In the MEA, South Africa is one of the major shareholders in the automotive lead acid battery industry. In recent years, the nation has seen an increase in demand for vehicles. According to the Bureau of Transportation Statistics, South Africa produced 631,983 passenger and commercial vehicles in 2019. Since lead-acid batteries are used in vehicles to facilitate start-stop operations, the market for lead-acid batteries will rise as the number of automobiles produced increases. The lead-acid battery industry in MEA would expand due to increased demand. In many MEA countries, a shared mobility model based on electric vehicles is being introduced in public transportation. The government of the United Arab Emirates, for example, plans to have 42,000 hybrid cars on the road by 2025, including passenger and light trucks. In September 2017, the Dubai Electricity and Water Authority (DEWA) and the Road Transport Authority (RTA) announced a variety of incentives for electric car users, ranging from free public parking and charging to toll/fee waivers and registration discounts. As a result, the region's increasing interest in electric vehicles would fuel the growth of lead-acid batteries.

South Africa has reported the largest COVID-19 cases in the MEA, followed by Iran and other countries. Industries across the region had come to a halt in the initial phases of the pandemic; however, with the gradual reopening of economies under restrictions and social distancing guidelines, industries are implementing and working on the changes needed to meet the customer's distinct demands in best possible ways. In April 2020, the number of preowned online car listings in the UAE dropped by ~50%. Since the factories are unable to resume operations due low requirements, the automotive sector is waiting for the situation to return to normalcy and other industries to restart their work processes, Thus, the abovementioned factors are limiting the growth of the automotive lead acid batteries market in the MEA.

Strategic insights for the Middle East and Africa Automotive Lead Acid Battery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

