Government Initiatives to Strengthen Vehicle Safety Evaluation Systems

The growing awareness among consumers about vehicle safety features, along with a rise in willingness to pay extra costs for airbags with better features, signifies a vast potential for the automotive airbag ECU market. In India, the Bharat New Vehicle Safety Assessment Program (BNVSAP) initiative is a voluntary star rating system based on crash safety performance features. The program focuses on systems such as front airbags, anti-lock braking systems (ABS), and seat belt reminder generators while evaluating cars. The New Car Assessment Program for Southeast Asian Countries (ASEAN NCAP) has brought multiple changes and adaptations regarding the region's socioeconomic development, focusing more on road safety. The UN initiative Decade of Action for Road Safety, introduced in October 2021, has helped to bring down the number of fatalities associated with road accidents.

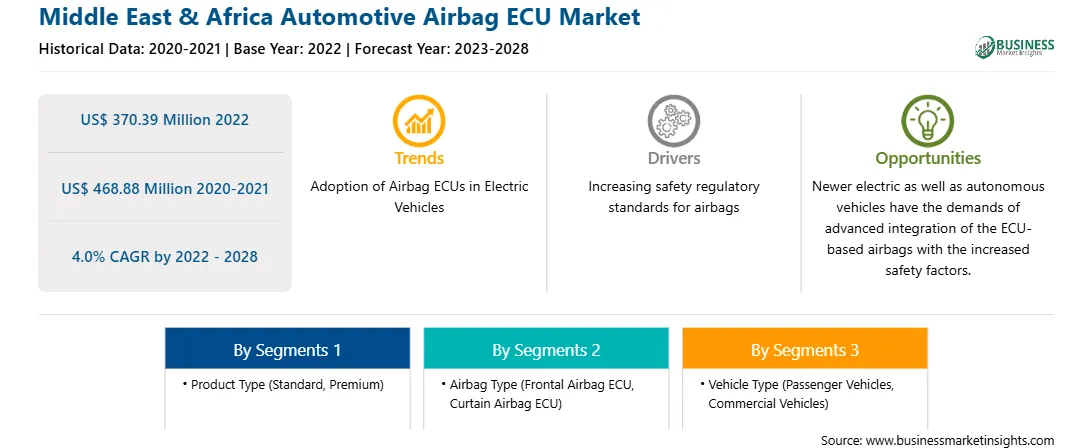

Market Overview

The automotive airbag ECU market in the MEA is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. The automotive sector in these countries is growing at a steady pace. The rising demand for commercial vehicles across the region can be attributed to increased development and infrastructure operations in many countries. Despite an increase in the sales in the automobile sector, Turnkey manufacturing was hampered by chips shortage. However, in the coming years, semiconductor production will increase due to the consistent rise in vehicles sales. Additionally, the region depends on foreign production facilities to import parts for the vehicle industry. The National Electronics and Cryptology Research Institute is striving to manufacture components at its semiconductor Technologies Research Laboratory. The growth of the automobile market will be considerably aided by this strategy.

The governments of several countries in the MEA have realized the importance of the automotive industry and are taking initiatives to support the growth of the automotive manufacturing industry in the region. For instance, the Government of South Africa launched South African Automotive Masterplan (SAAM) that aims to broaden and deepen the local value chains. Additionally, the automotive manufacturers in South Africa are focusing on strengthening their position in the country. For instance, in 2018, Mahindra SA opened its vehicle assembly facility in Durban, South Africa. In January 2020, Toyota announced that it would invest ~US$ 266.21 million in its parts distribution and manufacturing projects in South Africa. The rising government initiatives for the development of the automotive sector and the increasing focus of the companies toward strengthening their presence in the region support the growth of the automotive airbag ECU market in the country. In addition, the South African government and the businesses place the highest priority on passenger safety. Manufacturers have been forced to include safety equipment in cars by regulations aimed at enhancing consumer security and safety. Due to several government initiatives aimed at improving passenger safety, including the implementation of crash tests for front and side impact protection, and anti-lock braking requirements, South Africa continues to hold the largest automotive airbag ECU market share in the MEA. Furthermore, several leading companies, such as BMW and Mercedes, are dominating the automotive industry in the country. Further, Saudi Arabia is considered to have the largest automotive sales and auto parts segment. Moreover, it remains an important market for the US automakers. Besides, SUVs and luxury cars are widely adopted vehicles in the country, gaining significant traction among consumers.

Strategic insights for the Middle East & Africa Automotive Airbag ECU provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Automotive Airbag ECU refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Automotive Airbag ECU Strategic Insights

Middle East & Africa Automotive Airbag ECU Report Scope

Report Attribute

Details

Market size in 2022

US$ 370.39 Million

Market Size by 2028

US$ 468.88 Million

Global CAGR (2022 - 2028)

4.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Airbag Type

By Vehicle Type

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Automotive Airbag ECU Regional Insights

Middle East & Africa Automotive Airbag ECU Market Segmentation

The Middle East & Africa automotive airbag ECU market is segmented into product type, airbag type, vehicle type, and country.

The product type segment is bifurcated into standard and premium. Premium segment is expected to lead the automotive airbag ECU market in 2022.

Based on airbag type, the automotive airbag ECU market can be bifurcated into frontal airbag ECU and Curtain airbag ECU. Frontal airbag ECU segment is expected to lead the automotive airbag ECU market in 2022. Based on vehicle type, the market is segmented into passenger vehicles and commercial vehicles. The commercial segment is expected to hold the largest market share in 2022. Based on country, the market is segmented into Saudi Arabia, South Africa, UAE, and the Rest of Middle East & Africa. South Africa is expected to dominate the market in 2022. Aptiv; Autoliv Inc.; Continental AG; Denso Corporation; HELLA GmbH and Co. KGaA; Mitsubishi Electric Corporation; Robert Bosch GmbH; and ZF Friedrichshafen AG are the leading companies operating in the automotive airbag ECU market in the region.

The Middle East & Africa Automotive Airbag ECU Market is valued at US$ 370.39 Million in 2022, it is projected to reach US$ 468.88 Million by 2028.

As per our report Middle East & Africa Automotive Airbag ECU Market, the market size is valued at US$ 370.39 Million in 2022, projecting it to reach US$ 468.88 Million by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The Middle East & Africa Automotive Airbag ECU Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Automotive Airbag ECU Market report:

The Middle East & Africa Automotive Airbag ECU Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Automotive Airbag ECU Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Automotive Airbag ECU Market value chain can benefit from the information contained in a comprehensive market report.