The high-strength, modulus, and light-weight characteristics of carbon fiber have led to rising demand from the sporting goods manufacturing industry. Sporting goods such as golf shafts, racquets, skis, snowboards, hockey sticks, fishing rods, bats, and bicycles are manufactured using carbon fiber. Carbon fiber provides design flexibility to achieve precise shape of sporting equipment, which is critical to its performance. Carbon fiber helps to enhance the performance of bikers and golfers. The most specific use of carbon fiber in the sporting equipment is seen in the tennis racket. Players can hit faster ball with the lighter racket and control the ball better with a larger area of the racket. The increasing demand for carbon fiber-based sporting equipment provides a lucrative market opportunity for key and new market players. Many sports goods manufacturers in developed and developing countries are using carbon fiber. Thus, the increasing adoption of carbon fiber by the manufacturers of sporting goods across developed and developing countries provides lucrative growth opportunities for the carbon fiber market over the forecast period.

The carbon fiber market in Middle East and Africa is further segmented into the South Africa, Saudi Arabia, UAE, and Rest of Middle East and Africa. The Middle East and Africa carbon fiber market is expected to grow at a substantial rate during the forecast period. The growth in the market is attributed to increasing use of carbon fiber for manufacturing light weight vehicles, and wind turbines. Growth of aviation industry with the support of Government initiatives is another significant factor driving the demand for carbon fiber in the region. For instance, in March 2023, the Government of Saudi Arabia has aimed to invest US$ 100 billion in aviation sector to meet the growing demand for commercial aircrafts. Further, the rising government initiatives for infrastructure development has attributed the market growth. The region is experiencing huge investments in infrastructure including hospitals, administrative buildings, and hospitals. For instance, according to the ministry of finance, the UAE approved a federal budget of US$ 16.04 billion for 2022 for development of country’s construction projects. Moreover, the region has construction projects including Mohammed Bin Rashid (MBR) City, Dubai Creek Harbour, Etihad Rail (Emirates Railway Project), and other construction activities. Increasing construction activities has demand for construction composites where carbon fiber is used for manufacturing of construction composites. Increasing construction activities in the region has thereby surged the demand for carbon fiber. Thus, government initiatives and rapid growth of various end-use industries is expected to drive the growth of carbon fiber market in the region.

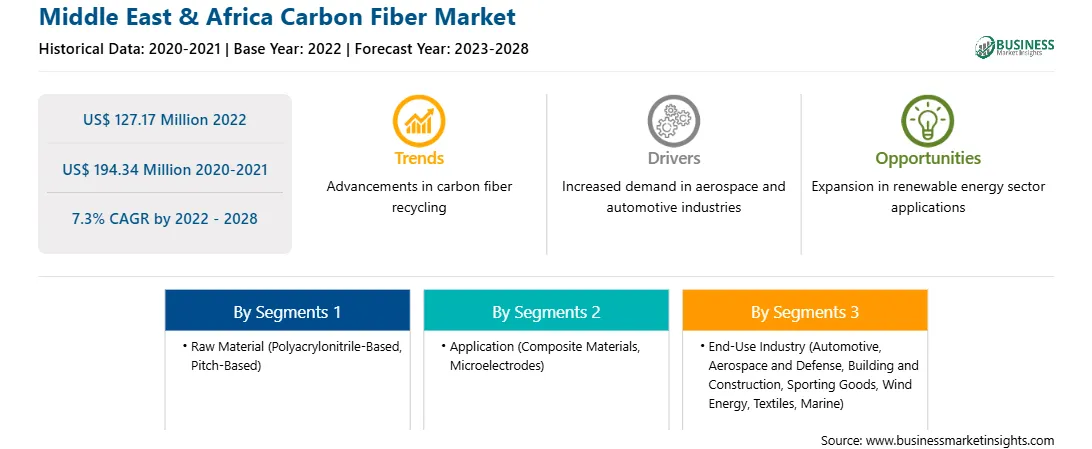

Strategic insights for the Middle East & Africa Carbon Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 127.17 Million |

| Market Size by 2028 | US$ 194.34 Million |

| Global CAGR (2022 - 2028) | 7.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Carbon Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East & Africa carbon fiber market is segmented into raw material, application, end use industry, and country.

Based on raw material, the Middle East & Africa carbon fiber market is segmented into polyacrylonitrile-based and pitch-based. The polyacrylonitrile-based segment held a larger Middle East & Africa carbon fiber market share in 2022.

Based on application, the Middle East & Africa carbon fiber market is segmented into composite materials, microelectrodes, and others. The composite materials segment held the largest Middle East & Africa carbon fiber market share in 2022.

Based on end use industry, the Middle East & Africa carbon fiber market is segmented into automotive, aerospace and defense, building and construction, sporting goods, wind energy, textiles, marine, and others. The automotive segment held the largest Middle East & Africa carbon fiber market share in 2022.

Based on country, the Middle East & Africa carbon fiber market has been categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa carbon fiber market share in 2022.

DowAksa Advanced Composite Material Industries Ltd Co; Formosa Plastics Corp; Hexcel Corp; Hyosung Advanced Materials Corp; Kureha Corp; Mitsubishi Chemical Corp; SGL Carbon SE; Solvay SA; Teijin Ltd; and Toray Industries Inc are the leading companies operating in the carbon fiber market in the Middle East & Africa.

The Middle East & Africa Carbon Fiber Market is valued at US$ 127.17 Million in 2022, it is projected to reach US$ 194.34 Million by 2028.

As per our report Middle East & Africa Carbon Fiber Market, the market size is valued at US$ 127.17 Million in 2022, projecting it to reach US$ 194.34 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The Middle East & Africa Carbon Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Carbon Fiber Market report:

The Middle East & Africa Carbon Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Carbon Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Carbon Fiber Market value chain can benefit from the information contained in a comprehensive market report.