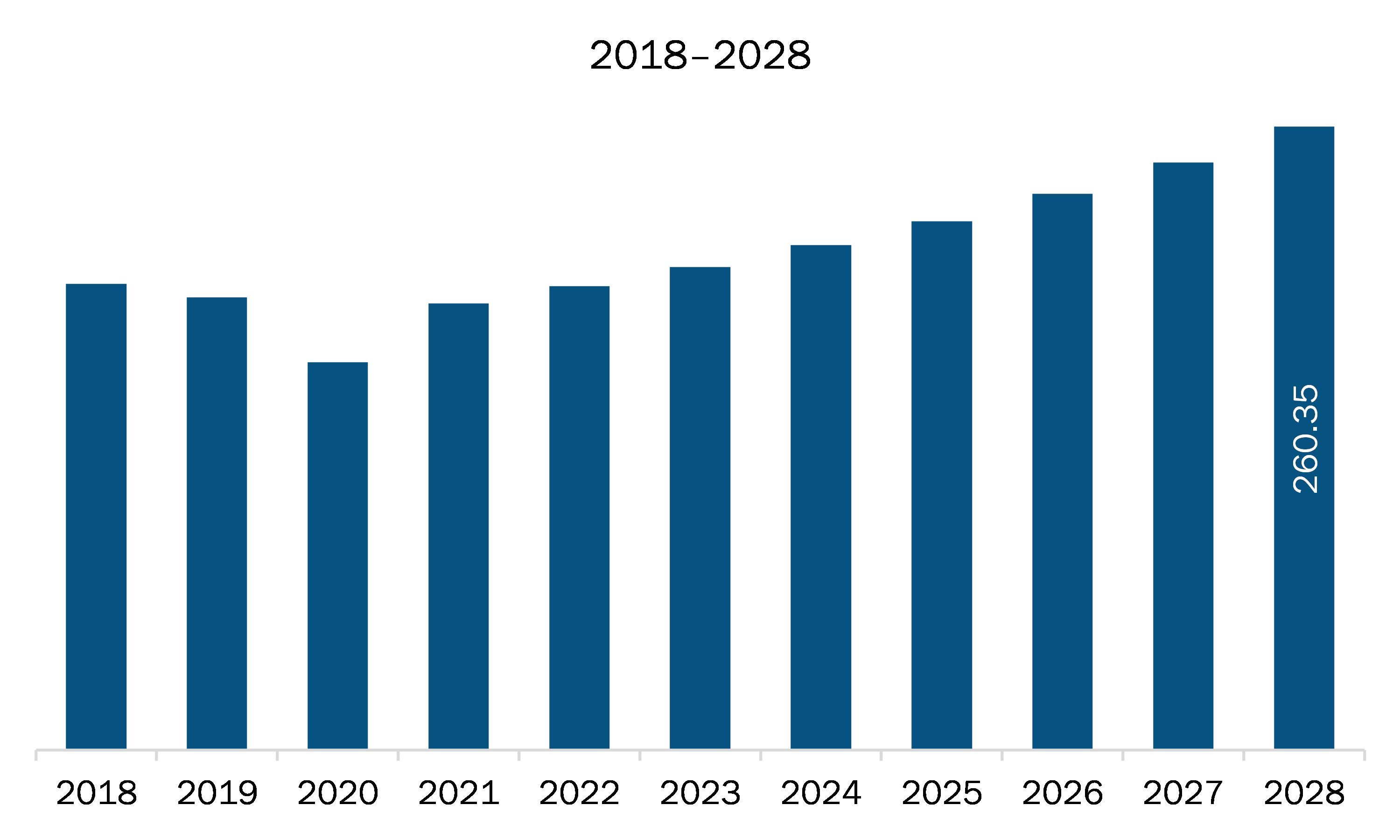

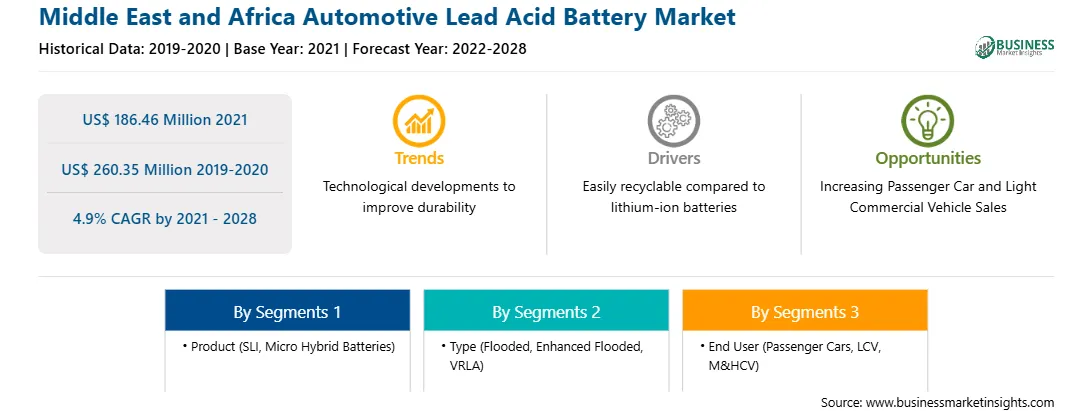

| Market size in 2021 | US$ 186.46 Million |

| Market Size by 2028 | US$ 260.35 Million |

| Global CAGR (2021 - 2028) | 4.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Automotive Lead Acid Battery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive lead acid battery market in MEA is expected to grow from US$ 186.46 million in 2021 to US$ 260.35 million by 2028; it is estimated to grow at a CAGR of 4.9% from 2021 to 2028. The world is witnessing a proliferation in the adoption of hybrid vehicles. Due to formulation of stringent emission standards by government to protect environment while boosting fuel efficiency, both automotive manufacturers and government are making a strategic towards promoting use of hybrid vehicles from old and conventional vehicles. EVI Membership, EV30@30 campaign, EVI MEA EV Pilot City Programme (EVI-PCP), FAME-I and II, National Mission for Transformative Mobility and Battery Manufacturing, National Electric Mobility Mission Plan, and Phased Manufacturing Program are some of the government initiatives promoting use of next generation of mobility. These initiatives are contributing towards fostering the adoption of vehicles including hybrid vehicles.

The MEA automotive lead acid battery market is segmented based on product, type, and end user. Based on product, the MEA automotive lead acid battery market is segmented into SLI, micro hybrid batteries. The SLI segment held the largest market share in 2020. Based on type, MEA automotive lead acid battery market is segmented into flooded, enhanced flooded, and VRLA. The flooded segment dominated the market. Based on end user, the market is segmented into passenger cars, LCV, M&HCV. The passenger cars segment dominated the end user segment in the market.

A few major primary and secondary sources referred to for preparing this report on the automotive lead acid battery market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Clarios; EnerSys;

The Middle East and Africa Automotive Lead Acid Battery Market is valued at US$ 186.46 Million in 2021, it is projected to reach US$ 260.35 Million by 2028.

As per our report Middle East and Africa Automotive Lead Acid Battery Market, the market size is valued at US$ 186.46 Million in 2021, projecting it to reach US$ 260.35 Million by 2028. This translates to a CAGR of approximately 4.9% during the forecast period.

The Middle East and Africa Automotive Lead Acid Battery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Automotive Lead Acid Battery Market report:

The Middle East and Africa Automotive Lead Acid Battery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Automotive Lead Acid Battery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Automotive Lead Acid Battery Market value chain can benefit from the information contained in a comprehensive market report.