Middle East & Africa Data Center Colocation Market

No. of Pages: 112 | Report Code: TIPRE00026091 | Category: Technology, Media and Telecommunications

No. of Pages: 112 | Report Code: TIPRE00026091 | Category: Technology, Media and Telecommunications

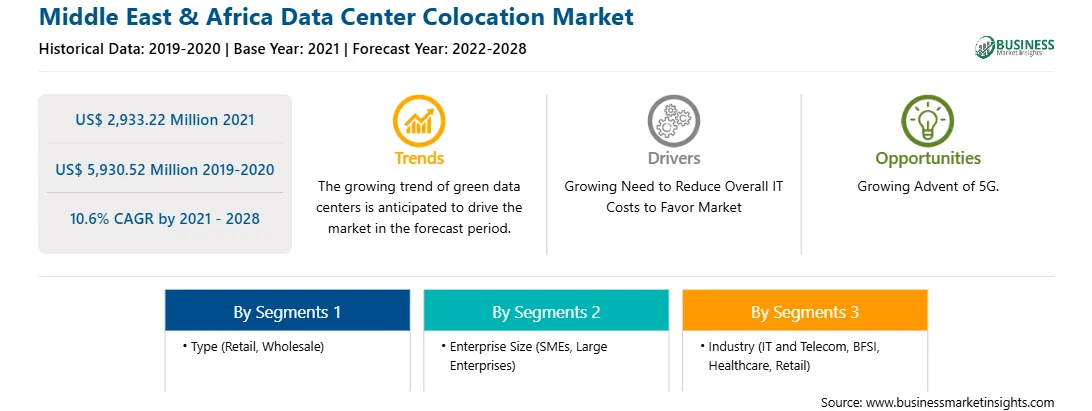

The Middle East & Africa data center colocation market is characterized by increase in customer base, active broadband connections, and growth of the digital economy. The Middle East & Africa exhibits some of the highest levels of broadband penetration in its financial markets with a global reach. In 2018, the MENA region only had one public cloud facility and many countries in the region had fewer than five edge nodes by global Internet providers. However, MEA’s data center colocation market is rapidly growing as more enterprises are adopting colocation services. There is a growing demand for hyperscale, altering the competitive structure, business models, and the nature of the MEA’s data center facilities. The MEA region offers lucrative growth opportunities to global investors and is rising as a potential investment site. As a result, many global players are expanding their business in the region. For instance, the world’s largest carrier-neutral colocation provider, Equinix, is expanding its facilities in the Middle East. Amazon Web Services (AWS) and Group 42 are investing in hyperscale data centers in the region. Other factors that are likely to contribute to the growth of the Middle East & Africa data center colocation market include increase in investment in big data, IoT, and cloud and rise in adoption of all-flash storage solutions, and smart city initiatives. The adoption of organization-specific software over the cloud platform is also augmenting the demand for high-computing servers, thereby bolstering the growth of the Middle East & Africa data center colocation market. Emergence of 5G services to surge demand for advanced data center infrastructure is the major factor driving the growth of the MEA data center colocation market.

Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are the leading countries facing the economic effects of COVID-19 in the Middle East & Africa. The outbreak has led to more people staying indoors, thereby adopting work-from-home practices. Many industries shifted their operational activities from a physical office to a virtual space. The shift in the working style among corporates and digitization of all work and deploying it to on cloud has increased the demand for high storage capacity servers in various industries in the region. The COVID-19 flare-up intensely affected global data center colocation market, and the lockdown forced a few difficulties to the strategic policies. Notwithstanding the pandemic, the data center colocation market estimate that there is a tremendous interest in the business, and it will fill dramatically in the estimated months. The development will withstand based on maximum usage of information utilization by the endeavors and embracing strategies of far off working.

Strategic insights for the Middle East & Africa Data Center Colocation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,933.22 Million |

| Market Size by 2028 | US$ 5,930.52 Million |

| Global CAGR (2021 - 2028) | 10.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Data Center Colocation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The data center colocation market in MEA is expected to grow from US$ 2,933.22 million in 2021 to US$ 5,930.52 million by 2028; it is estimated to grow at a CAGR of 10.6% from 2021 to 2028. There is a rising demand for data center solutions that are cost-effective and offer value unique features. According to industry experts, by 2025, data centers are anticipated to consume a fifth of the power, which is enabling companies to consider power-saving measures in order to bring cost benefits for an organization. As a result, companies are opting to utilize the space available for data center scaling or creating a cost-effective data center using a disaggregated architecture. This methodology has incremented the demand for high-performance compute (HPC) architecture. HPC architecture transforms the data center by operating with low power consuming servers and efficient cooling systems and has a higher power usage effectiveness. HPCs also provide scalability, speed, and reliability. Further, the growth of electronic design automation to shorten the design cycle is bolstering the growth of the high-performance compute data center architecture. Transformation of the existing data centers with effective architecture, fast deployment, and optimized power consumption across the region is enabling organizations to achieve long-term gains. This is also propelling the demand for high-performance compute (HPC) data centers.

The MEA data center colocation market is segmented into type, enterprise size, industry, and country. Based on type, the market is segmented into retail and wholesale. The retail segment dominated the market in 2020 and wholesale segment is expected to be the fastest growing during the forecast period. Based on enterprise size, the data center colocation market is divided into SMEs and large enterprises. The large enterprises segment dominated the market in 2020 and SMEs segment is expected to be the fastest growing during the forecast period. Further, based on industry, the market is segmented into IT & Telecom, BFSI, healthcare, retail, and others. The IT & Telecom segment dominated the market in 2020 and BFSI segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on data center colocation market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AT&T Intellectual Property; Cyxtera Technologies, Inc.; Digital Realty Trust LP; Equinix Inc.; NTT Communications Corporation; Telehouse; and Verizon Partner Solutions. are among others.

The Middle East & Africa Data Center Colocation Market is valued at US$ 2,933.22 Million in 2021, it is projected to reach US$ 5,930.52 Million by 2028.

As per our report Middle East & Africa Data Center Colocation Market, the market size is valued at US$ 2,933.22 Million in 2021, projecting it to reach US$ 5,930.52 Million by 2028. This translates to a CAGR of approximately 10.6% during the forecast period.

The Middle East & Africa Data Center Colocation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Data Center Colocation Market report:

The Middle East & Africa Data Center Colocation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Data Center Colocation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Data Center Colocation Market value chain can benefit from the information contained in a comprehensive market report.