Middle East & Africa Electronic Data Interchange (EDI) Market

No. of Pages: 80 | Report Code: BMIRE00029435 | Category: Technology, Media and Telecommunications

No. of Pages: 80 | Report Code: BMIRE00029435 | Category: Technology, Media and Telecommunications

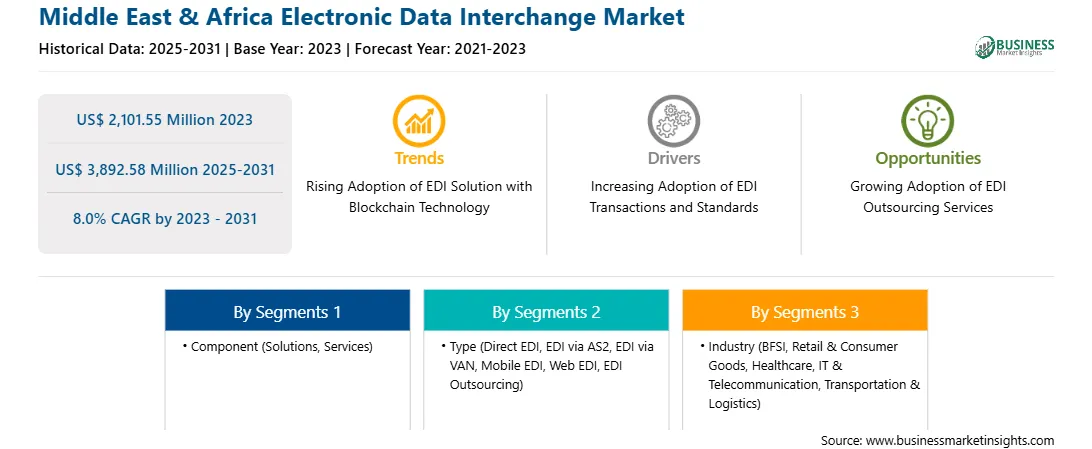

Blockchain is a revolutionary technology transforming business processes across many industries, from retail to logistics. It is deployed to transform the payment and invoicing industry globally by offering easy access and highly secure solutions for end customers. The growing integration of blockchain technology due to successful proof of concepts across various industries such as IT & telecom, BFSI, transportation, and logistics demands EDI solutions for efficient data interchange. A few blockchain applications consist of high-security applications, data of multiple parties, and tracking of goods from origin to end user. However, according to a few industry experts, blockchain technology cannot replace the B2B transactional methodology; it is suggested to be used as an add-on to EDI for producing a better business outcome instead of replacing the overall EDI solution with blockchain technology. Therefore, with the mounting digitalization of payment as well as invoice processes across diversified businesses, the adoption of blockchain technology is expected to lead to the future growth of the EDI market.

The EDI market in the MEA is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA. The adoption of EDI solutions is predicted to increase with time as the region is robustly focusing on development across several industries such as BFSI, healthcare, and IT. Further, manufacturers are focusing on the latest developments in logistics tracking and labeling technologies, which handle the interchange of a considerable amount of data with trading partners. Additionally, the expansion of the fifth generation-based telecommunication network and implementation of Vision Documents in Saudi Arabia, Qatar, the UAE, and Kuwait are expected to support the Middle East & North Africa EDI market in the coming years. In the Middle East, a few countries such as Saudi Arabia have taken steps to make e-invoicing mandatory. The country has shown its high interest in executing Continuous Transaction Controls (CTC), which includes mandatory e-invoicing. The UAE is another country using EDI solutions in B2B transactions to make it more accurate and faster. In the UAE, the implementation of e-invoicing is governed by Federal Law No. (1) of 2006 On Electronic Commerce and Transactions. The UAE-based companies are looking forward to introducing EDI solutions through a network of supply chain partners to meet legal requirements levied by the UAE legislative bodies. Oman, Kuwait, and Libya are a few countries that have no regulations for EDI solutions in their jurisdiction.

Rising disposable incomes in developing countries of Africa, increasing population, rapid procurement of advanced and innovative electronic solutions, and growing infrastructural development in the Middle East and African countries are anticipated to contribute to the EDI market growth in the coming years. Moreover, these countries are significantly getting involved in various global events, which are leading to the infrastructural development and strengthening of the economy. Thus, all these factors propel the demand for EDI solutions in the MEA.

The Middle East & Africa electronic data interchange (EDI) market is segmented based on component, type, industry, and country.

Based on component, the Middle East & Africa electronic data interchange (EDI) market is bifurcated into solution and services. The solution segment held a larger Middle East & Africa electronic data interchange (EDI) market share in 2022.

In terms of type, the Middle East & Africa electronic data interchange (EDI) market is categorized into direct EDI, EDI via AS2, EDI via VAN, mobile EDI, web EDI, EDI outsourcing, and others. The EDI via AS2 segment held the largest Middle East & Africa electronic data interchange (EDI) market share in 2022.

By industry, the Middle East & Africa electronic data interchange (EDI) market is segmented into BFSI, retail and consumer goods, healthcare, IT and telecommunication, transportation and logistics, and others. The retail and consumer goods segment held the largest Middle East & Africa electronic data interchange (EDI) market share in 2022.

Based on country, the Middle East & Africa electronic data interchange (EDI) market is categorized into South Africa, the UAE, Saudi Arabia, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa electronic data interchange (EDI) market in 2022.

Cerner Corp, International Business Machines Corp, The Descartes Systems Group Inc, and Comarch SA are some of the leading companies operating in the Middle East & Africa electronic data interchange (EDI) market.

Strategic insights for the Middle East & Africa Electronic Data Interchange (EDI) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,994.27 Million |

| Market Size by 2030 | US$ 3,553.88 Million |

| Global CAGR (2022 - 2030) | 7.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Electronic Data Interchange (EDI) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa Electronic Data Interchange (EDI) Market is valued at US$ 1,994.27 Million in 2022, it is projected to reach US$ 3,553.88 Million by 2030.

As per our report Middle East & Africa Electronic Data Interchange (EDI) Market, the market size is valued at US$ 1,994.27 Million in 2022, projecting it to reach US$ 3,553.88 Million by 2030. This translates to a CAGR of approximately 7.5% during the forecast period.

The Middle East & Africa Electronic Data Interchange (EDI) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Electronic Data Interchange (EDI) Market report:

The Middle East & Africa Electronic Data Interchange (EDI) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Electronic Data Interchange (EDI) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Electronic Data Interchange (EDI) Market value chain can benefit from the information contained in a comprehensive market report.