The Middle East and Africa aramid fiber market for automotive hoses is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Electric vehicles require different kinds of hoses and fluid transmission assemblies than traditional internal combustion engine vehicles. Large battery electric vehicles generate a lot of heat, and many manufacturers use composite tubes to enclose the batteries and prevent their heat management. Electric vehicles tubes are typically much longer and narrower than traditional automotive tubes and electric vehicles also require many of the same hoses, pipe fittings, and assemblies as traditional vehicles, such as the air conditioning and brake lines. They also require special considerations to ensure appropriate performance in the operation of an electric vehicle. For instance, air conditioning hose assemblies can also be used in electric vehicles to carry refrigerant and lubricant between the components of the electric vehicle. These systems typically utilize both a pressure and return line. Further, increasing adoption of aramid fiber in electric vehicles, owing to several requirements by the automotive companies, such as replacing conventional substrates materials with synthetic substrates and increasing focus on environmental concerns. Aramid fibers are known for their temperature resistance, strength, reinforcement, and other properties that can help improve filters, belts, gaskets, and other automotive components. Thus, the rising adoption of electric vehicles is expected to provide lucrative opportunities for automotive hoses manufacturers in the market.

Due to COVID-19 outbreak, supply chains, manufacturing processes, and research and development activities in the automotive industry are adversely affected. For instance, the car industry in the US remained vulnerable during the outbreak pandemic. Vehicle sales fell over 20% year-on-year in August, hitting 1.33 thousand vehicles. Total sales from January to August 2020 were roughly 8.8 thousand units, a 23% decrease compared to last year. However, with the opening of several growth markets, vaccination developments, and initiatives taken by various governments to support economic and industrial growth in North America, the demand for the aramid fiber is anticipated to grow at a steady pace in the coming years.

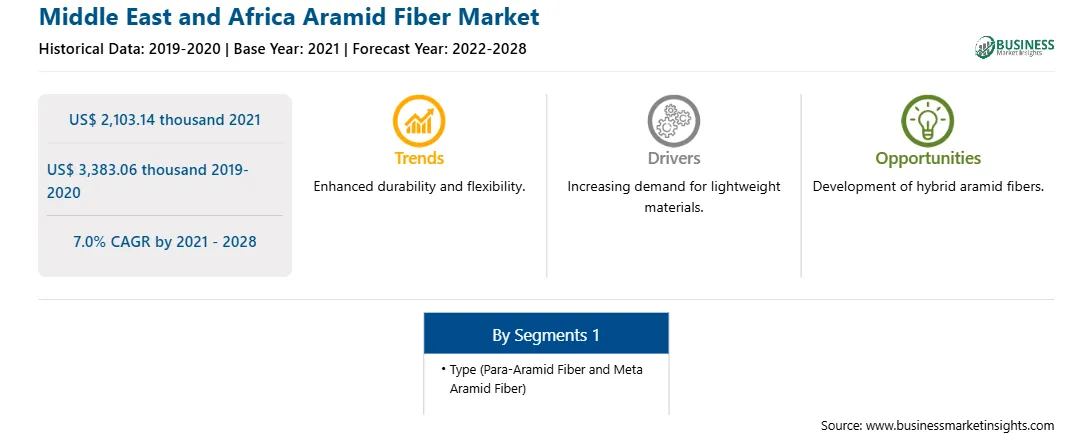

Strategic insights for the Middle East and Africa Aramid Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,103.14 thousand |

| Market Size by 2028 | US$ 3,383.06 thousand |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Aramid Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aramid fiber market for automotive hoses in Middle East and Africa is expected to grow from US$ 2,103.14 thousand in 2021 to US$ 3,383.06 thousand by 2028; it is estimated to grow at a CAGR of 7.0% from 2021 to 2028. The automotive industry uses a different type of materials such as iron, aluminum, plastic, steel, and glass to build cars and other vehicles. Aramid fibers are extensively used as a substitute for fiber glass and steel due to their lightweight, high tensile strength, and superior corrosion resistance in automotive hoses manufacturing. Manufacturers in the automotive industry are constantly looking to stay competitive by bringing innovative products to market. Safety aspects, excellent performance, and the need for sustainability, pressure the automotive industry to develop high-quality products. Today, automotive hoses have to perform well despite increasingly difficult conditions. For example, under-hood hose systems must withstand increasingly harsh operating conditions. Manufacturers are continuously innovating their products. For instance, Dupont provides knitted or braided Kevlar fiber for automobile hoses, which is used to reinforce radiator, gearbox, and turbocharger hoses to make them stronger and lighter. This is because Kevlar is not only stronger than other materials commonly used in high-pressure hoses, but it also has outstanding thermal stability and chemical resistance. In addition, Teijinconex offers meta-aramid for the extremely high-temperature circumstances on the hot side of the turbocharger for conveying high-temperature gases or fluids or supporting a high-pressure transmission system. Thus, the rising demand from the automotive industry is driving the aramid fiber market for automotive hoses

Based on type, the para-aramid fiber segment accounted for the largest share of the Middle East and Africa aramid fiber market for automotive hoses in 2020.

A few major primary and secondary sources referred to for preparing this report on the Middle East and Africa aramid fiber market for automotive hoses are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include DuPont de Nemours, Inc.; Teijin Limited; Continental AG; YOKOHAMA RUBBER CO., LTD.; Beaver Manufacturing Company; Gates Corporation; and Huvis Corp.

The Middle East and Africa Aramid Fiber Market is valued at US$ 2,103.14 thousand in 2021, it is projected to reach US$ 3,383.06 thousand by 2028.

As per our report Middle East and Africa Aramid Fiber Market, the market size is valued at US$ 2,103.14 thousand in 2021, projecting it to reach US$ 3,383.06 thousand by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The Middle East and Africa Aramid Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Aramid Fiber Market report:

The Middle East and Africa Aramid Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Aramid Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Aramid Fiber Market value chain can benefit from the information contained in a comprehensive market report.