R&D is a significant and essential part of the business of pharmaceuticals and biopharmaceutical companies. R&D enables companies to come up with new medicines for various therapeutic applications with significant medical and commercial potential. There has been an increase in R&D spending by biopharmaceutical companies over the years. Drug development and discovery are time-consuming and expensive processes. These processes involve various stages, including early detection of a target, designing of a molecule, and development and regulatory approval. The entire process can take more than 10–15 years. Throughout the drug development phase, various testing services are required to check the quality and efficacy of the drug. In the development and modification of a new vaccine strain for infectious disease, various cell culture studies and experiments are performed that majorly requires biosafety cabinets. Furthermore, increasing demand for smart laboratories has led to the development of smart biosafety cabinets with cloud-based, Internet of Things (IoT), and Artificial Intelligence (AI) technologies. Thus, the rising number of molecules entering clinical trial studies and ramp-up in R&D, along with the growing trend of smart laboratories, will create ample opportunities for the Middle East & Africa biosafety cabinet market during the forecast period.

The Middle East & Africa biosafety cabinet market is segmented into South Africa, Nigeria, Kenya, Saudi Arabia, the UAE, Kuwait, Egypt, the Rest of Middle East, and the Rest of Africa. Saudi Arabia is expected to account for the largest market share and is expected to develop moderately in the Middle East during the forecast period. The market growth is attributed to various factors such as extensive research projects undertaken by research institutes and availability of infrastructure and facilities for research in the UAE and Saudi Arabia. In Africa, only Kenya, Nigeria, and South Africa have a relatively sizable industry, with dozens of companies that produce for their local markets and, in some cases, for export to neighboring countries. Local producers also play in a limited range of the value chain. Local manufacturers often have the incentives and resources to introduce newer generation generics into Africa promoting the biosafety cabinet market.

Strategic insights for the Middle East & Africa Biosafety Cabinet provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Biosafety Cabinet refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Biosafety Cabinet Strategic Insights

Middle East & Africa Biosafety Cabinet Report Scope

Report Attribute

Details

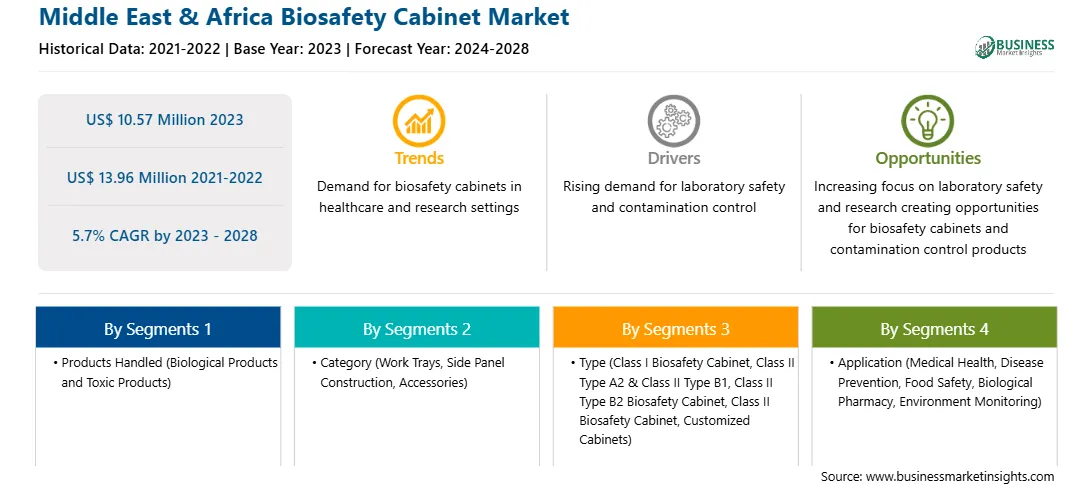

Market size in 2023

US$ 10.57 Million

Market Size by 2028

US$ 13.96 Million

Global CAGR (2023 - 2028)

5.7%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Products Handled

By Category

By Type

By Application

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Biosafety Cabinet Regional Insights

Middle East & Africa Biosafety Cabinet Market Segmentation

The Middle East & Africa biosafety cabinet market is segmented into products handled, category, type, application, end user, and country.

Based on products handled, the Middle East & Africa biosafety cabinet market is bifurcated into biological products and toxic products. The biological products segment held a larger share of the Middle East & Africa biosafety cabinet market in 2023.

Based on category, the Middle East & Africa biosafety cabinet market is segmented into work trays, side panel construction, and accessories. The work trays segment held the largest share of the Middle East & Africa biosafety cabinet market in 2023.

Based on type, the Middle East & Africa biosafety cabinet market is segmented into class I biosafety cabinet, class II type A2 & class II type B1, class II type B2 biosafety cabinet, class II biosafety cabinet, customized cabinets, and others. The class II type A2 & class II type B1 segment held the largest share of the Middle East & Africa biosafety cabinet market in 2023.

Based on application, the Middle East & Africa biosafety cabinet market is segmented into medical health, disease prevention, food safety, biological pharmacy, environment monitoring, and others. The disease prevention segment held the largest share of the Middle East & Africa biosafety cabinet market in 2023.

Based on end user, the Middle East & Africa biosafety cabinet market is segmented into academic centers, biotech & pharmaceutical companies, microbiology centers, research & development centers, hospitals & clinics, diagnostic laboratories, and others. The biotech & pharmaceutical companies segment held the largest share of the Middle East & Africa biosafety cabinet market in 2023.

Based on country, the Middle East & Africa biosafety cabinet market has been categorized into South Africa, Nigeria, Kenya, Saudi Arabia, the UAE, Kuwait, Egypt, the Rest of Middle East, and the Rest of Africa. Our regional analysis states that Saudi Arabia dominated the Middle East & Africa biosafety cabinet market in 2023.

ACMAS Technologies, Biobase Biodusty Co Ltd, Esco Group of Companies, Haier Biomedical, Kewaunee Scientific Corp, Labconco Corp, NuAire Inc, and Thermo Fisher Scientific Inc are the leading companies operating in the Middle East & Africa biosafety cabinet market.

The Middle East & Africa Biosafety Cabinet Market is valued at US$ 10.57 Million in 2023, it is projected to reach US$ 13.96 Million by 2028.

As per our report Middle East & Africa Biosafety Cabinet Market, the market size is valued at US$ 10.57 Million in 2023, projecting it to reach US$ 13.96 Million by 2028. This translates to a CAGR of approximately 5.7% during the forecast period.

The Middle East & Africa Biosafety Cabinet Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Biosafety Cabinet Market report:

The Middle East & Africa Biosafety Cabinet Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Biosafety Cabinet Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Biosafety Cabinet Market value chain can benefit from the information contained in a comprehensive market report.