The market players are aggressively conducting research and development activities on embolization coils. Also, the market is dynamic and complex, characterized by recurrent product launches and plentiful clinical trials. The embolization coils market has various growth opportunities due to the rising prevalence of peripheral vascular disease, neurovascular diseases, cardiac conditions, and other chronic diseases that lead to vascular disorders. The current trend for endovascular treatments or embolization coils is interventional radiology. The treatment is a minimally invasive procedure under the guidance of X-rays. The benefits of interventional radiology have proven itself to be the best treatment option for the control of extensive blood flow. Interventional radiology is also helpful in the field of gynecology during cesarean section procedures where the patients experience extensive blood loss. The rise in the prevalence of liver and kidney cancer has contributed extensively to the need for treatment. The rise in the geriatric population, which is highly affected by endovascular diseases, brain stroke, heart stroke, and chronic diseases, is adding up to the market's growth. Therefore, interventional radiology is highly preferred for the geriatric population to treat diseases as it is a minimally invasive procedure. In addition, the other advantages, such as less hospital stay, fast recovery, and less dependence on others after the procedure, attract the patients more.

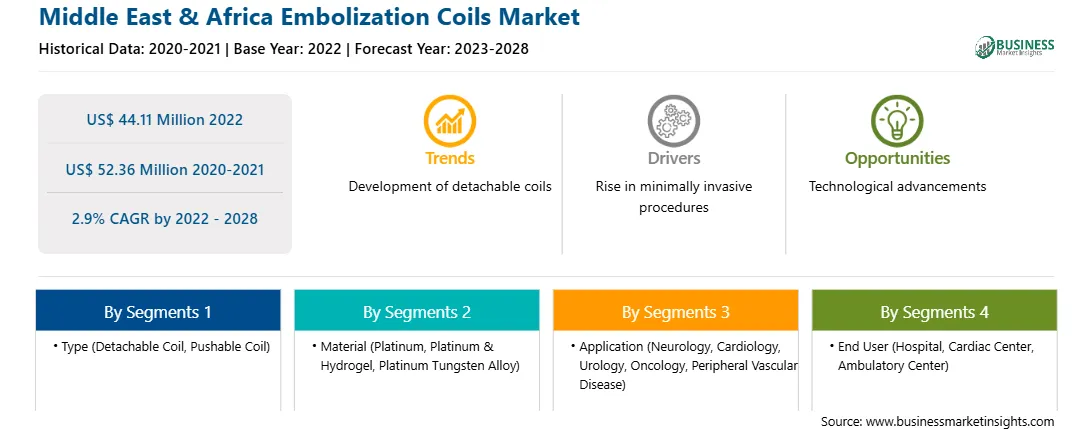

Middle East & Africa Embolization Coils Market Overview

The Middle East and Africa embolization coils market is segmented into Saudi Arabia, South Africa, UAE, and rest of Middle East and Africa. The embolization coil market in the region is expected to grow due to rising prevalence of chronic diseases, growing healthcare expenditure, and growing collaborations by market players. Saudi Arabia has experienced a significant change in the people’s standard of the living and lifestyle, the changes has led to increase in the consumption of fatty and poor quality of food. The administration of MOH is very much centralized, regional executives have limited independence in financing and planning of services. However, the major expenses are authorized by the central administration of MOH. Thus, owing to the above-mentioned factors the Middle East & Africa embolization coils market is likely to grow in the forecasted period.

Middle East & Africa embolization coils Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Middle East & Africa Embolization Coils provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 44.11 Million |

| Market Size by 2028 | US$ 52.36 Million |

| Global CAGR (2022 - 2028) | 2.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Embolization Coils refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa embolization coils market Segmentation

The Middle East & Africa embolization coils market is segmented on the basis of type, material, application, end user, and country. Based on type, the Middle East & Africa embolization coils market is bifurcated into detachable coil and pushable coil. The detachable coil segment held a larger market share in 2022.

Based on material, the Middle East & Africa embolization coils market is segmented into platinum, platinum & hydrogel, and platinum tungsten alloy. The platinum segment held the largest market share in 2022.

Based on application, the Middle East & Africa embolization coils market is segmented into neurology, cardiology, urology, oncology, peripheral vascular disease, and others. The neurology segment held the largest market share in 2022.

Based on end user, the Middle East & Africa embolization coils market is segmented into hospital, cardiac center, ambulatory center, and other. The hospital segment held the largest market share in 2022.

Based on country, the Middle East & Africa embolization coils market is segmented into the Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the market share in 2022.

Terumo Corporation; Medtronic; Boston Scientific Corporation; Stryker; KANEKA CORPORATION; MicroPort Scientific Corporation; Penumbra, Inc.; Cook Medical LLC; Johnson & Johnson Services, Inc.; and Shape Memory Medical INC. are the leading companies operating in the Middle East & Africa embolization coils market.

The Middle East & Africa Embolization Coils Market is valued at US$ 44.11 Million in 2022, it is projected to reach US$ 52.36 Million by 2028.

As per our report Middle East & Africa Embolization Coils Market, the market size is valued at US$ 44.11 Million in 2022, projecting it to reach US$ 52.36 Million by 2028. This translates to a CAGR of approximately 2.9% during the forecast period.

The Middle East & Africa Embolization Coils Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Embolization Coils Market report:

The Middle East & Africa Embolization Coils Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Embolization Coils Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Embolization Coils Market value chain can benefit from the information contained in a comprehensive market report.