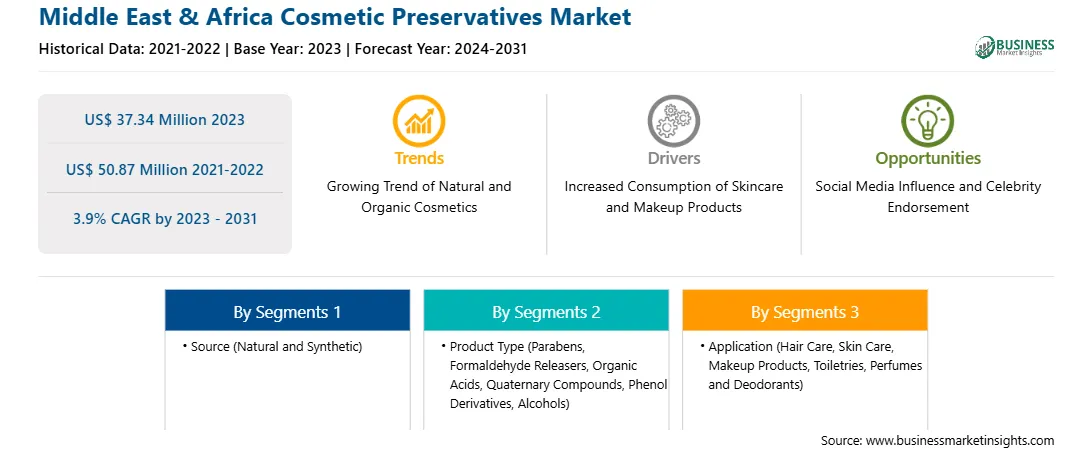

The Middle East & Africa cosmetic preservatives market was valued at US$ 37.34 million in 2023 and is expected to reach US$ 50.87 million by 2031; it is estimated to register a CAGR of 3.9% from 2023 to 2031.

Growing Trend of Natural and Organic Cosmetics Drives Middle East & Africa Cosmetic Preservatives Market

Organic and natural cosmetic products are gaining high prominence in the market. These products are free from chemicals and transparent about the content used during manufacturing. They are available with natural ingredients such as aloe vera, basil, turmeric, and neem, among others. The products are suitable for the skin as they do not cause irritation, itching, or other adverse effects. Natural and organic products reduce the chance of skin breakout, balance skin pH levels, rehydrate and tone skin for a healthier texture, and increase nutrient absorption capacity. This helps tighten skin and minimizes large pores while regulating oil production. Due to the abovementioned properties, organic and natural cosmetic products are becoming popular among consumers across the globe.

The rising consumer awareness and understanding of the benefits of organic products, owing to the emergence of social media, is further accelerating the cosmetics and personal care industry's growth. In addition, due to the surging popularity of various claims, such as vegan, natural, organic, and botanical. Consumers are increasing their consumption of herbal beauty products—particularly skincare and hair care products— boosting the demand for organic cosmetic preservatives. Also, with the growing availability of natural-identical preservatives, their usage in organic cosmetics is increasing. Benzoic acid and its salts, benzyl alcohol, sorbic acid and salts, salicylic acid, and its salts, and Dehydroacetic acid and salts are a few of the preservatives used in organic cosmetics. There are various manufacturers available in the global market offering organic and natural cosmetics and personal care products. Osea, Acure, Henua, MÁDARA Cosmetics are some of the popular organic cosmetic brands. Moreover, manufacturers are launching products with natural and organic ingredients. For instance, in October 2023, Organic Harvest, part of the Good Glamm Group, entered the color cosmetics category with the launch of a makeup line with certified organic ingredients. Such product launches further boost the demand for natural cosmetic preservatives.

Thus, the increasing preference for organic and natural cosmetic products is expected to create a new trend in the cosmetic preservatives market during the forecast period.

