Middle East & Africa Commercial Air Traffic Management Market

No. of Pages: 212 | Report Code: BMIRE00027931 | Category: Aerospace and Defense

No. of Pages: 212 | Report Code: BMIRE00027931 | Category: Aerospace and Defense

Increasing Number of Partnerships and Contracts is Driving the Middle East & Africa Commercial Air Traffic Management Market

The growing need for air traffic management systems encourages companies to develop advanced solutions. They prefer various strategic alliances, such as partnerships, collaborations, and contracts, a few of which are mentioned below:

• In March 2022, Dubai Aviation Engineering Projects awarded Thales with a contract to supply an advanced air traffic management system, wherein Thales will deliver TopSkyATC to the airport.

• In July 2022, Eve Holding, Inc. announced that they signed a letter of intent with Halo Aviation Ltd. to develop and launch Eve's Urban Air Traffic Management (UATM) software solution. Also, Halo will acquire Eve’s software to maximize its UAM operations.

Several companies, through contracts and partnerships, are working on providing advanced air traffic management systems, which are anticipated to provide potential opportunities for the growth of the Middle East & Africa air traffic management market.

Middle East & Africa Commercial Air Traffic Management Market Overview

The Middle East & Africa commercial air traffic management market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. One of the major reasons driving the demand for commercial air traffic management in the Middle East & Africa region is the presence of major airlines—Qatar Airways, Emirates, Etihad Airways, Turkish Airlines, Ethiopian, and South African Airways—across the region. The construction of new airports and expansion of the existing airports across the Middle East & Africa region is pushing these airlines to expand their flight routes to new destinations across the region. For instance, as of July 2022, Saudi Arabia already had construction projects of 20 new airports in its pipeline, which will add up new flights from such airlines across new destinations in Saudi Arabia. Moreover, Egypt has also been planning the construction of new airports and the expansion of the existing airports, along with several air traffic technology upgrades. For instance, recently in November 2022, Egypt’s new airport called Sphinx International Airport started its operations and is located in between Cairo and Alexandria. Thus, the rising number of investments in enhancing the airspace industry in the country is expected to propel the growth of the overall Middle East & Africa commercial air traffic management market during the forecast period.

Strategic insights for the Middle East & Africa Commercial Air Traffic Management provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Commercial Air Traffic Management refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Commercial Air Traffic Management Strategic Insights

Middle East & Africa Commercial Air Traffic Management Report Scope

Report Attribute

Details

Market size in 2022

US$ 547.82 Million

Market Size by 2030

US$ 898.27 Million

Global CAGR (2022 - 2030)

6.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Component

By Application

By Airport Class

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Commercial Air Traffic Management Regional Insights

Middle East & Africa Commercial air traffic management Market Segmentation

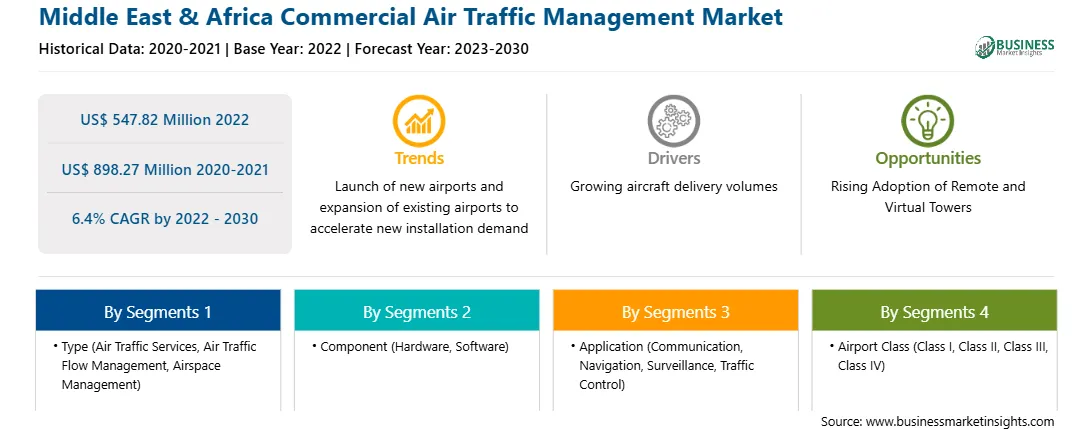

The Middle East & Africa commercial air traffic management market is segmented into type, component, application, airport class, and country.

Based on type, the Middle East & Africa commercial air traffic management market is segmented into air traffic services, air traffic flow management, and airspace management. The airspace management segment accounted for the largest share in the market in 2022.

Based on component, the Middle East & Africa commercial air traffic management market is segmented into hardware and software. The hardware segment accounted for the larger share in the market in 2022.

Based on application, the Middle East & Africa commercial air traffic management market is segmented into communication, navigation, surveillance, traffic control, and others. The surveillance segment accounted for the largest share in the market in 2022.

Based on airport class, the Middle East & Africa commercial air traffic management market is segmented into Class I, Class II, Class III, and Class IV. The Class I segment accounted for the largest share in the market in 2022.

Based on country, the Middle East & Africa commercial air traffic management market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the market share in 2022.

BAE Systems Plc, Honeywell International Inc, Indra Sistemas SA, L3Harris Technologies Inc, Leonardo SpA, NEC Corp, Raytheon Technologies Corp, Saab AB, SITA SC, and Thales SA are the leading companies operating in the Middle East & Africa commercial air traffic management market.

The Middle East & Africa Commercial Air Traffic Management Market is valued at US$ 547.82 Million in 2022, it is projected to reach US$ 898.27 Million by 2030.

As per our report Middle East & Africa Commercial Air Traffic Management Market, the market size is valued at US$ 547.82 Million in 2022, projecting it to reach US$ 898.27 Million by 2030. This translates to a CAGR of approximately 6.4% during the forecast period.

The Middle East & Africa Commercial Air Traffic Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Commercial Air Traffic Management Market report:

The Middle East & Africa Commercial Air Traffic Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Commercial Air Traffic Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Commercial Air Traffic Management Market value chain can benefit from the information contained in a comprehensive market report.