The MEA region includes various well-established economies such as South Africa, the UAE, and Saudi Arabia. The growth in the electric insulator in the region is mainly due to the investment in smart grids projects and development in transmission line projects. For instance, according to a new study published by Northeast Group, LLC, in Middle East & North African (MENA) countries there will be a total investment of US$ 17.6 billion in smart grid projects from 2018 to 2027. Similarly, in June 2021, the Guinea–Mali Electric Interconnection Project, which involves the construction of a 714-km-long, 225 kV transmission line between Guinea and Mali, of which 590 km is in Guinea and 124 km in Mali, started. Further, there is a construction project of a second 400 kV Kokerboom–Auas transmission line that will ensure network stability and transmission of sufficient power. Thus, multiple ongoing projects and investments in smart grid projects and transmission lines are boosting the demand for electric insulators in the region. The region also has several manufacturers of electric insulators such as Global Insulator Group LLC and NGK Insulators, Ltd. (South Africa). These manufacturers are offering different kinds of electric insulators including shackle insulators, pin insulators, suspension insulators. This will also support the growth of the electric insulator market in the region. Due to the COVID-19 pandemic, the electricity demand was low in the region due to factories and offices shutdowns in 2020. According to the International Energy Agency report of July 2021, with the release of lockdown restrictions and the opening of factories and offices, the electricity demand will increase in countries such as Iran, Kuwait, Oman, UAE, and Iraq.

In case of COVID-19, MEA is highly affected specially Turkey and South Africa. The MEA region has a smaller number of companies operating or offering market-specific solutions. The countries such as the UAE and South Africa are adopting advanced electronics such as smartphones, smart wearables, and IoT connected devices. Increasing focus of governments toward industrialization is expected to drive the market growth in the Middle Eastern countries. Further, due to COVID-19 impact in 2020, the electricity demand was low in the region due to factories and offices shutdown. However, with uplifting of lockdowns and opening of factories and offices, the electricity demand increases in countries such as Iran, Kuwait, Oman, UAE, and Iraq, according to the International Energy Agency report of July 2021.

Strategic insights for the Middle East & Africa Electric Insulator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

