Development and Adoption of Innovative Products such as Ready-Mix Concrete

Ready-mix concrete is a concrete that is batched for delivery from a central plant instead of being mixed on the job site. It is ideal for many jobs. Ready-mix concrete is particularly beneficial when small quantities of concrete or intermittent placing of concrete are required. It is also ideal for large jobs where space is limited and there is little room for a mixing plant and aggregate stockpiles. There are several advantages of ready-mix concrete, making it a more viable and efficient alternative to site-mix concrete. Ready-mix concrete circumvents the messy and long-drawn task of producing the concrete onsite. With the better handling practices and proper mixing, the consumption of cement can be reduced by nearly 10% to 12%. Ready-mix concrete helps save on capital investments by not having to invest in plants and machinery for cement. All these benefits contribute to the increasing use of ready-mix concrete in various construction activities. Various cities are increasingly changing the traditional dynamics with growing ready-mix concrete penetration. Therefore, the development and adoption of innovative products such as ready-mix-concrete is predicted to offer lucrative opportunities for the Middle East & Africa construction chemicals market growth during the forecast period.

Market Overview

South Africa, Saudi Arabia, UAE, and rest of Middle East & Africa are the key contributors to the construction chemicals market in the Middle East & Africa. The growing demand among real estate developers and the surge in infrastructural projects owing to industrialization and urbanization in the region are the key factors anticipated to drive the construction chemicals market. The rising urban population has improved the construction of private residential buildings in semi-urban and urban cities. The government looks forward to investing copious amounts in the building and construction industry. According to World Bank Data, the total value of infrastructure and construction projects in the Middle East & Africa reached $3.2 trillion in mid-2021. The increasing need for residential and non-residential buildings in the region has created lucrative opportunities for the Middle East & Africa construction chemicals market. The increasing adoption of innovative eco-friendly materials in construction and the presence of government standards and initiatives for developing the smart building in the region will drive market revenue growth during the forecast period—rapid urbanization and construction growth, with increasing government spending on infrastructure development through programs in the Middle East & Africa. The leading players in the region are in strategic collaborations that are likely to create growth opportunities for the regional market. In addition, rapid technological advancements in infrastructure development with improving economic conditions, thus resulting in rising disposable income among consumers, have created market opportunities for the Middle East & Africa construction chemicals market. Increasing investment in offices, malls, colleges, schools, universities, and hospitals in the region, with the global expansion of the hospitality business, is expected to support regional revenue growth during the forecast period.

Strategic insights for the Middle East & Africa Construction Chemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

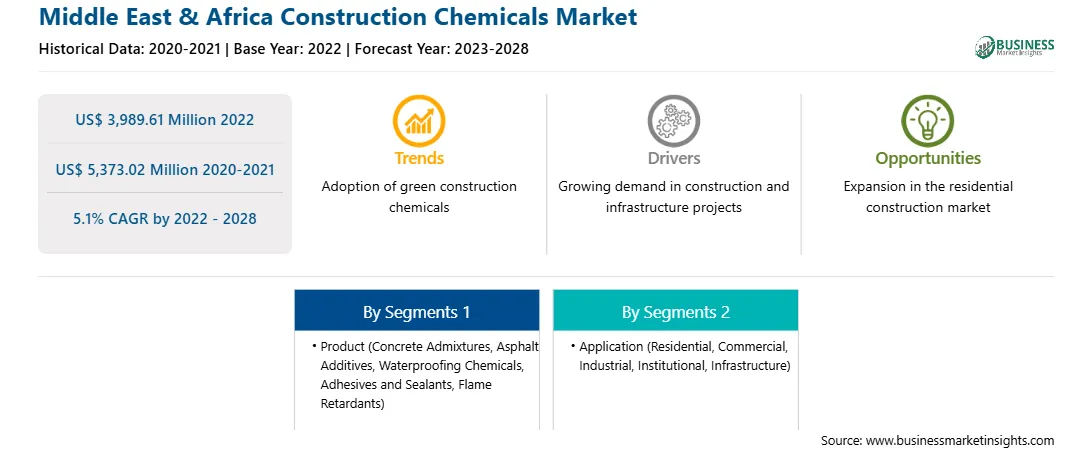

| Market size in 2022 | US$ 3,989.61 Million |

| Market Size by 2028 | US$ 5,373.02 Million |

| Global CAGR (2022 - 2028) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Construction Chemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa construction chemicals market is segmented into product, application, and country.

Based on product, the market is segmented into concrete admixtures, asphalt additives, waterproofing chemicals, adhesives and sealants, flame retardants, and others. The concrete admixtures segment registered the largest market share in 2022.

Based on application, the market is segmented into residential, commercial, industrial, institutional, and infrastructure. The residential segment held a largest market share in 2022.

Based on country, the market is segmented into South Africa, Saudi Arabia, UAE, and rest of Middle East & Africa. Rest of Middle East & Africa dominated the market share in 2022.

Ashland Global Holdings Inc; BASF SE; MAPEI S.p.A; Sika AG; Compagnie de Saint-Gobain S.A.; Pidilite Industries Limited; Forcing; RPM International Inc; and Dow Chemicals Company are the leading companies operating in the construction chemicals market in the Middle East & Africa region.

The Middle East & Africa Construction Chemicals Market is valued at US$ 3,989.61 Million in 2022, it is projected to reach US$ 5,373.02 Million by 2028.

As per our report Middle East & Africa Construction Chemicals Market, the market size is valued at US$ 3,989.61 Million in 2022, projecting it to reach US$ 5,373.02 Million by 2028. This translates to a CAGR of approximately 5.1% during the forecast period.

The Middle East & Africa Construction Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Construction Chemicals Market report:

The Middle East & Africa Construction Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Construction Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Construction Chemicals Market value chain can benefit from the information contained in a comprehensive market report.