investment is expected to create opportunities for the EMC testing market during the forecast period. EMC testing helps the manufacturers to identify, address, and rectify EMC issues in the first stage of development and reduce costs from pre-compliance to post-manufacturing cycle in the manufacturing sector.

The Gulf countries are economically advanced, while the African countries are yet to match the economic conditions of the Gulf countries. An increase in the number of passenger cars and commercial vehicles on the road, a rise in demand for electric vehicles, and the introduction of automated technology-integrated cars are among the factors that are positively affecting the automotive sector in the MEA. For instance, according to the World Economic Forum, in April 2023, the African country's average annual demand was 300,000 and 2.4 million for commercial vehicles and motor cars. Thus, the increase in car production and sales across the region is also fueling the Middle East & Africa electromagnetic compatibility (EMC) testing market growth. EMC testing provides several benefits to the users, such as safety and performance, cost-effective solutions, and enhanced reliability. Other countries in the Middle East, such as Oman and Israel, are also expected to witness growth in their manufacturing sectors. The government of Oman is supporting this sector by introducing several incentives as well as promoting FDIs. According to Ericsson's mobility report, 5G would account for a 15% share of the total connectivity market in the Middle East and North Africa by 2026, while LTE (4G) would hold a 51% share. Thus, the rising adoption of consumer electronics and modern lifestyle is contributing to the Middle East & Africa electromagnetic compatibility (EMC) testing market in the region.

Strategic insights for the Middle East & Africa EMC Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 134.93 Million |

| Market Size by 2030 | US$ 214.09 Million |

| Global CAGR (2022 - 2030) | 5.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa EMC Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa EMC testing market is segmented based on offering, service type, end use, and country. Based on offering, the Middle East & Africa EMC testing market is bifurcated into hardware & software and services. The hardware & software segment held a larger market share in 2022.

In terms of service type, the Middle East & Africa EMC testing market is segmented into testing services, inspection services, certification services, and others. The testing services held the largest market share in 2022.

By end use, the Middle East & Africa EMC testing market is segmented into consumer appliances and electronics, automotive, military and aerospace, IT and telecommunications, medical, Industrial, and others. The consumer appliances and electronics held the largest market share in 2022.

Based on country, the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa share in 2022.

Ametek Inc, Eurofins scientific SE, Intertek group PLC, TUV nord group, Rohde & schwarz Gmbh & co kG, SGS SA, TUV SUD AG, and UL LLC are some of the leading companies operating in the Middle East & Africa EMC testing market.

1. Ametek Inc

2. Element Material Technology Group Ltd

3. Eurofins Scientific SE

4. Intertek Group PLC

5. TUV Nord Group

6. Rohde & Schwarz Gmbh & co kG

7. SGS SA

8. TUV SUD AG

9. UL LLC

The Middle East & Africa EMC Testing Market is valued at US$ 134.93 Million in 2022, it is projected to reach US$ 214.09 Million by 2030.

As per our report Middle East & Africa EMC Testing Market, the market size is valued at US$ 134.93 Million in 2022, projecting it to reach US$ 214.09 Million by 2030. This translates to a CAGR of approximately 5.9% during the forecast period.

The Middle East & Africa EMC Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa EMC Testing Market report:

The Middle East & Africa EMC Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa EMC Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa EMC Testing Market value chain can benefit from the information contained in a comprehensive market report.