Middle East & Africa Copper-Nickel Alloys Market

No. of Pages: 101 | Report Code: BMIRE00027933 | Category: Chemicals and Materials

No. of Pages: 101 | Report Code: BMIRE00027933 | Category: Chemicals and Materials

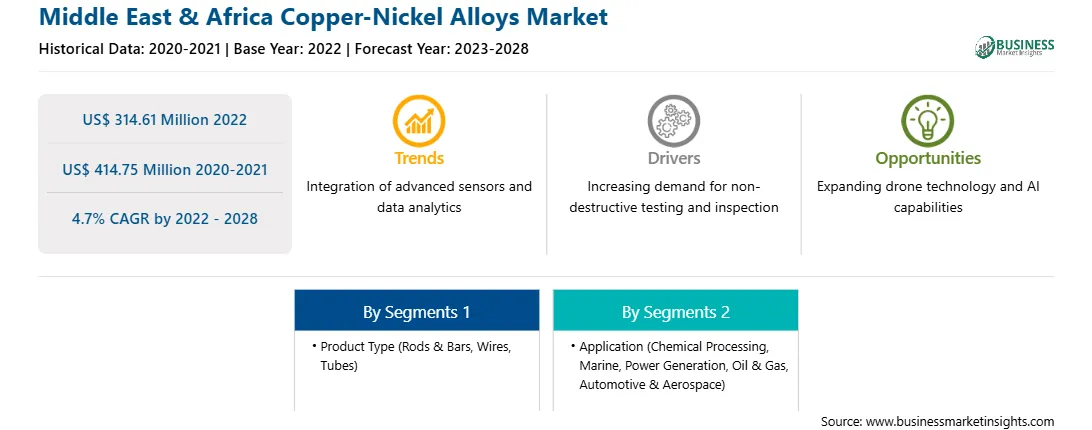

Presence of Large Desalination Plants is Fueling the Middle East & Africa Copper-Nickel Alloys Market

The Middle East & Africa relies heavily on desalinated water due to extreme water scarcity and low groundwater reservoirs. Saudi Arabia alone has more than 33 desalination plants across 17 locations run by the Saline Water Conversion Co-operation (SWCC), which accounts for 20% of the global production of desalinated water. Moreover, the UAE has planned to open three new desalination plants with a combined capacity of 420 million imperial gallons per day (MIGD), which would increase the country’s total water capacity to 1,590 MIGD by 2023. Copper-nickel alloys have excellent corrosion resistance. Copper-nickel alloys are widely used in multi-stage flash distillation (MSF) and multiple-effect distillation (MED) desalination plants to provide high corrosion resistance to heat exchangers and other components, including tubeplate, water boxes, pipe fittings, and evaporator shells. When seawater is fed to the desalination system, it causes corrosion of metal components, which can reduce the lifespan of the total system. Therefore, copper-nickel alloys are used in desalination systems. Thus, the presence of many desalination plants is expected to create huge demand for copper-nickel alloys, which would provide lucrative opportunities for the Middle East & Africa copper-nickel alloys market players during the forecast period.

Middle East & Africa Overview

The Middle East & Africa copper-nickel alloys market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East & Africa copper-nickel alloys market growth is attributed to the high demand for copper-nickel alloys from industries such as oil & gas, automotive, marine, etc. The growing automotive sales in South Africa and Saudi Arabia are creating a significant demand for copper-nickel alloys. Copper-nickel alloys are used in manufacturing different components of vehicles. Further, the strong presence of the oil & gas sector in countries of the Middle East & Africa, such as Saudi Arabia, Iraq, the UAE, Iran, and Kuwait, also creates a huge demand for copper-nickel alloys. Copper-nickel alloys are used in subsea bolting, shafts for pumps & valves, valve spindles, hydraulic pistons and cylinders, hydraulic connectors, and pressure couplings in the oil and gas industry. Moreover, Gulf countries are promoting the transition to renewable energy by launching ambitious infrastructure projects designed to help them reduce their reliance on oil and gas to meet domestic energy needs. Gulf states are diversifying their economies into solar energy production to meet net-zero targets. For example, Saudi Arabia launched five new renewable energy projects to produce electricity sustainably, it aims to grow the share of gas and renewable energy in its power mix to 50% by 2030.

Strategic insights for the Middle East & Africa Copper-Nickel Alloys provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Copper-Nickel Alloys refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Copper-Nickel Alloys Strategic Insights

Middle East & Africa Copper-Nickel Alloys Report Scope

Report Attribute

Details

Market size in 2022

US$ 314.61 Million

Market Size by 2028

US$ 414.75 Million

Global CAGR (2022 - 2028)

4.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Copper-Nickel Alloys Regional Insights

Middle East & Africa Copper-Nickel Alloys Market Segmentation

The Middle East & Africa copper-nickel alloys market is segmented based on product type, application, and country.

Based on product type, the Middle East & Africa copper-nickel alloys market is segmented into rods & bars, wires, tubes, and others. The rods & bars segment held the largest market share in 2022.

Based on application, the Middle East & Africa copper-nickel alloys market is segmented into chemical processing, marine, power generation, oil & gas, automotive & aerospace, and others. The marine segment held the largest market share in 2022.

Based on country, the Middle East & Africa copper-nickel alloys market has been categorized into the UAE, Saudi Arabia, South Africa, and the Rest of MEA. Our regional analysis states that Saudi Arabia dominated the market in 2022.

Aesteiron Steels LLP, American Elements Inc, Corrotherm International Ltd, Kalikund Steel and Engg Co, Lebronze Alloys SAS, and Materion Corp are the leading companies operating in the Middle East & Africa copper-nickel alloys market.

The Middle East & Africa Copper-Nickel Alloys Market is valued at US$ 314.61 Million in 2022, it is projected to reach US$ 414.75 Million by 2028.

As per our report Middle East & Africa Copper-Nickel Alloys Market, the market size is valued at US$ 314.61 Million in 2022, projecting it to reach US$ 414.75 Million by 2028. This translates to a CAGR of approximately 4.7% during the forecast period.

The Middle East & Africa Copper-Nickel Alloys Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Copper-Nickel Alloys Market report:

The Middle East & Africa Copper-Nickel Alloys Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Copper-Nickel Alloys Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Copper-Nickel Alloys Market value chain can benefit from the information contained in a comprehensive market report.