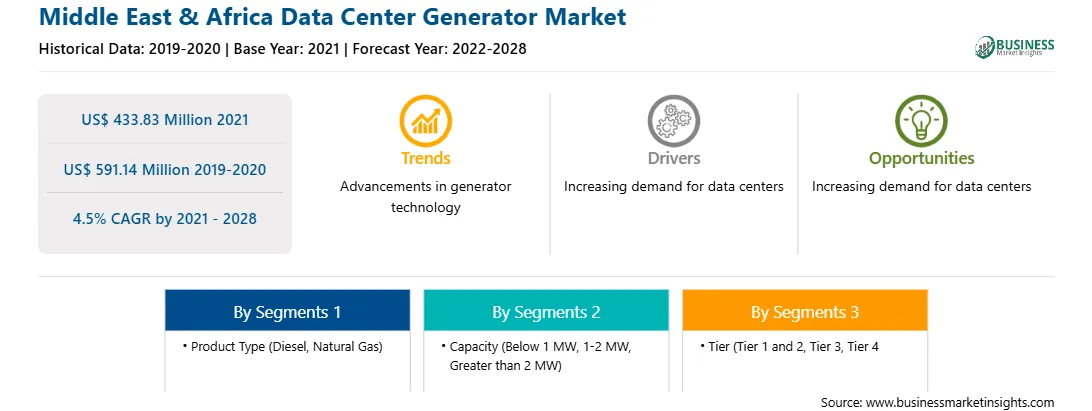

The data center generator market in Middle East & Africa is expected to grow from US$ 433.83 million in 2021 to US$ 591.14 million by 2028. It is estimated to grow at a CAGR of 4.5% from 2021 to 2028. Environmental sustainability and energy savings are two fundamental factors fueling the interest in renewables. The cost of power in a data center is high, accounting for over half of the total operating expenses. When rising and unpredictable energy costs and levies linked with pending carbon emission regulations are considered, it is easy to see why operators are becoming more interested in renewables' role in lowering and stabilizing energy costs. Google's hyper-scale data centers have been pioneers in renewable energy programs, researching their inherent financial, environmental, and social value. Google chooses locations for its data centers based on various considerations, including the availability of reliable service and the opportunity for renewable energy. As a result, it employs renewable energy in the form of wind and solar to power over 35% of its operations through power purchase agreements (PPAs), a technique that encourages utility providers to increase the use of renewables. Facebook is constructing facilities in Iowa that will be powered entirely by a local wind project that the company helped establish. Dubai Electricity and Water Authority launched the first phase of the Middle East & Africa's largest solar-powered data center as the emirate attempts to strengthen its green economy and focus on sustainable development. Rooftop solar, wind, geothermal, and waste heat reclamation are viable data center options due to the high cost of photovoltaic solar arrays, climate conditions, and space constraints. However, because rooftop solar is free when accessible, it has become one of the more frequently employed ways in data center environments, lowering the cost of implementation. Wind turbines are less common, owing to real estate constraints and costs, yet interest in this resource is growing. Geothermal and waste heat recovery projects are also in the works. Battery storage is also important in renewable energy management because it can help with intermittency. While the technology is viable, many businesses cannot use it on a wide scale due to financial and space constraints. Battery storage has the potential to help overcome some of the reliability issues that come with renewable energy if the costs come down.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Middle East & Africa data center generator market at a substantial CAGR during the forecast period.

Middle East & Africa Data Center Generator Market Segmentation

The Middle East & Africa data center generator market is segmented into product type, capacity, tire, and country. Based on product type, the market is segmented into diesel, natural gas, and bi-fuel. In 2020, the diesel segment held the largest market share. Based on capacity, the Middle East & Africa data center generator market is segmented into below 1 MW, 1–2 MW, and greater than 2 MW. In 2020, the below 1MW segment held the largest market share and is expected to register the highest CAGR in the market during the forecast period. Based on tire, the market is segmented into tier 1 and tier 2, tier 3, and tier 4. In 2020, the tier 3 segment held the largest market share. Based on country, the Middle East & Africa data center generator market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. In 2020, the UAE held the largest market share.

ABB Ltd; Atlas Copco AB; Caterpillar Inc.; Cummins Inc.; DEUTZ AG; GENERAC POWER SYSTEMS INC.; HITEC POWER PROTECTION; Kohler Co.; Mitsubishi Heavy Industries, Ltd.; and KIRLOSKAR OIL ENGINES LIMITED are among the leading companies in the Middle East & Africa data center generator market.

Strategic insights for the Middle East & Africa Data Center Generator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 433.83 Million |

| Market Size by 2028 | US$ 591.14 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Data Center Generator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa Data Center Generator Market is valued at US$ 433.83 Million in 2021, it is projected to reach US$ 591.14 Million by 2028.

As per our report Middle East & Africa Data Center Generator Market, the market size is valued at US$ 433.83 Million in 2021, projecting it to reach US$ 591.14 Million by 2028. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East & Africa Data Center Generator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Data Center Generator Market report:

The Middle East & Africa Data Center Generator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Data Center Generator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Data Center Generator Market value chain can benefit from the information contained in a comprehensive market report.