When the gym equipment is connected to an application, which records the workouts and displays the data about workouts, then it is called connected gym equipment. Fitness enthusiasts prefer the connected gym equipment as they can track their performance; this factor is also gaining demand for the connected gym equipment. The connected gym equipment monitors the performance of the user so that they can improve their performance. In addition, the increasing number of fitness club boosting the demand for connected gym equipment. In MEA region, connected gym equipment is developing mostly in countries like South Africa, UAE, Israel, Saudi Arabia, and Kuwait. High disposable income in these countries is a major factor for adoption of connected gym equipment for various physical activities and exercises. Also, due to literacy and education, people are very much aware about their health and fitness. Considering various technological innovations and liking for leaving a healthy lifestyle, availability of smart fitness equipment is sufficient in this region. It is expected that residential as well as commercial connected gym equipment are going to experience a significant demand in upcoming years.

In case of COVID-19, MEA is highly affected especially South Africa. The MEA connected gym equipment market is considerably impacted by various disruption in the supply chain. With the closure of country borders, the supply chain of several parts and components has disturbed. The demand for connected gym equipment has weakened over past few months in MEA countries. The outbreak of COVID-19 had devastating effects on many businesses in the region, and the fitness and gym sectors were also among them. In response to this challenging situation, some have come up with great innovative ideas to survive in this time and continue serving their customers. Fitness clubs and gyms in Kuwait were forced to shut down due to rising cases of corona virus. When the business was shut down for full six months, Elite Fitness innovated and implemented some new ideas. They went online immediately and offered fitness classes as well as personal training sessions. Any gym’s main source of income is there when people buy a membership. So, Elite Fitness and some of its competitors decided to take the gym to customers’ house. During this period, the receptionists, maintenance workers and management team rented out gym equipment to several customers. This helped the customers in getting similar experience at home only. Even after all this, the market has not recovered yet and coming back to where it was is unpredictable considering the uncertainty of COVID-19.

Strategic insights for the Middle East & Africa Connected Gym Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

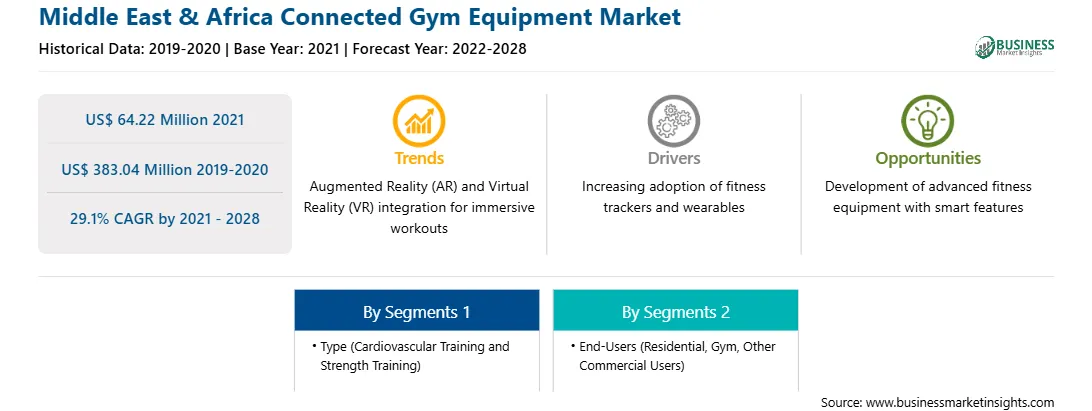

| Market size in 2021 | US$ 64.22 Million |

| Market Size by 2028 | US$ 383.04 Million |

| Global CAGR (2021 - 2028) | 29.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Connected Gym Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA connected gym equipment market is expected to grow from US$ 64.22 million in 2021 to US$ 383.04 million by 2028; it is estimated to grow at a CAGR of 29.1% from 2021 to 2028. Surging technological advancement in connected gym equipment is expected to escalate the MEA connected gym equipment market. It is true that people must manage their health, but they have very limited time to do physical activities and exercises considering their busy schedule. Connected gym equipment helps the user to save their time and do their work out effectively. Integration of gym equipment with smart devices has made gyming quite easier. Users can just leave for a walk and monitor the distance travelled, time travelled and number of steps on their smart watch. Few new devices are able to adjust users’ resistance and/or speed automatically, so that they don't need to fiddle with buttons or knobs during the workout session. Some latest equipment has also got heart rate monitors, so that one can glance at the screen to how hard they’re working out. Popular fitness apps like Fitbit is used for keeping all stats at one place. Smart treadmills allow several types of exercises on a one machine. Such exercises include jogging, running, walking, sprinting, and even simulated hiking if one has a machine that can incline. Using high speed internet, users can connect and workout together from different parts of the region at the same time. With smart mirrors for a Yoga classes, one can see the instructor as well as his/her own reflection in the mirror, thus making it easy to check the postures. All these factors are estimated to boost the MEA market growth for the forecast period.

In terms of type, the cardiovascular training segment accounted for the largest share of the MEA connected gym equipment market in 2020. In terms of end-users, the gym segment held a larger market share of the MEA connected gym equipment market in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA connected gym equipment market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Draper, Inc.; Johnson Health Tech; LES MILLS INTERNATIONAL LTD; Life Fitness; and Technogym S.p.A.

The Middle East & Africa Connected Gym Equipment Market is valued at US$ 64.22 Million in 2021, it is projected to reach US$ 383.04 Million by 2028.

As per our report Middle East & Africa Connected Gym Equipment Market, the market size is valued at US$ 64.22 Million in 2021, projecting it to reach US$ 383.04 Million by 2028. This translates to a CAGR of approximately 29.1% during the forecast period.

The Middle East & Africa Connected Gym Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Connected Gym Equipment Market report:

The Middle East & Africa Connected Gym Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Connected Gym Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Connected Gym Equipment Market value chain can benefit from the information contained in a comprehensive market report.