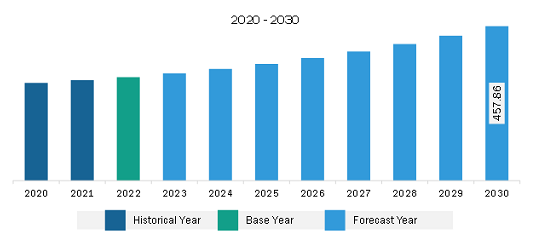

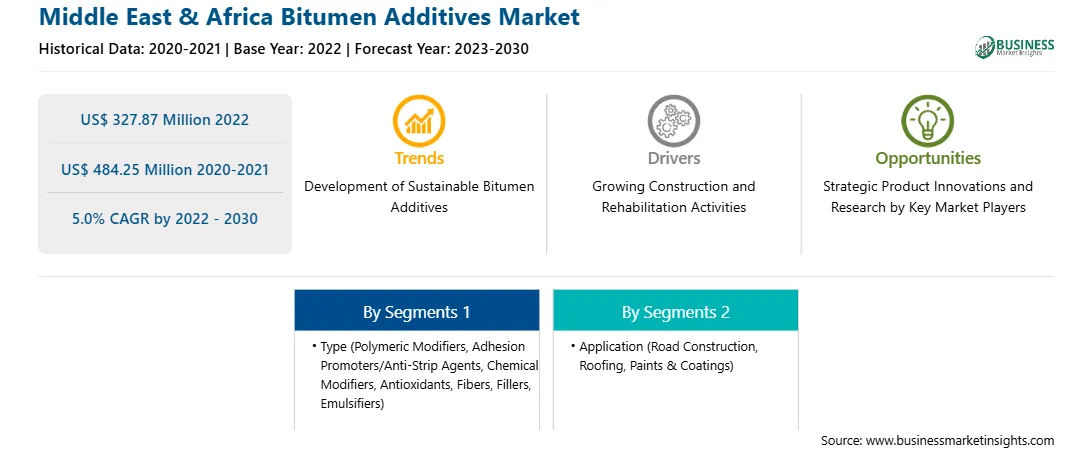

The Middle East & Africa bitumen additives market was valued at US$ 327.87 million in 2022 and is expected to reach US$ 484.25 million by 2030; it is estimated to register a CAGR of 5.0% from 2022 to 2030.

Development of Sustainable Bitumen Additives Bolsters Middle East & Africa Bitumen Additives Market

Rising awareness regarding greenhouse gas (GHG) emissions can upsurge the demand for bio-based and sustainable polymer products. Governments of various countries are adopting several initiatives to increase the awareness and development of bio-materials and recycled materials. In 2019, Nouryon launched sustainable ingredients for the asphalt market. The company launched Wetfix G400, a non-amine adhesion promoter derived from renewable resources. Wetfix G400 is aimed at meeting customers’ needs for a sustainable alternative that maintains asphalt mixture performance and durability. Adhesion promoters are added to asphalt used in road construction and maintenance to protect from damage caused by moisture and extend the service life of asphalt pavement. However, conventional adhesion promoters are incompatible with polyphosphoric acid (PPA), which is growing in popularity as an economical way to modify asphalt binders to the desired performance level. In 2021, Kao Performance Chemicals launched an asphalt additive made from recycled plastic (Polyethylene Terephthalate) bottles. The product NEWTLAC 5000 is an additive with high durability and oil resistance. Moreover, NEWTLAC 5000 pavement is less susceptible to damage from heavy vehicles. Therefore, the development of sustainable bitumen additives is expected to drive the bitumen additives market during the forecast period.

Middle East & Africa Bitumen Additives Market Overview

A rise in demand for construction materials due to a surge in infrastructural projects, sustainable construction, and industrialization in the Middle East & Africa are driving the demand for construction and building materials. The construction of commercial infrastructure has upsurged in the region due to the growing tourism industry and the rising immigrant population. The rising urban population has increased the construction of private residential buildings in semi-urban and urban cities, prompting governments to invest in the building & construction industry. Over the last ten years, the UAE government has invested extensively in airport developments and expansion projects, namely US$ 8.1 billion in Al Maktoum International Airport in Dubai, US$ 7.6 billion in the Dubai International Airport Expansion Phase 4, US$ 6.8 billion in Abu Dhabi Airport development and expansion plans, and ~US$ 400 million in Sharjah’s International Airport terminal expansion.

In 2021, the construction of the Jeddah Corniche Circuit (Saudi Arabia) was finished, which involved the utilization of 37 thousand tons of asphalt, 600 thousand tons of cement, 30 thousand square meters of bricks, and 1.4 thousand tons of glass. The growing need for residential and commercial buildings in the Middle East & Africa is expected to create lucrative opportunities for bitumen, bitumen additives, and other building materials in the Middle East & Africa. Rising construction activities across the region and increasing government spending on infrastructure development through programs such as Saudi Vision 2030 and Abu Dhabi Economic Vision 2030 are expected to positively impact the bitumen additives market during the forecast period.

Middle East & Africa Bitumen Additives Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Bitumen Additives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Bitumen Additives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Bitumen Additives Strategic Insights

Middle East & Africa Bitumen Additives Report Scope

Report Attribute

Details

Market size in 2022

US$ 327.87 Million

Market Size by 2030

US$ 484.25 Million

Global CAGR (2022 - 2030)

5.0%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Bitumen Additives Regional Insights

Middle East & Africa Bitumen Additives Market Segmentation

The Middle East & Africa bitumen additives market is categorized into type, application, and country.

Based on type, the Middle East & Africa bitumen additives market is segmented into polymeric modifiers, adhesion promoters / anti-strip agents, chemical modifiers, antioxidants, fibers, fillers, emulsifiers, and others. The polymeric modifiers segment held the largest market share in 2022.

In terms of application, the Middle East & Africa bitumen additives market is segmented into road construction, roofing, paints & coatings, and others. The road construction held the largest market share in 2022.

By country, the Middle East & Africa bitumen additives market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa bitumen additives market share in 2022.

Arkema SA, BASF SE, Dow Inc, Honeywell International Inc, Huntsman International LLC, Kao Corp, and Sasol Ltd are some of the leading companies operating in the Middle East & Africa bitumen additives market.

The Middle East & Africa Bitumen Additives Market is valued at US$ 327.87 Million in 2022, it is projected to reach US$ 484.25 Million by 2030.

As per our report Middle East & Africa Bitumen Additives Market, the market size is valued at US$ 327.87 Million in 2022, projecting it to reach US$ 484.25 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The Middle East & Africa Bitumen Additives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Bitumen Additives Market report:

The Middle East & Africa Bitumen Additives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Bitumen Additives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Bitumen Additives Market value chain can benefit from the information contained in a comprehensive market report.