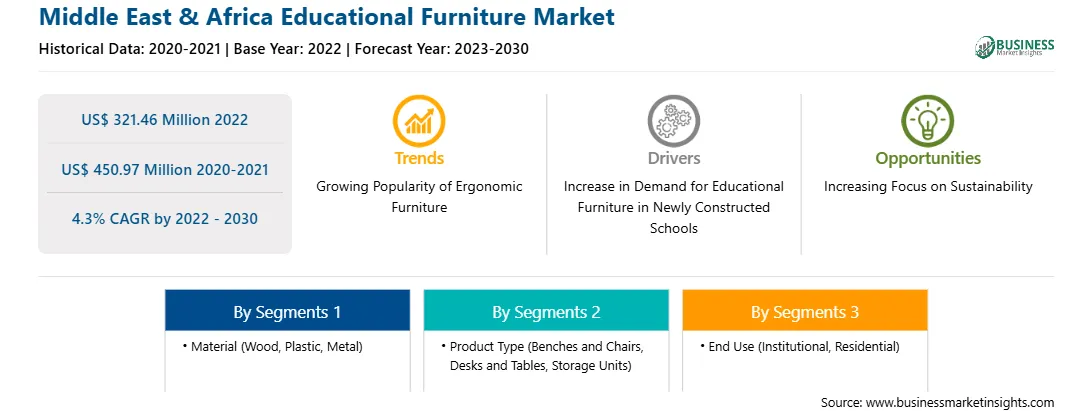

The Middle East & Africa educational furniture market was valued at US$ 321.46 million in 2022 and is expected to reach US$ 450.97 million by 2030; it is estimated to record a CAGR of 4.3% from 2022 to 2030.

As many people spend extended periods sitting at desks and workstations, ergonomic furniture has become a major trend in recent years. This trend has extended to the education sector, where students and teachers spend long hours sitting at desks and tables. Creating learning environments that keep students focused and comfortable has become one of the prime goals of educators, which has increased the demand for ergonomically designed furniture to avoid health issues arising from incorrect body postures while sitting. Ergonomic furniture is designed to promote healthy posture and reduce the risk of musculoskeletal disorders caused by prolonged sitting. Ergonomic chairs, desks, and tables can be adjusted to accommodate different heights and body types, and are designed to provide support for the back, neck, arms, and wrists. Raw materials that are more durable, sustainable, and stable than traditional ones are used in the production of ergonomic furniture. For example, materials such as processed or engineered wood, molded plastics, and high-pressure laminates are used to manufacture chairs, benches, and tables for schools. Further, furniture with additional storage options acts as a space-saving solution in smaller, more compact classrooms, and its demand has increased significantly in recent years. For instance, CBT Supply, Inc. dba Smartdesks produces smart tables and chairs with stackable options and multifunctional applications for classrooms and school offices. Thus, the emerging trend of ergonomic furniture is likely to boost the growth of the education furniture market during the forecast period.

According to the Knowledge and Human Development Authority (KHDA), Dubai registered a surge in school enrollments by 5% in 2022 compared to 2020. The city marked the presence of 215 schools with 18 curriculum options as of 2022. The provision of high-quality education at affordable fee structures, rise in employment opportunities, and economic boom (attributed to the Expo Dubai 2020) are among the factors contributing to the increasing school admissions in the region. The rising admission rate in educational institutes and the availability of government funding for school infrastructure development in rural and urban areas are expected to drive the demand for educational furniture and related products.

As per the World Bank Group, in 2020, the literacy rate in the Middle East & North Africa was 90.33%, which was 0.21% higher than that in 2019. School furniture manufacturers in the Middle East and Africa are undertaking efforts to expand their production facilities to ensure a steady supply of durable furniture that suits the requirement of educational institutes.

Strategic insights for the Middle East & Africa Educational Furniture provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 321.46 Million |

| Market Size by 2030 | US$ 450.97 Million |

| Global CAGR (2022 - 2030) | 4.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Educational Furniture refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa educational furniture market is segmented based on material, product type, end use, and country.

Based on material, the Middle East & Africa educational furniture market is segmented into wood, plastic, metal, and others. The wood segment held the largest Middle East & Africa educational furniture market share in 2022.

In terms of product type, the Middle East & Africa educational furniture market is categorized into benches and chairs, desks and tables, storage units, and others. The benches and chairs segment the largest Middle East & Africa educational furniture market share in 2022.

In terms of end use, the Middle East & Africa educational furniture market is bifurcated into institutional and residential. The institutional segment held a larger Middle East & Africa educational furniture market share in 2022. The institutional segment is further sub segmented into elementary school, secondary school, and higher education.

Based on country, the Middle East & Africa educational furniture market is categorized into the UAE, South Africa, Saudia Arabia, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa educational furniture market in 2022.

Knoll Inc, Haworth Inc, Vitra International AG, and Virco Manufacturing Corp are some of the leading companies operating in the Middle East & Africa educational furniture market.

1. Haworth Inc

2. Knoll Inc

3. Virco Manufacturing Corp

4. Vitra International AG

The Middle East & Africa Educational Furniture Market is valued at US$ 321.46 Million in 2022, it is projected to reach US$ 450.97 Million by 2030.

As per our report Middle East & Africa Educational Furniture Market, the market size is valued at US$ 321.46 Million in 2022, projecting it to reach US$ 450.97 Million by 2030. This translates to a CAGR of approximately 4.3% during the forecast period.

The Middle East & Africa Educational Furniture Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Educational Furniture Market report:

The Middle East & Africa Educational Furniture Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Educational Furniture Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Educational Furniture Market value chain can benefit from the information contained in a comprehensive market report.