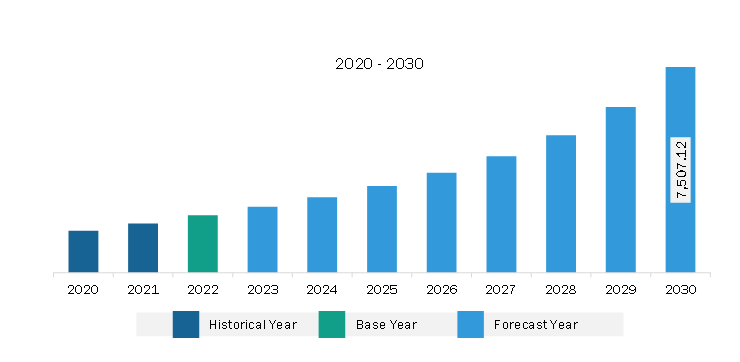

The Middle East & Africa cloud ERP market is expected to grow from US$ 2,102.57 million in 2022 to US$ 7,507.12 million by 2030. It is estimated to register a CAGR of 17.2% from 2022 to 2030.

The reach of ERP solutions has expanded from traditional solutions to support most business functions and manufacturing to front-office functions such as marketing automation, sales force automation (SFA), and e-commerce. ERP systems with integrated artificial intelligence and machine learning capabilities assist in fulfilling the growing need for personalization and enhance a variety of business operations in the background. In the past, businesses could add AI functionality to select ERP systems, but manufacturers are now offering ERP software products that are already embedded with AI features. Organizations rely on AI to deliver insightful business decisions based on the vast amounts of operational and customer data they collect. AI technologies can scan large volumes of unstructured data, swiftly recognizing patterns and forecasting different trends that are impossible to detect with processing numerical data alone. AI helps to improve and automate a whole range of processes. For instance, a just-in-time inventory strategy is implemented with the intent to deliver components to minimize inventory carrying costs. AI, in the form of ML, can optimize labor schedules and supply delivery to increase productivity and lower costs. IFS's Global Enterprise Software Solution Provider study found that 40% of manufacturers planned to implement AI for inventory logistics and planning, and 36% intended to use it for customer relationship management and production scheduling. Therefore, technological advancements are likely to bring new trends into the cloud ERP market in the coming years.

The Middle East & Africa cloud ERP market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Numerous large-scale enterprises heavily adopted ERP software to gain a constant approach to integrated business operations in the Middle East & Africa across any location. The growing need to enhance employee demand and efficiency for better business management has increased the adoption of ERP software among large companies, improving financial management and connectivity with stakeholders.

Numerous large-scale enterprises heavily adopted ERP software to gain a constant approach to integrated business operations in the Middle East & Africa (MEA) across any location. The growing need to enhance employee demand and efficiency for better business management has increased the adoption of ERP software among large companies, improving financial management and connectivity with stakeholders. Various companies are taking initiatives, such as partnerships and product launches, to increase market growth. For instance, in February 2023, XY Retail announced a partnership with ALGOCAS. The strategic partnership allowed XY Retail to capitalize on growth opportunities in MENA, particularly in Egypt and the Gulf region. The company optimizes cloud deployments designed around the customer, delivering digital strategy and expert guidance for the best business practices while managing the cloud environment as the business grows, allowing for maximum performance. Also, in September 2022, Microsoft partnered with G42, a technology holding company owned by a top security official in the UAE, to build out that company's sovereign cloud capabilities and jump-start its AI capabilities. Therefore, with the increasing number of such partnerships, the deployment of cloud-based ERP software is increasing in the MEA.

Strategic insights for the Middle East & Africa Cloud ERP provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,102.57 Million |

| Market Size by 2030 | US$ 7,507.12 Million |

| Global CAGR (2022 - 2030) | 17.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Business Function

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Cloud ERP refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa cloud ERP market is segmented into business function, organization size, vertical, and country.

Based on business function, the Middle East & Africa cloud ERP market is segmented into finance and accounting, sales and marketing, inventory and order management, human capital management, and others. The finance and accounting segment held the largest share of the Middle East & Africa cloud ERP market in 2022.

In terms of organization size, the Middle East & Africa cloud ERP market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the Middle East & Africa cloud ERP market in 2022.

By vertical, the Middle East & Africa cloud ERP market is segmented into manufacturing, IT and telecom, BFSI, healthcare, retail, government, aerospace and defense, and others. The manufacturing segment held the largest share of the Middle East & Africa cloud ERP market in 2022.

Based on country, the Middle East & Africa cloud ERP market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa cloud ERP market in 2022.

Epicor Software Corp, Infor Inc, Microsoft Corp, Oracle Corp, Sage Group Plc, SAP SE, SYSPRO Proprietary Ltd, Unit4 Group Holding BV, and Workday Inc are some of the leading companies operating in the Middle East & Africa cloud ERP market.

1. Epicor Software Corp

2. Infor Inc

3. Microsoft Corp

4. Oracle Corp

5. Sage Group Plc

6. SAP SE

7. SYSPRO Proprietary Ltd

8. Unit4 Group Holding BV

9. Workday Inc

The Middle East & Africa Cloud ERP Market is valued at US$ 2,102.57 Million in 2022, it is projected to reach US$ 7,507.12 Million by 2030.

As per our report Middle East & Africa Cloud ERP Market, the market size is valued at US$ 2,102.57 Million in 2022, projecting it to reach US$ 7,507.12 Million by 2030. This translates to a CAGR of approximately 17.2% during the forecast period.

The Middle East & Africa Cloud ERP Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Cloud ERP Market report:

The Middle East & Africa Cloud ERP Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Cloud ERP Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Cloud ERP Market value chain can benefit from the information contained in a comprehensive market report.