Cocoa is increasingly being used in formulating different beverages and confectionery products, such as milkshakes, cakes, croissants, and hot cocoa. The influx of cocoa-based confectioneries has increased tremendously in developed and developing economies in the last several years due to growing consumer spending on various indulgent confectioneries, particularly chocolate-based products, and the surging popularity of molded and countline chocolates. Moreover, key manufacturers are adding new chocolate types, such as dark chocolate and ruby chocolate, to their portfolio. In February 2022, Hershey's created the limited-edition "Celebrate SHE" cocoa-based bars to commemorate all women and girls. The brand highlighted “SHE” in the center of the milk cocoa-based bar. The launch of such innovative cocoa-based confectioneries would further accelerate the Middle East & Africa cocoa derivatives market growth. Moreover, acceptance of chocolates, consistency in quality, attractive packaging, rising urban influence on youth, high disposable incomes, and sweet tooth together are the other prominent aspects that bolster the popularity of cocoa-based confectioneries. The flourishing trend of gifting chocolates during festivities also favors the demand for cocoa derivatives. Thus, the overall increase in demand for cocoa-based confectioneries drives the growth of the Middle East & Africa cocoa derivatives market.

The Middle East & Africa cocoa derivatives market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. According to a report by the International Cocoa Organization (ICCO), production of cocoa beans is projected to increase by ~11.1% to reach 3.975 million tons in Africa, and Ghana reported the purchase of 1.03 million tons of cocoa beans on August 19, 2021, representing the country's all times highest crop size. Hence, due to increased cocoa production in Africa, by 2022, processing activities are anticipated to expand by 0.5% to 1.001 million tons. The western influence on snack preferences, particularly with the increasing popularity of French snacks such as pastries and cakes, has inspired chefs in the Middle East & Africa to develop innovative and creative baking methods and unique recipes. The UAE has experienced a surge in the number of French bakeries, including La Patisserie des Rêves, Aubaine, Pierre Hermé, and Dalloyau, as well as pastry chef schools such as Richemont Masterbaker, Dubai. These developments are likely to create a high demand for cocoa derivatives in the region in the future. Female consumers in Saudi Arabia are highly aware of organic cosmetics. According to a report published by Kacey Cullinay in January 2021, 81.8% of the population in the Middle East & Africa strongly agree that cosmetics containing organic ingredients are better for the environment, and 56.4% would prefer to use organic cosmetics in the future. Therefore, increasing awareness regarding cosmetics products incorporated with organic ingredients is likely to accelerate the growth of the Middle East & Africa cocoa derivatives market in the Middle East & Africa in the coming years.

Strategic insights for the Middle East & Africa Cocoa Derivatives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Cocoa Derivatives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Cocoa Derivatives Strategic Insights

Middle East & Africa Cocoa Derivatives Report Scope

Report Attribute

Details

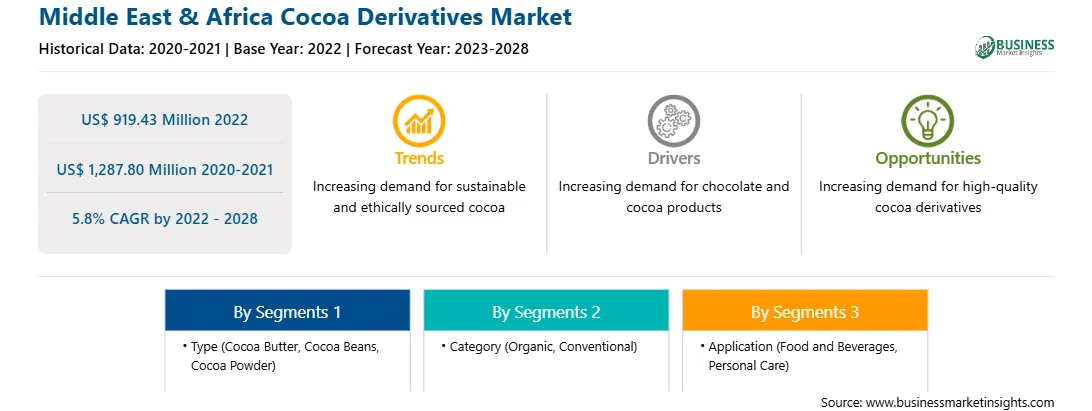

Market size in 2022

US$ 919.43 Million

Market Size by 2028

US$ 1,287.80 Million

Global CAGR (2022 - 2028)

5.8%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Category

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Cocoa Derivatives Regional Insights

Middle East & Africa Cocoa Derivatives Market Segmentation

The Middle East & Africa Cocoa Derivatives Market is segmented into type, category, application, and country.

Based on type, the Middle East & Africa Cocoa Derivatives Market is segmented into cocoa butter, cocoa beans, cocoa powder, and others. In 2022, the cocoa beans segment registered a largest share in the Middle East & Africa cocoa derivatives market.

Based on category, the Middle East & Africa Cocoa Derivatives Market is bifurcated into organic and conventional. In 2022, the conventional segment registered a larger share in the Middle East & Africa cocoa derivatives market.

Based on application, the Middle East & Africa Cocoa Derivatives Market is segmented into food and beverages, personal care, and other. In 2022, the food and beverages segment registered a largest share in the Middle East & Africa cocoa derivatives market. The food and beverages segment is further segmented into bakery and confectionery, dairy and frozen desserts, beverages, and other food and beverages.

Based on country, the Middle East & Africa Cocoa Derivatives Market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East and Africa. In 2022, the Rest of Middle East & Africa segment registered a largest share in the Middle East & Africa cocoa derivatives market.

Altınmarka Gıda San ve Tic AS, Barry Callebaut AG, Cargill, Inc, Indcre SA, JB Foods Ltd, MONERA COCOA SA, Natra SA, and Olam Groupe Ltd are the leading companies operating in the Middle East & Africa cocoa derivatives market.

The Middle East & Africa Cocoa Derivatives Market is valued at US$ 919.43 Million in 2022, it is projected to reach US$ 1,287.80 Million by 2028.

As per our report Middle East & Africa Cocoa Derivatives Market, the market size is valued at US$ 919.43 Million in 2022, projecting it to reach US$ 1,287.80 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The Middle East & Africa Cocoa Derivatives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Cocoa Derivatives Market report:

The Middle East & Africa Cocoa Derivatives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Cocoa Derivatives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Cocoa Derivatives Market value chain can benefit from the information contained in a comprehensive market report.