The Middle East and Africa coffee machines market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Coffee is among the largest commodities consumed by people. Major companies operating in coffee machines market include Caribou, Starbucks, Coffee Bean, Dunkin' Donuts, and Tea Leaf, and Diedrich (Gloria Jean's). Moreover, collaboration, partnership, and product launches are the major trends that tie into the industry's focus on growth and product/service innovation. For instance, on October 19, Nestlé Nespresso SA launched the newest coffee machine: Nespresso Momento. Nespresso Momento has been designed to be easy to set up, use, clean, and service. It has an elegant touchscreen display that allows users to brew a variety of coffee sizes, including Americanos, with a single touch. Thus, the rising number of high-rated coffee shops has led the manufacturers toward innovation. Hence the above-mentioned factors are likely to act as a key trend for the coffee machine market.

In Middle East and Africa, South Africa witnessed an unprecedented rise in number of COVID-19 cases, which led to the discontinuation of coffee machines manufacturing activities. Downfall of other consumer goods manufacturing sectors has negatively impacted the demand for coffee machines during the early months of 2020. Moreover, decline in the overall brewing activities has led to discontinuation of coffee machines manufacturing projects, thereby reducing the demand for coffee machines. Similar trend was witnessed in other Middle East and Africa countries, such as Morocco, UAE and Saudi Arabia. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Middle East and Africa Coffee Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

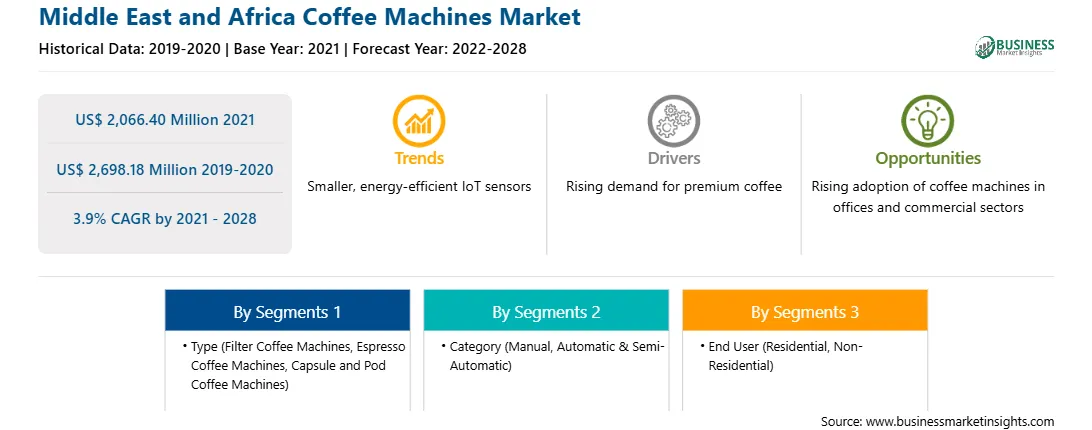

| Market size in 2021 | US$ 2,066.40 Million |

| Market Size by 2028 | US$ 2,698.18 Million |

| Global CAGR (2021 - 2028) | 3.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Coffee Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The coffee machines market in Middle East and Africa is expected to grow from US$ 2,066.40 million in 2021 to US$ 2,698.18 million by 2028; it is estimated to grow at a CAGR of 3.9% from 2021 to 2028. South Africa's coffee culture is evolving, which can be attributed to the growing influence of Western culture and the popularity of coffee products such espressos and coffee pods among the working class and middle-aged population. The increasing urbanization in Saudi Arabia has led to an increase in demand for coffee machines from consumers. Besides, due to shifting consumer preferences, a fast-paced lifestyle, and an expanding working-class population, Saudi Arabia's coffee machine industry has grown significantly in recent years. Furthermore, as younger generations become more interested in coffee consumption outside the home, a growing number of coffee shops and specialty cafés are springing up to meet the rising demand for blended and flavored coffee. As a result of these factors, demand for different roasts and flavors of coffee is increasing, propelling the market's growth throughout the forecast period. The high influx of foreigners in the region has aided the growth of the coffee machines market in UAE. Furthermore, rising demand for smart equipment in offices, changing consumer tastes and preferences, and an expanding working-class population base are expected to drive Middle East and Africa coffee machines growth through 2028.

Based on type, the filter coffee machines segment accounted for the largest share of the Middle East and Africa coffee machines market in 2020. Based on category, the automatic and semi-automatic segment accounted for the largest share of the Middle East and Africa coffee machines market in 2020. Based on end-user, the non-residential segment accounted for the largest share of the Middle East and Africa coffee machines market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Middle East and Africa coffee machines market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Robert Bosch Gmbh; Electrolux Ab.; Illycaffè S.p.A.; Koninklijke Philips N.V; Morphy Richards; Nestlé S.A.; Panasonic Corporation; and Luigi Lavazza S.p.A.

The Middle East and Africa Coffee Machines Market is valued at US$ 2,066.40 Million in 2021, it is projected to reach US$ 2,698.18 Million by 2028.

As per our report Middle East and Africa Coffee Machines Market, the market size is valued at US$ 2,066.40 Million in 2021, projecting it to reach US$ 2,698.18 Million by 2028. This translates to a CAGR of approximately 3.9% during the forecast period.

The Middle East and Africa Coffee Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Coffee Machines Market report:

The Middle East and Africa Coffee Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Coffee Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Coffee Machines Market value chain can benefit from the information contained in a comprehensive market report.