An artificial cornea implant is a surgery to eliminate all or part of a damaged cornea and replace it with healthy donor tissue. But, currently, there shortage of cornea donors worldwide, and eye and tissue banking is also not carrying in many countries. Meanwhile, there is always the possibility that the human eye will reject the transplantation, which can cause infection or lack of vision. Cornea Implant is usually performed under certain conditions such as keratoconus, degenerative disease, or other. The artificial cornea tissue can be made up of polymer plastic such as silica material. Artificial cornea implant is of two types, i.e., synthetic cornea implant and biosynthetic cornea implant.

Strategic insights for the Middle East and Africa Artificial Cornea and Corneal Implant provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

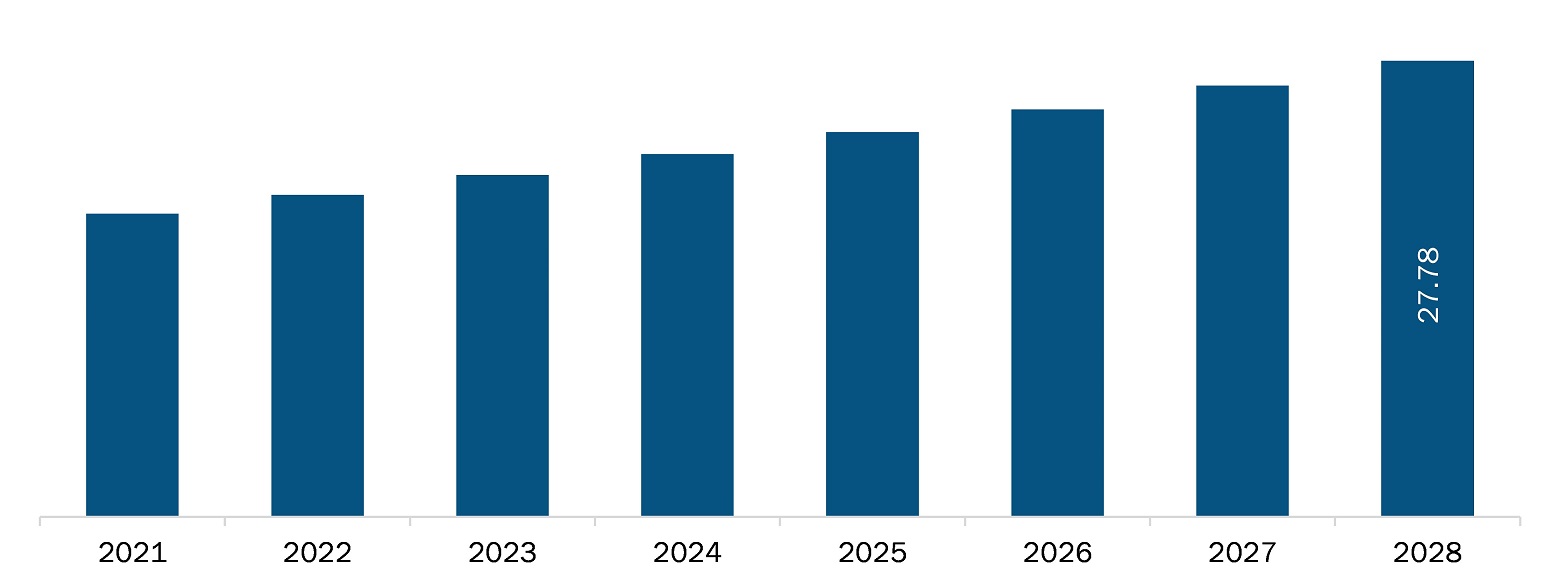

| Market size in 2021 | US$ 18.46 Million |

| Market Size by 2028 | US$ 27.78 Million |

| Global CAGR (2021 - 2028) | 6.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Artificial Cornea and Corneal Implant refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Middle East and Africa artificial cornea and corneal implant market is expected to reach US$ 27.78 million by 2028 from US$ 18.46 million in 2021; it is estimated to grow at a CAGR of 6.0% from 2021 to 2028. The key factors that are driving the growth of market are rising prevalence of eye diseases that causes corneal blindness, significantly rising elderly population are factors propelling the artificial cornea and corneal implant market. However, the expensive ophthalmology surgeries and devices may hamper the growth of the Middle East and Africa artificial cornea and corneal implant market in the forecast period.

