The airports robots market in the MEA is segmented into Saudi Arabia, the UAE, South Africa, and Rest of the MEA. Since these countries are heavily promoting their tourism sectors, airline are growing at a rapid pace. The construction of new airports in major Gulf cities is a key factor contributing to the airport robots market growth in the region. The market in this region is expected to grow at a substantially fast pace due to exponential investments by several countries in the modernization of infrastructure and adoption of advanced technologies. In May 2020, Doha International Airport invested in fully autonomous disinfectant robots. Moreover, Qatar Airways partnered with Ava Robotics in 2019 and featured passenger guidance robot Ava Telepresence Robot. In March 2018, Muscat International Airport deployed two robots for passenger guidance. Irrespective of unbalanced economic conditions, the MEA expects a 4.8% increase in passenger traffic by 2037, necessitating the expansion of existing airports with new terminals. According to the Gulf Cooperation Council (GCC), various aviation projects are underway across the region, including 95 aviation projects worth US$ 49 billion. Of these 95 projects, 68 are extension and development projects for existing airports with a total investment of ~US$ 45 billion, while the remaining 27 focus on runway, hangar, and ancillary facility building construction with a total investment of ~US$ 3 billion. Further, Africa does not typically see new airport developments, though the demand for air travel in the countries is increasing. Refinement in sanitation programs and procedures at airports and growing investment in developing countries are the major factor driving the growth of the MEA airport robots market.

In case of COVID-19, Iran has reported the highest number of cases. Moreover, Turkey, Saudi Arabia, the UAE, Egypt, Morocco, and Kuwait are among the other countries in the region that faced notable disruptive effect of the COVID-19 pandemic. The lockdown measures were imposed only in a few countries that witnessed rapid spread of the infection. However, in line with the global trend, the airport robots market in MEA region witnessed a negative effect of the pandemic. The demand for new airport robots staggered, and since manufacturing facilities faced logistic issues and raw material procurement issues, the overall manufacturing schedule was impacted too. However, the situation improved from the beginning of 2021, and various domestic and international airport modified their sanitation procedure. They are now willing to invest and procure new and advance airport robots, creating immense opportunity in the MEA region.

Strategic insights for the Middle East and Africa Airport Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

