The MEA includes countries such as South Africa, Saudi Arabia, the UAE, and rest of MEA. The region is expected to witness a rapid increase in commercialization and industrialization, which would further boost the varied industrial sectors. The oil & gas industry in the UAE accounts for 40% of the total GDP. However, the industry is facing problems since the past few years due to ringing investment in the generation of alternative forms of energy. Thus, the government has recently undertaken various steps to boost up the contributions of other manufacturing industries to the economic growth of the country. Support by the government has also welcomed various industrial hubs in Dubai. The MEA countries are at the forefront of adopting transformative economy to reduce their economic dependencies on the oil & gas sector and exploring opportunities in the manufacturing sector. For instance, Dubai has established itself as one of the biggest industrial centers for attracting new manufacturers. The UAE’s Department of Economic Development boasts that its manufacturing sector is gaining pace as it accounts for ~80% of the nonoil trade of the country. Thus, this sector is the second-biggest contributor to the economy of the UAE. According to the UAE’s Department of Economic Development (DED), the manufacturing industry accounts for 80% of Dubai’s nonoil trade, which makes it the second-largest contributor to the UAE economy. The overall growth in the manufacturing segment will provide an attractive market for axial fans in the near future. Major manufacturing industries in Dubai include food & beverages and electric equipment and machinery, among others. Africa is also experiencing growth in its manufacturing sector, which is boosting need of precise workflows and consistently high quality with increasing production speeds.

The MEA axial fans market is majorly affected by the disruption in the supply chain. Pertaining to the closure of country borders, the supply chain of several components and parts have been disturbed. The demand for axial fans has weakened over the past couple of months in MEA countries. This has resulted in a loss of business among the axial fans manufacturers and distributors offering their products to varied industries including food & beverage, energy & utilities, power generation, automotive, and many more. With business getting resumed, the scope of manufacturing and commercializing axial fans will expand. Due to disruption caused in supply chain, the region has witnessed decline in the supply of raw material/components from national & international territory got hampered. On the contrary, as the region is rich with energy & utilities plants for power generation, the scope of axial fans in mentioned plants will increase once again. Blue Star Fabrication Llc, ebm-papst, and Hidria are some of the companies exiting in the market and are expected to create opportunities for the development of axial fans as restriction are getting eased for manufacturing business related to COVID-19.

Strategic insights for the Middle East & Africa Axial Fans provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

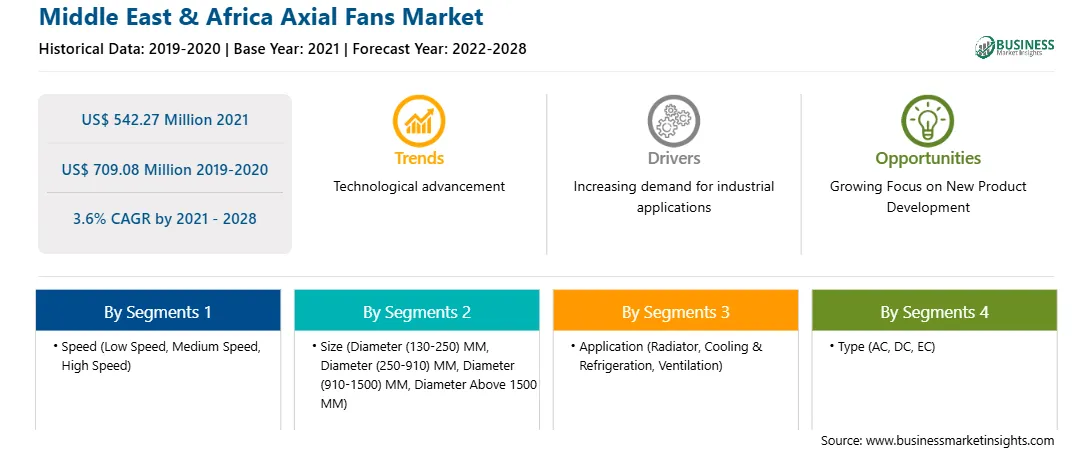

| Market size in 2021 | US$ 542.27 Million |

| Market Size by 2028 | US$ 709.08 Million |

| Global CAGR (2021 - 2028) | 3.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Speed

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Axial Fans refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The axial fans market in MEA is expected to grow from US$ 542.27 million in 2021 to US$ 709.08 million by 2028; it is estimated to grow at a CAGR of 3.6% from 2021 to 2028. Speedy industrialization The developed and developing countries provide a huge market growth perspective for many small and large players operating in the axial fans market. The rapid industrial development in these countries is projected to boost market growth during the forecast period. Axial fans have applications in a wide range of industries, such as cement, paper & wood, pharmaceuticals, steel, and food. Axial fans are used in these industries for handling critical processes that require drying, ventilation, and fume & hot air exhaust, among others. These types of fans are mainly applied in equipment dedicated to exchanging heat through environmental air. Cooling towers, air-cooled condensers, and air-cooled heat exchangers are other applications. The low cost of manufacturing coupled with the availability of cheap labor, is attracting various industry players to set their manufacturing bases in these countries. Further, limited government regulations for manufacturers in countries positively influence the growth of the axial fans market in this region. This is bolstering the growth of the axial fans market

In terms of type, the AC segment accounted for the largest share of the MEA Axial Fans Market in 2020. In terms of Size, the Diameter (250-910) MM segment held a larger market share of the axial fans market in 2020

A few major primary and secondary sources referred to for preparing this report on the MEA Axial Fans Market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report Sunonwealth Electric Machine Industry Co., Ltd

• Low Speed

• Medium Speed

• High Speed

• Diameter Below 250 MM

• Diameter (250-910) MM

• Diameter (910-1500) MM

• Diameter Above 1500 MM

• Radiator

• Cooling & Refrigeration

• Ventilation

• Other

• AC

• DC

• EC

• Commercial

• Industrial

• Residential

• South Africa

• Saudi Arabia

• UAE

• Rest of MEA

The Middle East & Africa Axial Fans Market is valued at US$ 542.27 Million in 2021, it is projected to reach US$ 709.08 Million by 2028.

As per our report Middle East & Africa Axial Fans Market, the market size is valued at US$ 542.27 Million in 2021, projecting it to reach US$ 709.08 Million by 2028. This translates to a CAGR of approximately 3.6% during the forecast period.

The Middle East & Africa Axial Fans Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Axial Fans Market report:

The Middle East & Africa Axial Fans Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Axial Fans Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Axial Fans Market value chain can benefit from the information contained in a comprehensive market report.