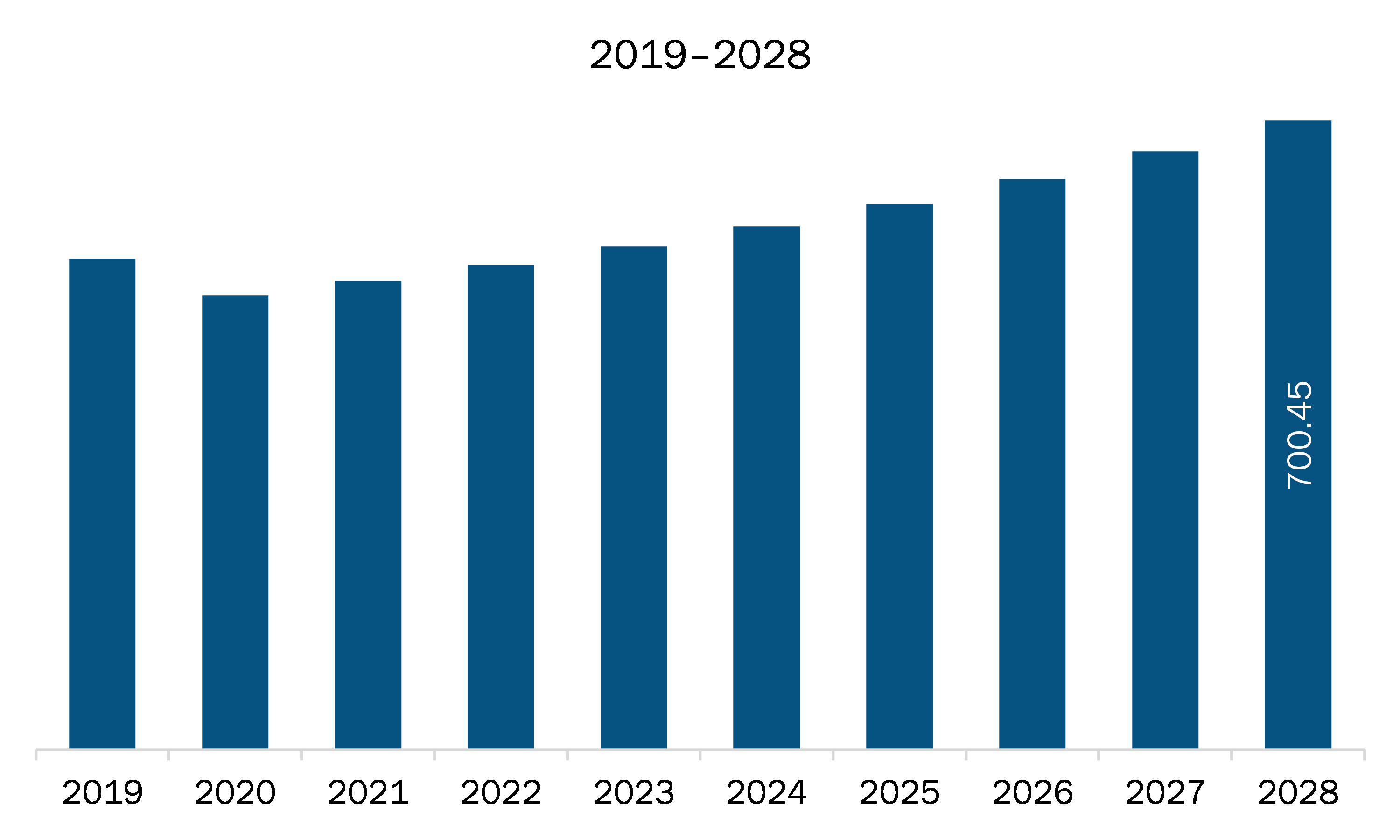

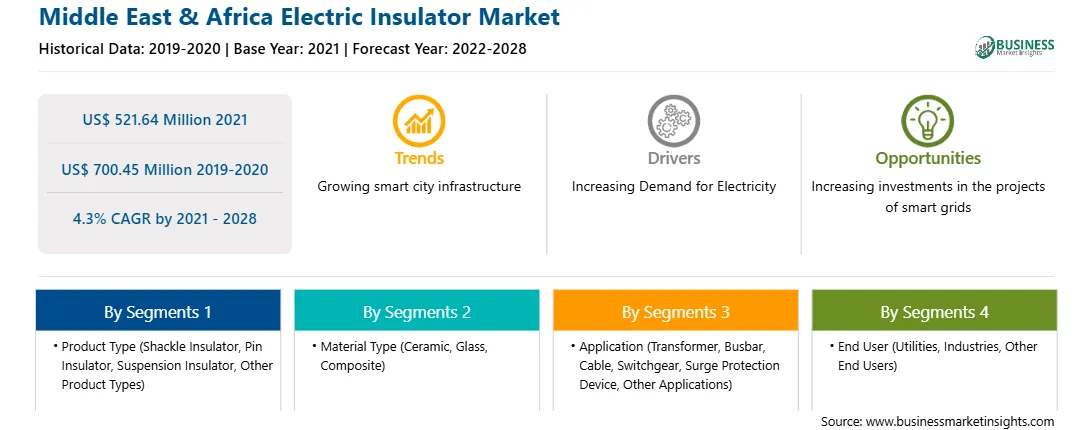

| Market size in 2021 | US$ 521.64 Million |

| Market Size by 2028 | US$ 700.45 Million |

| Global CAGR (2021 - 2028) | 4.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Electric Insulator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA electric insulator market is expected to grow from US$ 521.64 million in 2021 to US$ 700.45 million by 2028; it is estimated to grow at a CAGR of 4.3% from 2021 to 2028. Escalating electricity demand across the region is expected to fuel the MEA electric insulator market. The growing population demands more electricity. With the increase in the electricity demand across residential, commercial, and industrial applications, more transmission and distribution networks are needed to provide electricity across the region. The energy sector is likely to account for 24% of capital expenditure over FY 2019–2025. Moreover, it is also estimated that electricity’s share of the total energy demand is expected to be more than double in 2050, driven by substantial electrification in the transport, buildings, and manufacturing sectors. Therefore, the increasing demand for electricity and rising investments in transmission and distribution networks are boosting the need for electric insulators across MEA region.

In terms of product type, the pin insulator segment accounted for the largest share of the MEA electric insulator market in 2020. In terms of material type, the ceramic segment held a larger market share of the MEA electric insulator market in 2020. In terms of application, the transformer segment held a larger market share of the MEA electric insulator market in 2020. Further, the utilities segment held a larger share of the MEA electric insulator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA electric insulator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aditya Birla Insulators; General Electric Company; Hitachi ABB Power Grids Group; Hubbell Incorporated; MacLean-Fogg Company; NGK Insulators, Ltd.; PFISTERER Holding AG; SEVES Group; Siemens AG; and TE Connectivity Ltd.

The Middle East & Africa Electric Insulator Market is valued at US$ 521.64 Million in 2021, it is projected to reach US$ 700.45 Million by 2028.

As per our report Middle East & Africa Electric Insulator Market, the market size is valued at US$ 521.64 Million in 2021, projecting it to reach US$ 700.45 Million by 2028. This translates to a CAGR of approximately 4.3% during the forecast period.

The Middle East & Africa Electric Insulator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Electric Insulator Market report:

The Middle East & Africa Electric Insulator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Electric Insulator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Electric Insulator Market value chain can benefit from the information contained in a comprehensive market report.