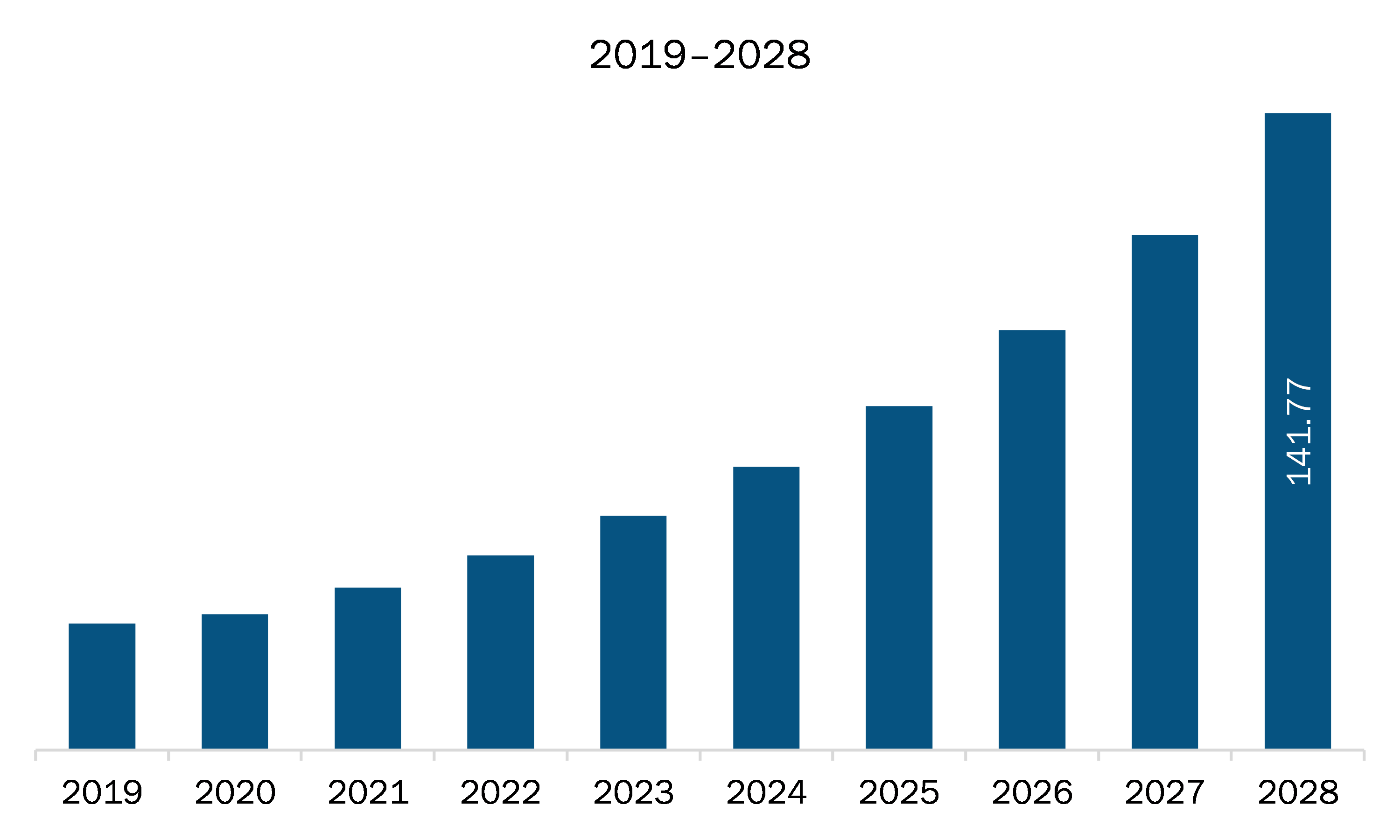

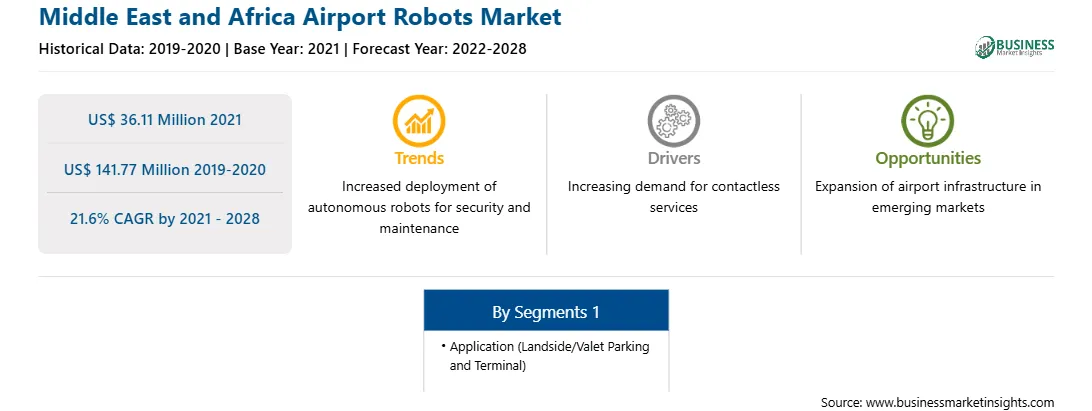

| Market size in 2021 | US$ 36.11 Million |

| Market Size by 2028 | US$ 141.77 Million |

| Global CAGR (2021 - 2028) | 21.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

The geographic scope of the Middle East and Africa Airport Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MEA airport robots market is expected to grow from US$ 36.11 million in 2021 to US$ 141.77 million by 2028; it is estimated to grow at a CAGR of 21.6% from 2021 to 2028. Original equipment manufacturers (OEMs) have been investing in research and development (R&D) to develop best in class and advanced robots. Enormous daily foot traffic experienced by airports over the last decade is compelling them to optimize various operations at airports. With many companies offering airport robots for simplifying these operations, = airports are shifting their focus on adopting autonomous = robots to optimize labor, enhance operational performance, mitigate risk, and improve traveler experiences. As a result, many of them are looking forward to partnering with robot suppliers that can offer the best-in-class advanced robots for applications such as security, luggage handling, passenger guidance, and cleaning. Moreover, airports are facing issues in terms of significantly rising labor costs as well as the shortage of qualified, experienced, and reliable employees. Thus, the burgeoning complexity of airport operations is resulting in overburdening of existing personnel, compelling them to make tradeoffs between the quantity and quality of their work, which might hamper their reputation. To address this issue, airports are switching toward more advanced and autonomous robots that not only reduce the burden on personnel, but also work more efficiently than humans, without facing the issues such as excessive workload and fatigue. So, escalating demand for advanced robots will drive the MEA airport robots market in coming years.

In terms of application, the terminal segment accounted for the largest share of the MEA airport robots market in 2020. In terms of terminal, the airport security and cleaning segment held a larger market share of the MEA airport robots market in 2020.

A few major primary and secondary sources referred to for preparing this report on the MEA airport robots market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd., Avidbots Corp., LG Electronics, SITA, and SoftBank Robotics.

The Middle East and Africa Airport Robots Market is valued at US$ 36.11 Million in 2021, it is projected to reach US$ 141.77 Million by 2028.

As per our report Middle East and Africa Airport Robots Market, the market size is valued at US$ 36.11 Million in 2021, projecting it to reach US$ 141.77 Million by 2028. This translates to a CAGR of approximately 21.6% during the forecast period.

The Middle East and Africa Airport Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Airport Robots Market report:

The Middle East and Africa Airport Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Airport Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Airport Robots Market value chain can benefit from the information contained in a comprehensive market report.