Middle East & Africa Digital Twin Market

No. of Pages: 113 | Report Code: BMIRE00031003 | Category: Technology, Media and Telecommunications

No. of Pages: 113 | Report Code: BMIRE00031003 | Category: Technology, Media and Telecommunications

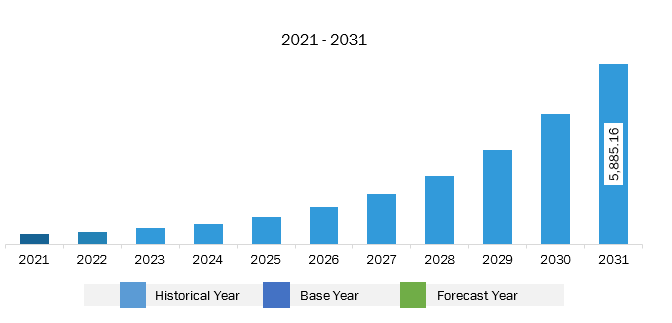

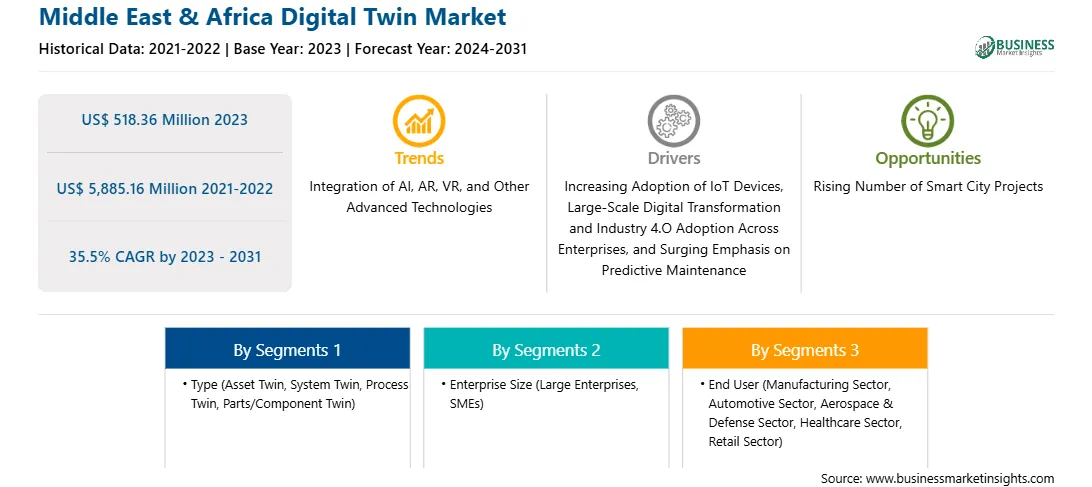

The Middle East & Africa digital twin market was valued at US$ 518.36 million in 2023 and is expected to reach US$ 5,885.16 million by 2031; it is estimated to register a CAGR of 35.5% from 2023 to 2031. Integration of AI, AR, VR, and Other Advanced Technologies Bolster Middle East & Africa Digital Twin Market

Digital twins are the accurate replica build of a system, product, process, or gadget to use it for development, testing, and validation purposes. Monitoring machinery and plant environments in the physical and virtual worlds is a crucial aspect for businesses in sectors such as manufacturing, transportation, and energy, wherein large machinery and other equipment are at the core of operations. Integrating these tangible assets with IT applications and infrastructure is necessary to boost productivity, enhance customer support, and generate crucial business insights that offer businesses a competitive edge. Hence, businesses might benefit from digital twins, AR, and VR to automate and modernize their operations in line with Industry 4.0. Integrating technologies such as AI, machine learning, VR, and AR with digital twins enhances the decision-making capabilities of users and businesses. Virtual reality and augmented reality enable a more immersive experience, allowing users to interact with virtual models and thoroughly analyze all aspects related to them. Artificial intelligence and machine learning provide meaningful insights into the data generated from these simulations. This enables better decision-making while designing, developing, and optimizing complex industrial systems. For instance, Unilever has generated an AI-powered digital twin for approximately 300 plants to monitor their manufacturing closely, implement real-time changes, increase productivity, reallocate materials and reduce waste. Thus, the integration of advanced technologies such as AI, AR, and VR is expected to emerge as a significant digital twin market trend in the coming years.

Strategic insights for the Middle East & Africa Digital Twin provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Digital Twin refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Digital Twin Strategic Insights

Middle East & Africa Digital Twin Report Scope

Report Attribute

Details

Market size in 2023

US$ 518.36 Million

Market Size by 2031

US$ 5,885.16 Million

Global CAGR (2023 - 2031)

35.5%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Enterprise Size

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Digital Twin Regional Insights

Middle East & Africa Digital Twin Market Segmentation

The Middle East & Africa Digital Twin Market is categorized into type, enterprise size, end user, and country.

Based on type, the Middle East & Africa digital twin market is segmented into asset twin, system twin, process twin, and parts/component twin. The asset twin segment held the largest share of Middle East & Africa digital twin market share in 2023.

In terms of enterprise size, the Middle East & Africa digital twin market is bifurcated into large enterprises and SMES. The large enterprises segment held a larger share of Middle East & Africa digital twin market in 2023.

Based on end user, the Middle East & Africa digital twin market is categorized into manufacturing, automotive, aerospace & defense, healthcare, retail, and others. The manufacturing segment held the largest share of Middle East & Africa digital twin market in 2023.

By country, the Middle East & Africa digital twin market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa digital twin market share in 2023.

General Electric Co; Microsoft Corp; Siemens AG; Dassault Systemes SE; PTC Inc.; Robert Bosch GmbH; International Business Machines Corp; Oracle Corp; Ansys, Inc.; and Autodesk, Inc. are some of leading companies operating in the Middle East & Africa digital twin market.

The Middle East & Africa Digital Twin Market is valued at US$ 518.36 Million in 2023, it is projected to reach US$ 5,885.16 Million by 2031.

As per our report Middle East & Africa Digital Twin Market, the market size is valued at US$ 518.36 Million in 2023, projecting it to reach US$ 5,885.16 Million by 2031. This translates to a CAGR of approximately 35.5% during the forecast period.

The Middle East & Africa Digital Twin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Digital Twin Market report:

The Middle East & Africa Digital Twin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Digital Twin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Digital Twin Market value chain can benefit from the information contained in a comprehensive market report.