The governments of several nations are taking initiatives to support and promote the development and adoption of robotics in their respective countries. The government is offering considerable subsidies and tax breaks for industrial automation. For instance, by advancing innovation and cutting-edge technology, the UAE's Fourth Industrial Revolution Strategy seeks to enhance the country's status as a global centre for the Fourth Industrial Revolution and raise its economic contribution. The main focuses of the strategy include Robo-Care, which uses clinical robots and nanobots to improve healthcare in the UAE and offer remote robotic medical services both domestically and overseas. Furthermore, According to Vision 2021, which was expanded upon in the UAE Centennial 2071 project, the UAE government has been pushing the country towards a tech-driven economy. These goals must include AI and robots, and the government is actively promoting these fields through programs like the UAE Artificial Intelligence Strategy 2031. Such initiatives and measures taken by governments worldwide are expected to propel the market growth for industrial robotics regionally thereby, bolstering the demand for collaborative robots as well.

The Middle East region comprises of several oil & gas refineries, which accounts for a major portion of the region’s GDP. However, the manufacturing sector of Middle East is booming, and the government is taking several steps to encourage the manufacturing sector of the region. For instance, Dubai has established one of the biggest industrial centres for attracting new manufacturers. The UAE’s Department of Economic Development has stated that the manufacturing sector is gaining pace and accounts for approximately 80% of the country’s trade that does not include oil. Thus, signifying manufacturing industry as the second biggest contributor to the UAE’s economy. Major manufacturing industries in Dubai includes rubber, plastics, F&B, printing and publishing, base metals, chemicals, metals, and electrical equipment and machinery, among others. Further, dominant industry sectors in Saudi Arabia include chemical and fertilizer manufacturing, plastics, metals, and ship & aircraft repair. Also, Africa is experiencing a growth in its manufacturing industry as well. Several countries in the region are attracting a lot of FDI in their manufacturing sector. The growth of the manufacturing industry in the region is anticipated to further propel the market demand for collaborative robots in MEA region. Also, other countries in MEA such as Israel has a robust aerospace industry, which further propels the market growth.

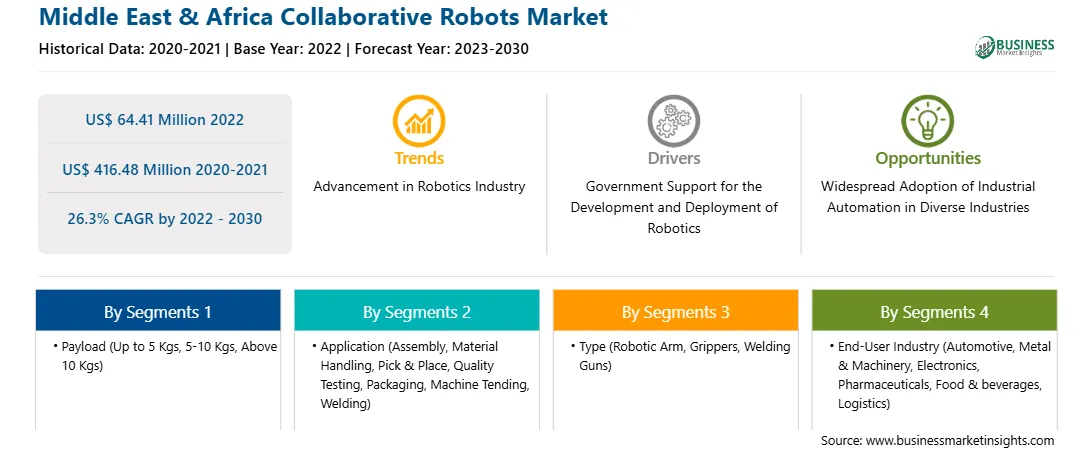

The Middle East & Africa collaborative robots market is segmented into payload, application, type, end-user industry, and country.

Based on payload, the Middle East & Africa collaborative robots market is segmented into up to 5 Kgs, 5-10 Kgs, and above 10 Kgs. The above 10 Kgs segment held the largest share of the Middle East & Africa collaborative robots market in 2022.

In terms of application, the Middle East & Africa collaborative robots market is segmented into assembly, material handling, pick & place, quality testing, packaging, machine tending, welding, and others. The material handling segment held the largest share of the Middle East & Africa collaborative robots market in 2022.

Based on type, the Middle East & Africa collaborative robots market is segmented into robotic arm, grippers, welding guns, and others. The robotic arm segment held the largest share of Middle East & Africa collaborative robots market in 2022.

In terms of end user industry, the Middle East & Africa collaborative robots market is automotive, metal & machinery, electronics, pharmaceuticals, food & beverages, logistics, and others. The automotive segment held the largest share of Middle East & Africa collaborative robots market in 2022.

By country, the Middle East & Africa collaborative robots market is segmented into the South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa collaborative robots market in 2022.

Kuka AG, Yaskawa America Inc, Aubo (Beijing) Robotics Technology Co Ltd, Fanuc Corp, ABB Ltd, Universal Robots AS and Kawasaki Heavy Industries Ltd are some of the leading companies operating in the Middle East & Africa collaborative robots market.

Strategic insights for the Middle East & Africa Collaborative Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 64.41 Million |

| Market Size by 2030 | US$ 416.48 Million |

| Global CAGR (2022 - 2030) | 26.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Payload

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Collaborative Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa Collaborative Robots Market is valued at US$ 64.41 Million in 2022, it is projected to reach US$ 416.48 Million by 2030.

As per our report Middle East & Africa Collaborative Robots Market, the market size is valued at US$ 64.41 Million in 2022, projecting it to reach US$ 416.48 Million by 2030. This translates to a CAGR of approximately 26.3% during the forecast period.

The Middle East & Africa Collaborative Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Collaborative Robots Market report:

The Middle East & Africa Collaborative Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Collaborative Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Collaborative Robots Market value chain can benefit from the information contained in a comprehensive market report.