In recent years, antibiotic-impregnated acrylic bone cement has been used extensively in the prevention and treatment of orthopedic infections. The presence of biomaterials in various orthopedic surgeries involves the risk of developing a deep infection. Infections that develop around joint arthroplasties are among the most unmanageable ones and are difficult to heal. Bone cement impregnated with an antibiotic helps successfully eliminate the risk of developing any form of infection post-surgery. Companies have been involved in the manufacturing and marketing of bone cement in recent years. The use of systemic antibiotics and antibiotic bone cement was significantly more effective in preventing deep-seated infections than the use of systemic antibiotics or antibiotic bone cement alone. The use of antibiotic-loaded bone cement (ALBC) to treat active infections in arthroplasty is well established. The basis for using ALBC as a precautionary measure is to reduce the prevalence of deep joint infections. Gentamicin, cefuroxime, and tobramycin are the most commonly used antibiotics in bone cement in clinical trials. Of the three antibiotics, gentamicin is the most commonly used and most widely studied. Bone cement impregnated with antibiotics (also known as bone cement loaded with antibiotics) releases the antibiotics into the surrounding tissue. Bone cement with antibiotics can be used to treat infections after surgery or prevent infections during surgery. Antibiotic-loaded cement spacers have been established to treat hip and knee joint infections. The main advantage of incorporating antibiotics into bone cement arises directly from the release of antibiotics at the site of action, allowing high concentrations to be achieved at the site of action, with minimal or no systemic toxicity. The growing use of antibiotic-loaded bone cement is becoming the major reason for the development of the MEA bone cement market in the coming years.

In the case of COVID-19, South Africa was the highly affected country in the MEA. Economic uncertainties and ongoing conflicts are worsening the condition in the region. For instance, countries such as Syria, Libya, and Yemen are suffering violent conflicts and cannot implement robust public health measures. Iran was in a deep economic recession due to the US sanctions. The major source of economic stabilization in the MEA countries is oil production and export. However, the recent pandemic caused turbulence in the economies of the MEA. A sudden drop in domestic and external demand for goods and products, especially crude oil, and halted production due to labor shortage were major impacts observed in the region. The COVID-19 pandemic caused a heavy burden on the healthcare system across the region. The businesses in the region were hampered due to disruption in the supply chain and an increase in demand. The outbreak is expected to leverage the technology adoption and usability to streamline the process during the COVID-19 treatment. Moreover, the enterprise sector suffered a significant loss of production due to the worldwide lockdown.

Manufacturing companies were significantly hit by the lockdown, with nearly every plant coming to a halt. Many vital commodity manufacturing enterprises were likewise unable to continue operations due to the worker shortage caused by the social distancing norms. The COVID-19 pandemic affected orthopedics in several aspects. On the other hand, reports on orthopedic surgery during the COVID-19 outbreak have been scarce. After the announcement of the first cases of COVID-19 in Iran on February 19, 2021. Following that, all elective surgeries were canceled, and only emergency surgeries were conducted, as directed by Iran's Ministry of Health. As a result of these changes, the number of orthopedic surgeries in our center decreased dramatically during the outbreak.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA bone cement market. The MEA bone cement market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the Middle East and Africa Bone Cement provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

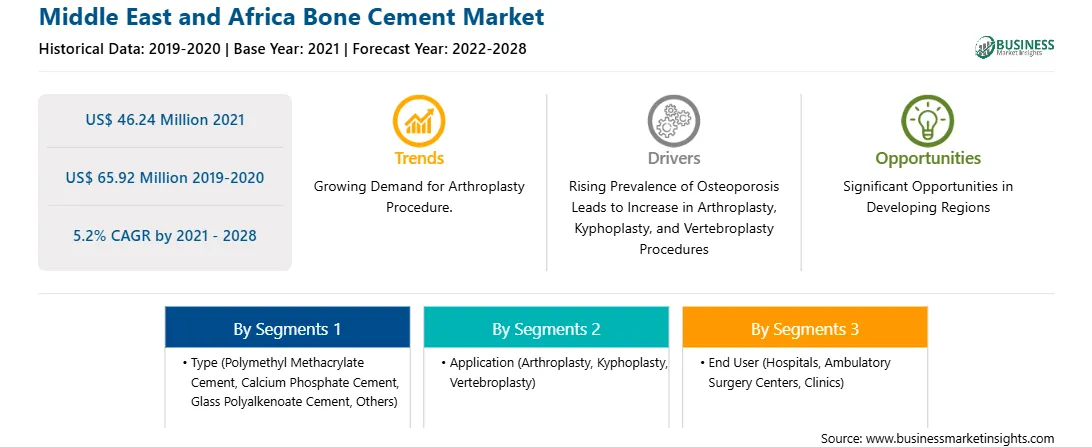

| Market size in 2021 | US$ 46.24 Million |

| Market Size by 2028 | US$ 65.92 Million |

| Global CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Bone Cement refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa Bone Cement Market is valued at US$ 46.24 Million in 2021, it is projected to reach US$ 65.92 Million by 2028.

As per our report Middle East and Africa Bone Cement Market, the market size is valued at US$ 46.24 Million in 2021, projecting it to reach US$ 65.92 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The Middle East and Africa Bone Cement Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Bone Cement Market report:

The Middle East and Africa Bone Cement Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Bone Cement Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Bone Cement Market value chain can benefit from the information contained in a comprehensive market report.