Middle East & Africa Automotive Passive Safety System Market

No. of Pages: 109 | Report Code: BMIRE00027422 | Category: Automotive and Transportation

No. of Pages: 109 | Report Code: BMIRE00027422 | Category: Automotive and Transportation

Technological Advancements in Passive Safety Systems

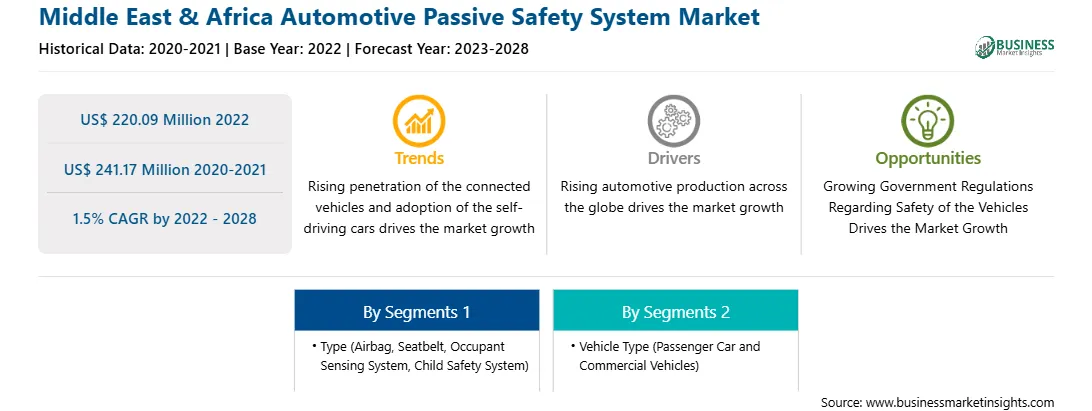

There is a growing trend of integrated vehicle safety that connects the passive safety system with active safety technology resulting in increasingly powerful electronic control units, and sensor technology providing the basis for increasing levels of semi- and fully automated driving functions. With the rapid expansion of the automotive landscape, manufacturers are primarily focused on improving the driving experience, and working toward the overall safety of passengers and drivers. Integrated safety enhances comfort, convenience and driver support with easy-to-use assistance systems and functions like health monitoring of the vehicle occupants. These technologies can help assist in critical driving situations and in protecting occupants. Some technological advancement have taken place in recent years. For instance, Autoliv has introduced Life-Cell airbags. This provides protection regardless of the occupant's position. When activated in conjunction with the deployment of the steering wheel airbag, the Life-Cell airbag acts like a protective cocoon. Similarly, ZF has introduced external pre-crash airbags that deploy outward from the sides of the vehicle. These airbags act as additional crumple zones in the event of an accident. Tests have shown it can help reduce the severity of occupant injuries by up to 40%. Self-driving cars will continue to improve the travel experience. ZF develops restraint systems such as seat belts and airbags to protect occupants in flexible seating positions. ZF has designed the airbags to adapt to the position of the occupants and new degrees of freedom in the passenger compartment. Moreover, the technological advancements in seatbelts are strengthening the market growth. Thus, such developments in technology for airbags and seatbelts are anticipated to drive the market. Thus, such trends in technology for airbags and seatbelts are anticipated to drive the market.

Market Overview

The MEA includes countries such as South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. The region is expected to see a rapid rise in marketing and industrialization, further improving the diverse industries. The Gulf countries are economically advanced, while the African countries still have to balance the economic conditions of the Gulf countries. Several factors, such as growing passenger cars, commercial vehicles on the road, and automated technologies integrated within the vehicles, are positively affecting the automotive passive safety system market. In 2019, the production of vehicles in Africa, accounted for 1,105,147 units. Thus, the growth in vehicle production, growing disposable income, and rising demand for the passive safety system are driving the market growth in the MEA. Further, the government of various countries in the MEA has realized the importance of the automotive sector and is taking initiatives to strengthen the automotive sector in the region. For instance, the Government of South Africa launched South African Automotive Masterplan (SAAM), which aims to broaden and deepen the local value chains. Such initiatives by the governments in MEA countries might support the growth of the automotive sector in the region, which in turn will further support the demand for an automotive passive safety system in the MEA.

Strategic insights for the Middle East & Africa Automotive Passive Safety System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 220.09 Million |

| Market Size by 2028 | US$ 241.17 Million |

| Global CAGR (2022 - 2028) | 1.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East & Africa Automotive Passive Safety System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Automotive Passive Safety System Market Segmentation

The Middle East & Africa automotive passive safety system market is segmented into type, vehicle type and country.

Based on type, the Middle East & Africa automotive passive safety system market can be categorized into airbags, seatbelts, occupant sensing system, child safety system, and others. The airbags segment registered the largest market share in 2022. Based on vehicle type, the Middle East & Africa automotive passive safety system market is bifurcated into passenger car and commercial vehicles. The passenger car segment held a larger market share in 2022. Based on country, the Middle East & Africa automotive passive safety system market is segmented into the UAE, Saudi Arabia, South Africa, and rest of MEA. South Africa dominated the market share in 2022. Autoliv Inc; Continental AG; FAURECIA; Hyundai Mobis; Joyson Safety Systems; Knauf Industries; Robert Bosch GmbH; Toyoda Gosei Co., Ltd; and ZF Friedrichshafen AG are the leading companies operating in the Middle East & Africa automotive passive safety system market.

The Middle East & Africa Automotive Passive Safety System Market is valued at US$ 220.09 Million in 2022, it is projected to reach US$ 241.17 Million by 2028.

As per our report Middle East & Africa Automotive Passive Safety System Market, the market size is valued at US$ 220.09 Million in 2022, projecting it to reach US$ 241.17 Million by 2028. This translates to a CAGR of approximately 1.5% during the forecast period.

The Middle East & Africa Automotive Passive Safety System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Automotive Passive Safety System Market report:

The Middle East & Africa Automotive Passive Safety System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Automotive Passive Safety System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Automotive Passive Safety System Market value chain can benefit from the information contained in a comprehensive market report.