Owing to hectic work schedules and extended working hours, people pay less attention to their daily diet, health, and fitness. As a result, awareness regarding health and nutrition has increased significantly in the last few years. Thus, there has been a rapid shift in consumer food preferences with increasing health concerns. Consumers have become more aware of what they eat. People seek fresh products that are natural, organic, and minimally processed. Youngsters are most willing to purchase premium goods with health claims, as this demographic group shows more flexibility toward adopting healthier food habits. Broth made from fresh vegetables, bones, and meat have gained tremendous popularity due to various health benefits and nutritional value associated with them. The demand for different broth types is increasing, as they help improve immunity, hydration, and muscle protein synthesis; support joint and bone health; and exhibit antiaging properties. The inclusion of macronutrients and micronutrients in a good proportion with a high concentration of proteins drives the popularity of bone broth among consumers as an alternative to other protein sources. Bone broth is a source of gelatin, which may break down into collagen in the body. The collagen produced through the breakdown of the gelatin content can improve knee joint symptoms in osteoarthritis, such as pain, stiffness, and poorer physical function. Furthermore, glutamine and a few more amino acids present in bone broth may also aid in effective digestion. This may help with conditions such as leaky gut, which is characterized by the irritation of the mucosal lining in the intestines and interference with the body’s ability to digest food. The consumption of broth may also help people lose weight. It is high in protein, which helps the body feel fuller for longer spans alongside meeting calorie restrictions. Moreover, drinking broth or making a simple soup may be perceived as a beneficial way to enhance protein content in the diet, without feeling unsatisfied with a meal. Thus, consumer inclination toward nutritious food is contributing to the growth of the Middle East & Africa broth market.

The Middle East & Africa broth market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Middle East & Africa broth market is growing due to the rising consumption of meat and meat-based products. The rising disposable income is expected to bolster the demand for convenience products such as broth and is further expected to drive the consumption of broth market in the region. In addition, consumers are more inclined toward healthy products that provide high nutritional benefits. With the growing awareness of maintaining healthy dietary habits, the consumption of broth has increased, which has favored the growth of the Middle East & Africa broth market in the region. However, due to religious beliefs, pork and pork-derived products are strictly forbidden in countries such as the UAE and Saudi Arabia. Therefore, the demand for pork-based broth is negligible in a few countries, which can negatively impact the Middle East & Africa broth market in the region.

Strategic insights for the Middle East & Africa Broth provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 261.62 Million |

| Market Size by 2028 | US$ 299.98 Million |

| Global CAGR (2022 - 2028) | 2.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Broth refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

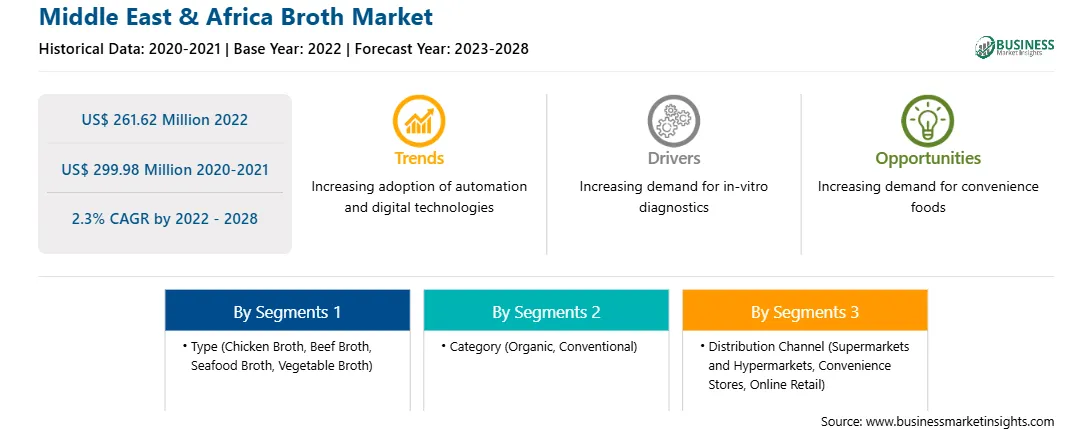

The Middle East & Africa broth market is segmented into type, category, distribution channel, and country.

Based on type, the Middle East & Africa broth market is segmented into chicken broth, beef broth, seafood broth, vegetable broth, and others. In 2022, the chicken broth segment registered a largest share in the Middle East & Africa broth market.

Based on category, the Middle East & Africa broth market is bifurcated into organic and conventional. In 2022, the conventional segment registered a larger share in the Middle East & Africa broth market.

Based on distribution channel, the Middle East & Africa broth market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. In 2022, the convenience stores segment registered a largest share in the Middle East & Africa broth market.

Based on country, the Middle East & Africa broth market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. In 2022, the Rest of Middle East & Africa segment registered a largest share in the Middle East & Africa broth market.

Campbell Soup Co; Del monte Foods Inc; Kettle & Fire Inc; The Hain Celestial Group Inc; and The Manischewits Co are the leading companies operating in the Middle East & Africa broth market.

The Middle East & Africa Broth Market is valued at US$ 261.62 Million in 2022, it is projected to reach US$ 299.98 Million by 2028.

As per our report Middle East & Africa Broth Market, the market size is valued at US$ 261.62 Million in 2022, projecting it to reach US$ 299.98 Million by 2028. This translates to a CAGR of approximately 2.3% during the forecast period.

The Middle East & Africa Broth Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Broth Market report:

The Middle East & Africa Broth Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Broth Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Broth Market value chain can benefit from the information contained in a comprehensive market report.