Rise in geriatric population in developed countries such as the US, the UK and in developing countries such as UAE and Saudi Arabia is driven by the modernization of healthcare facilities and improvements in healthcare services, which have boosted the life expectancy in these countries. According to the United Nation’s World Population Ageing 2017 report, by 2050, all regions of the world, except Africa, would have ~25% or more of their populations aged 60 and above. The loss of vision is a major health problem among the elderlies. At the age of 65, one-third of people suffer from an eye disease with impaired vision. Age-related macular degeneration, glaucoma, cataracts, and diabetic retinopathy are the most common causes of vision loss among the people from this age group. Age-related macular degeneration results in the loss of central vision. Optic nerve injury and visual field loss can occur as a result of primary open-angle glaucoma. As this ailment can be asymptomatic at first, elderly people should have regular check-ups. Although cataracts are a common source of visual issues in these people, surgeries to remove them is usually successful. Diabetic retinopathy is also common among the older people during the early stages of diabetes or at the time of diagnosis. When a patient is diagnosed with diabetes, a mydriatic examination is recommended, as well as once a year thereafter. Thus, the rise in geriatric population is fuelling the artificial cornea and corneal implant market growth.

The healthcare sector in the UAE has undergone a considerable number of infrastructure and procedural changes to position itself as a leading healthcare provider across Middle East. These improvements have been recognized throughout the COVID-19 pandemic due to the continuous investments made to improve the sector’s hard and soft infrastructure. However, the pandemic had a significant impact on healthcare operations in other countries. Due to the COVID-19 pandemic, a substantial number of planned elective surgery operations was cancelled or postponed. The pandemic has brought unprecedented challenges for eye care in the Middle east and Africa. Owing to the increase in the number of COVID-19 confirmed cases in Lagos, hospital managers decided to reduce services to protect staff. Non-urgent follow up appointments, elective surgeries, and clinic consultations were postponed. Only emergency cases of conditions such as retinoblastoma, retinopathy of prematurity, red eye, trauma, and sudden vision los were attended. Similarly, in Ethiopia, eye health units suspended eye examinations and attended only injury-related eye emergencies due to the fear of the spread of novel coronavirus. Elective ocular surgery has been suspended across the country. People with eye diseases, such as bilateral blindness from cataract, are being turned away, even if surgery would improve vision. Also, corrective eyelid surgical services to treat trichiasis have been suspended, leaving hundreds of thousands of people at risk of getting an irreversible vision impairment. Community-based eye health surveys and ongoing research have also been discontinued, which has led to considerable delays in the planning of eye health services.

The Middle East and Africa artificial cornea and corneal implant market, based on type, is bifurcated into human cornea and artificial cornea. In 2021, the human cornea segment held a larger share of the market. However, the artificial cornea segment is expected to register a higher CAGR during the forecast period.

The Middle East and Africa artificial cornea and corneal implant market, by transplant type, is segmented into penetrating keratoplasty, endothelial keratoplasty, and others. In 2021, the penetrating keratoplasty segment held the largest share of the market. However, the market for the endothelial keratoplasty segment is expected to grow at the highest rate in the coming years.

The Middle East and Africa artificial cornea and corneal implant market, by disease indication, is segmented into Fuchs’ Dystrophy, keratoconus, fungal keratitis, and others. The Fuchs’ Dystrophy segment held the largest share of the market in 2021, whereas the fungal keratitis segment is anticipated to register the highest CAGR of the market during the forecast period.

The Middle East and Africa artificial cornea and corneal implant market, based on end user, is segmented into hospitals, specialty clinics and ASCs, and others. The specialty clinics and ASCs segment held the largest share of the market in 2021 and is anticipated to register the highest CAGR of the market during the forecast period.

A few of the primary and secondary sources referred to while preparing the report on the Middle East and Africa artificial cornea and corneal implant market are the International Diabetes Federation (IDF), World Health Organization (WHO), and Ethiopian Ministry of Health (EMoH).

The Middle East and Africa Artificial Cornea and Corneal Implant Market is valued at US$ 18.46 Million in 2021, it is projected to reach US$ 27.78 Million by 2028.

As per our report Middle East and Africa Artificial Cornea and Corneal Implant Market, the market size is valued at US$ 18.46 Million in 2021, projecting it to reach US$ 27.78 Million by 2028. This translates to a CAGR of approximately 6.0% during the forecast period.

The Middle East and Africa Artificial Cornea and Corneal Implant Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Artificial Cornea and Corneal Implant Market report:

The Middle East and Africa Artificial Cornea and Corneal Implant Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Artificial Cornea and Corneal Implant Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Artificial Cornea and Corneal Implant Market value chain can benefit from the information contained in a comprehensive market report.