Middle East & Africa Building Automation System Market

No. of Pages: 143 | Report Code: BMIRE00031116 | Category: Electronics and Semiconductor

No. of Pages: 143 | Report Code: BMIRE00031116 | Category: Electronics and Semiconductor

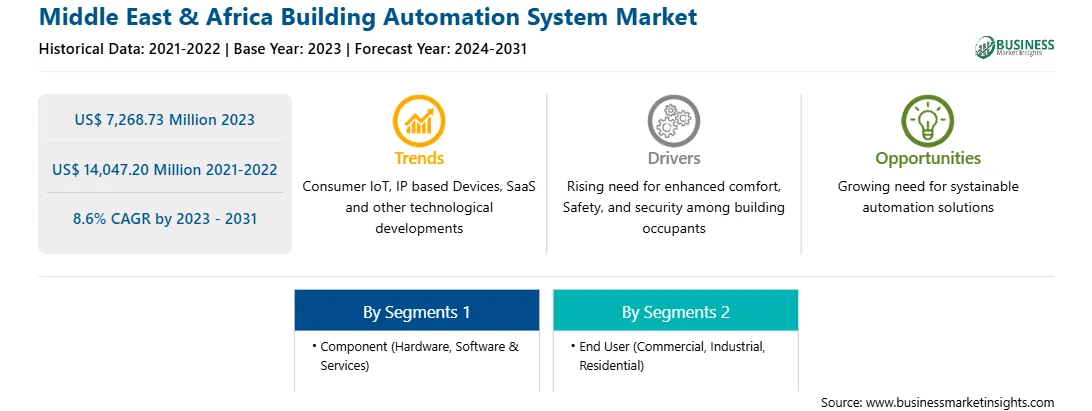

The Middle East & Africa building automation system market was valued at US$ 7,268.73 million in 2023 and is expected to reach US$ 14,047.20 million by 2031; it is estimated to register a CAGR of 8.6% from 2023 to 2031.

IoT, machine intelligence, and new networking capabilities play important roles in advancing building automation systems. Advanced fault detection and diagnostics, energy analytics, and grid integration are crucial aspects as building owners and facility managers prioritize increased energy efficiency and cost savings. The demand for consumer IoT-based devices, such as smart alarms, home appliances, security systems, and thermostats, is increasing worldwide. These devices will also help building owners and occupants gain extensive data on temperature, humidity, and indoor air quality, as well as greater control over indoor settings, particularly in HVAC systems in commercial buildings. In addition, the integration of IP-based devices to the building network in modern building automation systems (BAS) can provide increased scalability without the need to connect more fiber or Cat6 cables or reprogram individual devices to free up IP address ranges. Further, integrating IP-based devices in BAS can help eliminate operational challenges such as expensive reprogramming, incompatibility of devices and automation systems, and the time-intensive process of laying cables.

The growing adoption of cloud-hosted BAS is raising the demand for software-as-a-service (SaaS) solutions. This shift to SaaS-based solutions reduces operating expenses because building owners no longer need to maintain expensive software or manage application-specific programmers. With SaaS-based solutions, the owner can easily forecast their monthly operating budget without having to commit to a long-term service agreement. Simple integration of new building equipment, feature deployment, and cloud-hosted automatic upgrades are achieved through the cloud-hosted, SaaS-based BAS platform. SaaS-based BAS solutions also provide contractors with remote access and control, so they do not have to visit the site. Thus, the growing adoption of advanced technologies such as consumer IoT, IP-based devices, and SaaS is expected to facilitate the expansion of the building automation system market during the forecast period.

Johnson Controls, a prominent global advocate for smart, health-conscious, and environmentally friendly buildings, introduced newly appointed Vice President and General Manager for the Middle East & Africa (MEA). This appointment underscores the company's enduring dedication to delivering top-tier digital solutions through its OpenBlue platform, as well as its HVAC equipment, fire and security systems, controls, and services. The timing and strategic significance of this appointment are remarkable, aligning with the company's ongoing efforts to lead in innovation and technology, aiding governments, businesses, and other institutions in achieving their sustainability objectives while drawing on a legacy of over 135 years in building systems expertise. This appointment underlines the importance of building an automation system in the region.

Strategic insights for the Middle East & Africa Building Automation System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Building Automation System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Building Automation System Strategic Insights

Middle East & Africa Building Automation System Report Scope

Report Attribute

Details

Market size in 2023

US$ 7,268.73 Million

Market Size by 2031

US$ 14,047.20 Million

Global CAGR (2023 - 2031)

8.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Building Automation System Regional Insights

The Middle East & Africa building automation system market is categorized into component, end user, and country.

Based on component, the Middle East & Africa building automation system market is bifurcated into hardware and software & services. The hardware segment held a larger market share in 2023. Furthermore, the hardware segment is sub segmented into security & surveillance system, facility management systems, fire protection systems, and others.

In terms of end user, the Middle East & Africa building automation system market is segmented into commercial, industrial, and residential. The commercial segment held the largest market share in 2023.

By country, the Middle East & Africa building automation system market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa building automation system market share in 2023.

ABB Ltd; Mitsubishi Electric Corp; Bosch Sicherheitssysteme GmbH; Honeywell international Inc; Schneider Electric SE; Siemens AG; Johnson Controls International Plc; Carrier Global Corp; Lutron Electronics Co., Inc; and Trane Technologies Plc, are among the leading companies operating in the Middle East & Africa building automation system market.

The Middle East & Africa Building Automation System Market is valued at US$ 7,268.73 Million in 2023, it is projected to reach US$ 14,047.20 Million by 2031.

As per our report Middle East & Africa Building Automation System Market, the market size is valued at US$ 7,268.73 Million in 2023, projecting it to reach US$ 14,047.20 Million by 2031. This translates to a CAGR of approximately 8.6% during the forecast period.

The Middle East & Africa Building Automation System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Building Automation System Market report:

The Middle East & Africa Building Automation System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Building Automation System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Building Automation System Market value chain can benefit from the information contained in a comprehensive market report.