Middle East & Africa Cosmetic Preservatives Market Overview

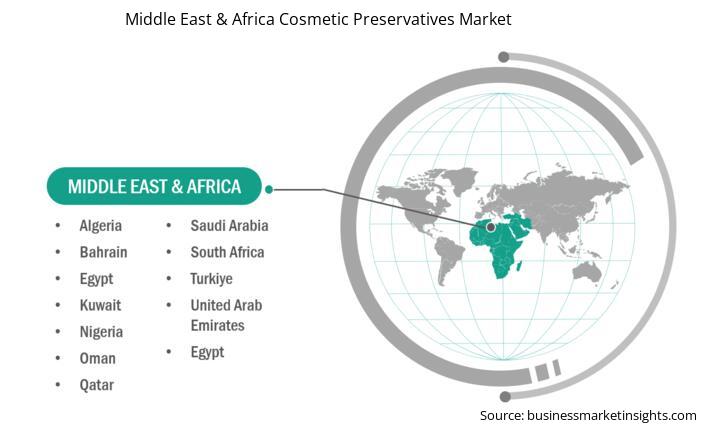

Iran, Israel, Turkey, Egypt, Oman, Qatar, Iraq, and Algeria are among the major countries in the Rest of the Middle East and Africa cosmetic preservatives market. The growing trend of experimenting with new and innovative cosmetic products such as skincare and makeup products with skinification and increasing disposable income of consumers due to urbanization in these countries are expected to boost the cosmetic industry in the region. This growing cosmetic industry in the region leads to increased demand for cosmetic preservatives.

Middle East & Africa Cosmetic Preservatives Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Middle East & Africa Cosmetic Preservatives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Cosmetic Preservatives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Cosmetic Preservatives Strategic Insights

Middle East & Africa Cosmetic Preservatives Report Scope

Report Attribute

Details

Market size in 2023

US$ 37.34 Million

Market Size by 2031

US$ 50.87 Million

Global CAGR (2023 - 2031)

3.9%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Source

By Product Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Cosmetic Preservatives Regional Insights

Middle East & Africa Cosmetic Preservatives Market Segmentation

The Middle East & Africa cosmetic preservatives market is categorized into source, product type, application, and country.

By source, the Middle East & Africa cosmetic preservatives market is segmented into natural and synthetic. The synthetic segment held a larger share of the Middle East & Africa cosmetic preservatives market share in 2023.

In terms of product type, the Middle East & Africa cosmetic preservatives market is segmented into parabens, formaldehyde releasers, organic acids, quaternary compounds, phenol derivatives, alcohols, and others. The organic acids segment held the largest share of the Middle East & Africa cosmetic preservatives market share in 2023.

Based on application, the Middle East & Africa cosmetic preservatives market is segmented into hair care, skin care, makeup products, toiletries, perfumes and deodorants, and others. The skin care segment held the largest share of the Middle East & Africa cosmetic preservatives market share in 2023.

Based on country, the Middle East & Africa cosmetic preservatives market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa segment held the largest share of Middle East & Africa cosmetic preservatives market in 2023.

Akema S.R.L.; Ashland Inc; BASF SE; Clariant AG; Evonik Industries AG; Lanxess AG; Symrise AG; Celanese Corp; Tate & Lyle Plc; INEOS Group Holdings SA; Biosynth AG; Valtris Specialty Chemicals Inc; Sharon group; CHEMIPOL, S.A.; and SEIWA KASEI Co, Ltd. are the among leading companies operating in the Middle East & Africa cosmetic preservatives market.

The Middle East & Africa Cosmetic Preservatives Market is valued at US$ 37.34 Million in 2023, it is projected to reach US$ 50.87 Million by 2031.

As per our report Middle East & Africa Cosmetic Preservatives Market, the market size is valued at US$ 37.34 Million in 2023, projecting it to reach US$ 50.87 Million by 2031. This translates to a CAGR of approximately 3.9% during the forecast period.

The Middle East & Africa Cosmetic Preservatives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Cosmetic Preservatives Market report:

The Middle East & Africa Cosmetic Preservatives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Cosmetic Preservatives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Cosmetic Preservatives Market value chain can benefit from the information contained in a comprehensive market report.